WASHINGTON — Florida Governor Ron DeSantis, as he prepares for a widely anticipated jump in a 2024 presidential campaign, seems to have discovered something that populists throughout history have found to be true: Federal Reserve bashing is good politics .

Mr. DeSantis has begun to criticize Jerome H. Powell, the Fed Chairman, in speeches and press conferences. He has claimed without evidence that the Biden administration is about to introduce a central bank digital currency — which neither the White House nor the politically independent Fed have decided to do — in an effort to keep Americans in check. and control their gas expenditure. He quoted the Fed Twitter messages contemptuously.

His criticism echoes a well-known Trump administration playbook. Former President Donald J. Trump often killed the central bank during the 2016 campaign and during his term in office as policymakers raised interest rates and slowed economic growth. Mr. Trump at one point called Mr. Powell — his own choice for Fed chairman — an “enemy,” likening him to President Xi Jinping of China.

Because the central bank is responsible for controlling inflation, it is often blamed both for periods of rapid price increases and for the economic damage it causes when it raises interest rates to control that inflation. That can make it an easy political target.

And populist skepticism about government control of money dates back centuries in America. The country’s first and second attempts to establish a central bank failed in part because of such concerns. Founded in 1913, the Fed was designed as a decentralized institution with quasi-private branches scattered across the country, in part to avoid concentrating too much power in one place. Since then it has been the subject of conspiracy theories and political attacks.

“In many ways, it’s not surprising at all,” said Sarah Binder, a political scientist at George Washington University who has studied politics and the Fed. DeSantis puts herself on Mr. Trump’s right, she said, “and it sounds like a lot of populist right-wing criticisms of the Fed, of monetary control, that we’ve heard throughout history.”

While Mr. DeSantis’ Fed bashing isn’t new, some of his comments have strayed into misinformation, said Peter Conti-Brown, a lawyer and Fed historian at the University of Pennsylvania.

“The Fed can and should take this seriously,” said Conti-Brown.

Although the Fed is independent of and largely isolated from the White House, it is ultimately accountable to Congress. And a lack of popular support could limit the Fed’s room for manoeuvre: if the administration decided, for instance, that pursuing a digital currency was a good idea, the backlash could make it more difficult to do so.

Mr. DeSantis’ tone could also hint at the future. From the early 1990s, presidential administrations have largely respected the independence of the Fed and avoided commentary on monetary policy. Mr. Trump turned that tradition on its head. President Biden has returned to a hands-off approach, but the recent criticism offers an early indication that the détente may not last if a Republican wins in 2024.

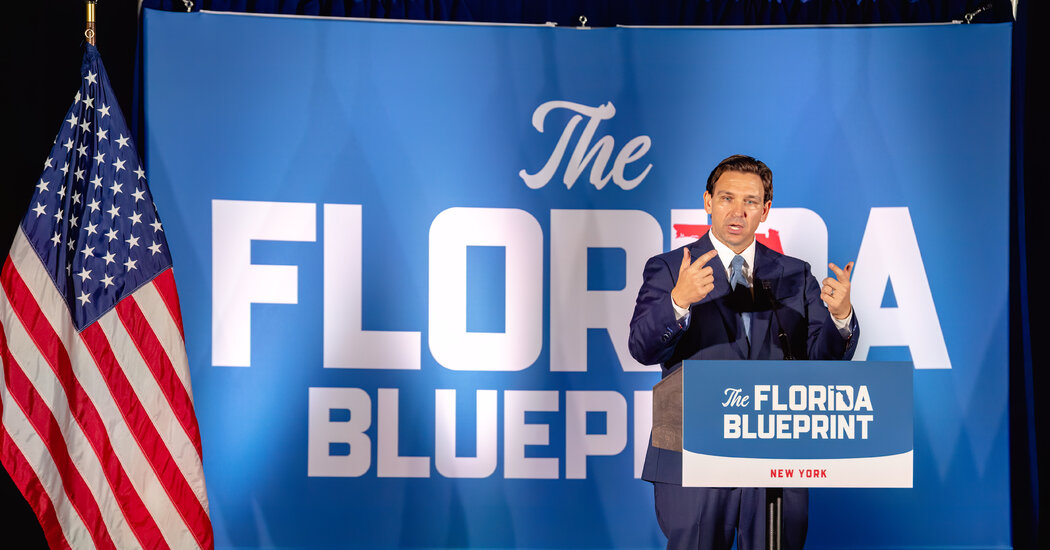

Gov. Ron DeSantis and his administration

Florida’s Republican governor has turned the swing state into a right-wing laboratory by engaging in cultural battles.

Mr. DeSantis has criticized Mr. Powell’s policies for failing to control inflation, and recently called the Fed chairman a “complete disaster.”

In Mr. Powell, the would-be presidential candidate has a rare opportunity to simultaneously criticize Mr. Trump and Mr. Biden: The Fed leader was first nominated to the central bank by President Barack Obama, then made chairman by Mr. Trump and reappointed as chairman by Mr. Biden.

Mr. DeSantis has focused much of his attention on a central bank digital currency, or CBDC, that would work like electronic money, but with backing from the federal government. The Fed has explored both the potential use and technical feasibility of a digital currency, but has not yet decided to issue one. Mr. Powell has made it clear that the Fed “wouldn’t go through with this without the support of Congress.”

The digital money Americans use today — whether using a credit card or completing a Venmo transaction — is issued by banks. Physical money, on the other hand, comes directly from the Fed. A central bank digital currency would essentially be the digital version of a dollar bill.

Many people who think the Fed should seriously consider issuing a central bank digital currency suggest it could help improve access to banking services. Some have argued that it’s important to develop the technology: America’s global competitors, including China, are researching and issuing digital money, so they risk falling behind.

Still, critics have been concerned about the privacy concerns of a centralized digital dollar. And the dollar is the world’s leading reserve currency, so any technology issues with a digital offering could be catastrophic. That’s why the Fed has pledged to proceed with caution — and why the idea of issuing a digital currency in America is still in the formative research stage.

While there is no plan to release a digital currency, Mr. DeSantis on March 20 proposes state legislation to “protect Florians from the Biden administration’s weaponization of the financial sector through a central bank digital currency.”

Then, in an April 1 speech, without any factual basis, he warned that Democrats wanted to use a digital currency to “impose an ESG agenda,” referring to environmental and social goals such as reducing fossil fuel consumption or tightening arms control.

Mr. DeSantis “rejects any attempt to control people’s behavior through centralized digital currency,” his press secretary, Bryan Griffin, said in response to a request for comment.

Mr DeSantis’ claims mirror those on right-wing social media, and they are in line with the interests of major Republican donors: many banks and cryptocurrency firms are adamantly opposed to the idea of a central bank digital currency, fearing it would take away company.

Florida in particular has been kind to the digital currency industry, with legislators passing favorable legislation.

And people with interests in cryptocurrency are among Mr. DeSantis’ top political donors. Kenneth Griffin, the billionaire hedge fund executive and crypto skeptic turned investor, gave $5 million to a political action committee that supported Mr. DeSantis’ reelection in 2022. Paul Tudor Jones, a billionaire investor who owned significant shares in the now-bankrupt crypto trading platform FTX, contributed $850,000 to the group, according to campaign finance filings.

Nor is it Mr. DeSantis who opposes the idea of a central bank digital currency: Prominent Republicans such as Texas Senator Ted Cruz And Representative Marjorie Taylor Greene of Georgia have participated.

Mr. Cruz and Representative Tom Emmer of Minnesota, the Republican whip, introduced legislation to prevent the Fed from creating such a currency. Gov. Kristi Noem of South Dakota, another potential 2024 Republican presidential candidate, recently vetoed a state law that she says would have opened the door for a CBDC

Some political figures are also mistakenly confusing a possible central bank digital currency with the central bank’s FedNow initiative, a separate effort to modernize the U.S. payments system to make transactions faster and more efficient. A spokesman for the Fed underlined that FedNow and the investigation into a possible digital currency were completely different.

Robert F. Kennedy Jr., a prominent figure in the anti-vaccine movement who recently announced his intention to run for president as a Democrat in 2024, merged incorrectly FedNow and the digital currency, claiming it would “lubricate the slippery slope to financial slavery and political tyranny”.

Tulsi Gabbard, a former Democratic presidential candidate and representative from Hawaii who is now an independent, repeated warnings that a digital currency would undermine freedom, falsely claiming that the government has “just started implementing” such a currency.

Having incorrect statements about FedNow and digital currencies spread on social mediaspread by influential political figures and conspiracy theorists.

The Fed has been trying to cut back on the swirling misinformation.

“The FedNow service is not a form of currency nor a step toward eliminating any form of payment, including cash,” the central bank wrote on Twitter Friday. Are six-tweet FAQ made no mention of politics, but nevertheless read like a rare public rebuke from an institution that diligently avoids venturing into political commentary.

“The Federal Reserve has not made a decision on whether to issue a central bank digital currency (CBDC) and would not do so without clear support from Congress and the executive branch, ideally in the form of a specific authorization bill,” said the Fed in a tweet. which Mr. DeSantis quoted.

“It’s not just ‘ideal’ for major policy changes to get specific authorization from Congress,” Mr. DeSantis said in an answer.

By Tuesday afternoon, the Fed had updated its FAQ online to be even more explicit: The central bank “would only proceed to issue a CBDC with an enabling law.”