The expectations were high for companies for artificial intelligence (AI), but they took a hit on Monday afterwards Chinese startup Deepseek claimed that it can spend much less money and deliver AI performance that are comparable to large technology companies.

This caused massive sale in megacap shares. NVIDIA (NVDA) fell by 17%and lost more than $ 500 billion in market capitalization and record-breaking decrease, larger than the entire market capitalization of companies such as Mastercard (MA), Netflix (NFLX), Costco (costs) and Bank of America (BAC (BAC ).

Broadcom (AVGO) also dropped 17%and lost around $ 200 billion in market value, while Oracle (ORCL) fell around 14%, or $ 70 billion in market capitalization. It made me curious how shares tend to perform after such enormous losses.

I will leave it to the fundamental traders to assess the impact of Deepseek on the income of Nvidia, Oracle and Broadcom. What I have done below is looking at historical authorities when large -scale losses have occurred and then see how the shares were then performed. In particular, I went back to 2000 and found cases where the price of a share decreased by 10% or more, which resulted in a loss of at least $ 50 billion in market capitalization.

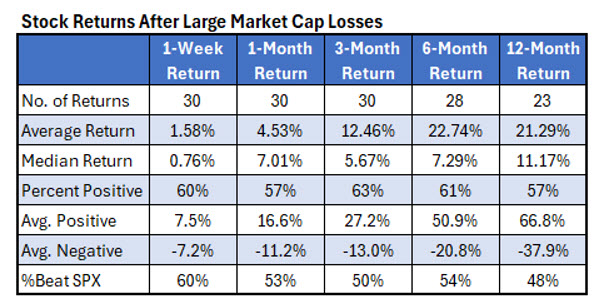

The table below indicates that this can be a purchase option for these shares. I found 30 times earlier in which a share fell by 10% and $ 50 billion in market capitalization in one day, with these shares that achieved on average more than 12% in the coming three months, and more than 20% in the coming six months. With 60% of the return positive.

The average positive return of more than 50% in the coming six months suggests that there has been a huge advantage in these situations, despite the fact that these are mega -hip shares.

This following table is for comparison and shows the return that you would have earned if you had purchased the S&P 500 index (SPX) instead of the stored stock. Buying the beaten shares that on average performed better at any registered time frame.

Above it shows that when massive market hood loses took place in the past, they were usually exaggerated. In the meantime, the table below, together with the performance of a share after a single profit of 10% or more, results in a market capitalization of at least $ 50 billion.

It seems that when the value of a share changes by $ 50 billion or more during a single day, it is now or down, it is a good idea to buy it and hold it for six months. These shares achieved an average of 10.6% in the coming six months, with 58% that performed better than the SPX. If you had invested in the SPX, it would have won only 3% in the coming six months.