Agricultural and energy costs are falling, but basic items remain stubbornly expensive for consumers.

It is the most basic staple food: sliced white bread. In Britain, the average price of a loaf of bread was 28 percent higher in April at £1.39 or $1.72 than a year earlier.

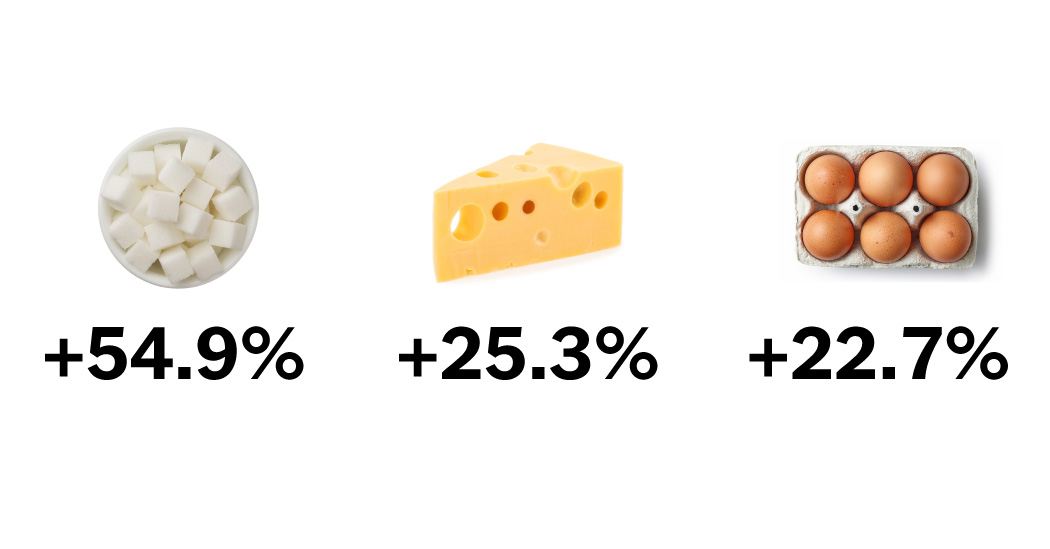

In Italy, the price of spaghetti and other pasta, a regular part of the Italian diet, has risen by almost 17 percent compared to the previous year. In Germany, the largest economy in the European Union, cheese prices are almost 40 percent higher than a year ago and potatoes are 14 percent more expensive.

Across the European Union, consumer food prices averaged almost 17 percent higher in April than a year earlier, a slight slowdown from the previous month, which produced the fastest rate of growth in more than two and a half decades. The situation in Britain is worse than in its Western European neighbours: prices of food and non-alcoholic drinks were 19 percent higher, the highest rate of annual food inflation in more than 45 years. By comparison, annual food inflation in the US was 7.7 percent.

Continued food inflation is weighing on low-income households and alarming European politicians. (In Italy, the government held a meeting this month to discuss rising pasta prices.)

At the same time, the main costs of making food products, including fuel, wheat and other agricultural products, have been falling in international markets for most of the past year, raising the question of why food prices for consumers in Europe remain so high. . And with rising labor costs and the possibility of profit-seeking, food prices are unlikely to fall any time soon. More generally, rising prices could also put pressure on central banks to keep interest rates high, potentially curbing economic growth.

What is driving up food prices?

Behind the sticker price for a loaf of bread are not only the costs for the most important ingredients, but also the costs for processing, packaging, transport, wages, storage and company payments.

A United Nations index of global food commodity prices, such as wheat, meat and vegetable oil, peaked in March 2022, right after Russia’s invasion of Ukraine, one of the largest grain producers. The war disrupted grain and oil production in the region and also had global repercussions, exacerbating food crises in parts of East Africa and the Middle East.

But the worst was avoided, thanks in part to a deal to export grain from Ukraine. European wheat prices have fallen by about 40 percent since last May. Global vegetable oil prices have fallen by about 50 percent. But there is still some way to go: the United Nations food price index was 34 percent higher in April than the 2019 average.

Apart from commodity prices, Europe has experienced particularly sharp increases in costs in the food supply chain.

Energy prices soared as the war forced Europe to quickly replace Russian gas with new supplies, driving up the costs of food production, transportation and storage.

While wholesale energy prices have recently fallen again, retailers warn that it will be a long time – perhaps a year – before consumers see the benefits, as energy contracts closed months earlier, most likely due to those higher prices.

And Europe’s tight labor markets with high job vacancies and low unemployment are forcing employers, including food companies, to push up wages to attract workers. This in turn drives up costs for companies, including in the food sector.

Is the pursuit of profit keeping prices high?

Suspicion is growing among consumers, unions and some economists that inflation could be unnecessarily kept high by companies raising prices above cost to protect profit margins. The European Central Bank said corporate profits contributed as much to domestic inflation as wage growth at the end of last year, but did not say whether certain industries had made excessive profits.

Economists at Allianz, the German insurer and asset manager, estimate that 10 to 20 percent of food inflation in Europe can be attributed to extortionate profits. “There’s some of the food price inflation that we’re seeing that isn’t easily explained,” said Ludovic Subran, chief economist at Allianz.

But the lack of detailed data on corporate profits and supply chains has led to a rift in economic views.

Some economists and food retailers have pointed the finger at major global food producers, which have maintained double-digit profit margins while driving up prices. In April, Swiss giant Nestlé said it expected its profit margin this year to be about the same as last year, about 17 percent, while reporting it had increased prices by nearly 10 percent in the first quarter.

Even accounting for costs such as transportation and accounting for farm-to-shelf price differentials, Mr Subran said he had expected food inflation to have come down by now.

In Britain, some economists tell a different story. Michael Saunders, an economist at Oxford Economics and a former interest rate setter at the Bank of England, said in a note to clients in May that “greed” was not the culprit. Most of the increase in inflation reflects higher costs of energy and other raw materials, he said.

Rather than rising, the overall profits of Britain’s non-financial companies, excluding the oil and gas industry, have fallen over the past year, he said.

Britain’s competition regulator also said it had seen no evidence of competition problems in the food sector, but was stepping up its investigation into “cost of living pressures”.

Have food prices peaked?

Despite widely publicized reductions in milk prices in Britain, food prices in general are unlikely to fall in the foreseeable future.

Instead, policymakers are watching closely for a slowdown in the rate of increase.

There are tentative signs that the pace of food inflation – the double-digit increase in annual prices – has peaked. In April, the rate in the European Union fell for the first time in two years.

But the slowdown from here will likely be gradual.

“This time around, food price pressures seem to be taking longer to work their way through the system than we expected,” Andrew Bailey, the governor of the Bank of England, said this month.

Across the continent, some governments are intervening by capping prices for essential food items, rather than waiting for economic debates over corporate profit to play out. In France, the government is pushing for an ‘anti-inflation quarter’, asking food retailers to cut prices on some products until June. But finance minister Bruno Le Maire said this month he wanted food producers to contribute more to the effort, warning they could face tax penalties to recoup any unfair margins at the expense of consumers if they refuse to return. to the negotiations.

These efforts may help some customers, but overall there is little to comfort Europeans. Food prices are unlikely to fall – it is only likely that the rate of increases will slow down later this year.