The federal government may have less than a month left for an economically devastating default on its debt.

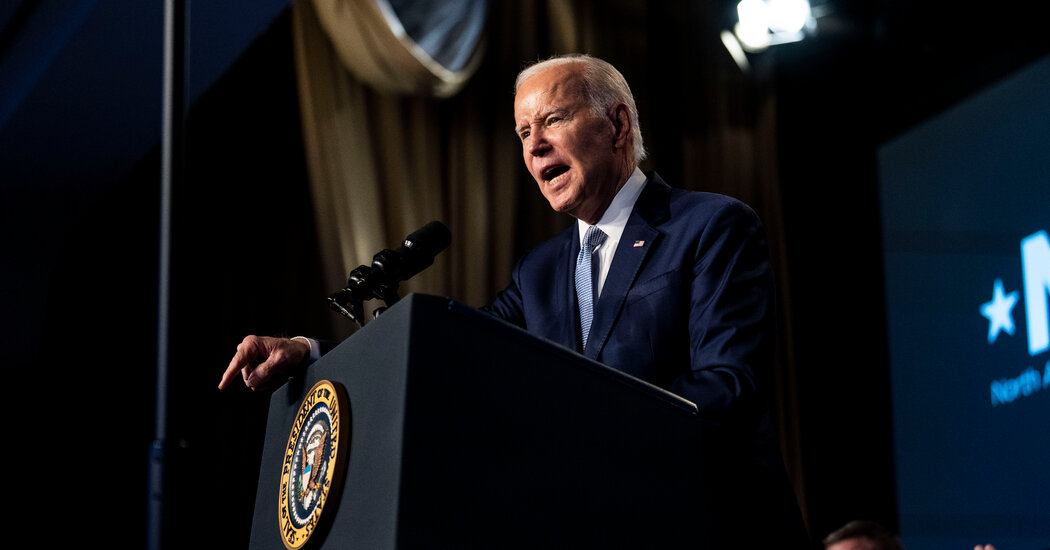

No matter who bears the political blame for a default, aides recognize that President Biden has a lot to lose if the nation slides into recession just as he begins his re-election campaign.

Mr Biden has several strategic options to prevent that from happening. All have been the subject of debate within the government and with Democratic allies in recent weeks. They range from insisting on Republicans raising the country’s debt limit without obligation to preparing unilateral action to effectively bypass the limit and continue paying the country’s bills.

Some include negotiations with Republican leaders, which Mr. Biden will insist are unrelated to the debt limit, even if they were.

Each path carries risks, which government officials privately acknowledge. By far the biggest is the economic disaster: White House economists warned in an analysis published Wednesday that if the country defaulted on its debts and defaulted for several months, the economy would shed eight million jobs if it went into recession. come.

The economists also warned that the mere approach of a potential default would rattle markets and drive up borrowing costs across the economy, “increasing the ability of firms to fund themselves and make the productive investments essential to today’s expansion would be hindered”.

Here are the paths available to Mr. Biden, as his aides and allies see them.

Stay on task

Mr Biden has been urging lawmakers for months to raise the country’s borrowing ceiling without conditions, saying it simply allows the United States to pay for spending that Congress has already approved. He could continue to do so and refuse to negotiate, as many progressives have urged him to do.

It would be an attempt to stare down House Republicans, who last week passed a bill linking a limit increase to federal spending cuts and a reversal of Mr Biden’s climate agenda. Mr. Biden would, in effect, challenge Speaker Kevin McCarthy of California to run out of money for the government to pay its bills on time, which the Treasury Department estimates could happen as early as June 1.

The risk is that Mr. McCarthy will refuse to budge, pointing to the House bill as proof that Republicans had done enough to raise the debt limit. Mr Biden would count on pressure from business groups and turmoil in the financial markets to get Republicans to blink at the last minute and at least pass a bill to avoid default for a few weeks or months. But as of now, House Republicans have shown no willingness to pass such a bill, known as a “clean” debt limit increase. Nor would it take a critical mass of Senate Republicans to push the bill forward in that chamber.

Negotiate cuts that are not tied to the debt limit

Mr. Biden will welcome Mr. McCarthy and other congressional leaders to the White House next week for talks about fiscal policy — how much the nation taxes, spends and borrows. The president says those talks are separate from the debt limit, but in fact they are not.

The deadline that hangs over the talks is the so-called X-date, estimated at June 1; Mr Biden’s invitation to congressional leaders has been accelerated by revised projections of when that date will hit. In contrast, the bill to fund the federal government’s operations, which Biden signed late last year, runs through the end of September.

Mr Biden could negotiate without “negotiating” by trying to reach an early agreement on spending levels for the next fiscal year, before the X date. In return, Mr. McCarthy commit to approve the debt limit outright.

Business groups and even some government officials expect such a deal to center on caps on federal discretionary spending — though almost certainly not as strict as those in the bill passed by Republicans. White House officials have said privately for months that they don’t expect the House to approve significant spending increases for next year anyway, so depending on the details, some limit may be acceptable to Mr Biden.

The risk of that strategy is that Mr. McCarthy’s most conservative members have shown no interest in a deal of that size. Mr Biden will not accept the further-reaching demands of those members. That complicates the prospects for an agreement that goes through the speaker.

Bypass McCarthy

Mr. Biden could try to sidestep the speaker and lure a handful of moderate Republicans in the House and Senate to vote to raise the limit, offering some tax concessions as an enticement. Getting such a deal to the House of Representatives may require some legislative maneuvering, such as the so-called discharge petition that Democrats have been preparing for months.

It may also require a different approach from Mr. Biden than the congressional Republicans he needs to pass such a bill. Moderate Republicans in the House say they have received little friendly contact from the White House so far. Instead, Biden administration officials gleefully hammered them for voting to bring forward the Republican debt cuts bill and its sweeping cuts.

Again and again this week, administration officials posted the photos and names of House Republicans to Mr. Biden’s official Twitter account, accusing them of voting to cut funding for veterans programs and Meals on Wheels. Two of the legislators named were members of the leadership, including Mr. McCarthy. Two others were high-profile, far-right congresswomen. The rest — more than two dozen — were legislators in seats Biden won in 2020.

Officials have defended that strategy. “I have hope that we will find a way to avoid default,” Shalanda Young, the White House budget director, told reporters Thursday, after she opposed the cuts included in the Republican bill. “But our job is to keep coming to you, to go to the American people and make sure people understand what this debate is about.”

Go it alone

If Mr Biden’s chosen tactics do not lead to a bill he will sign that raises the debt limit before the X date, the president will have to choose between allowing the nation to default or continuing with what is effectively a constitutional challenge to keep borrowing through the debt ceiling to pay the bills when the government runs out of money.

That challenge is said to be rooted in a clause in the 14th Amendment that requires the government to pay its debts. Administration officials debated that idea for months, with no resolution. But even the proponents admit it wouldn’t be a perfect solution. The move would trigger an immediate lawsuit and sow at least temporary uncertainty in the bond market, causing the government’s borrowing costs to skyrocket.

Catie Edmondson reporting contributed.