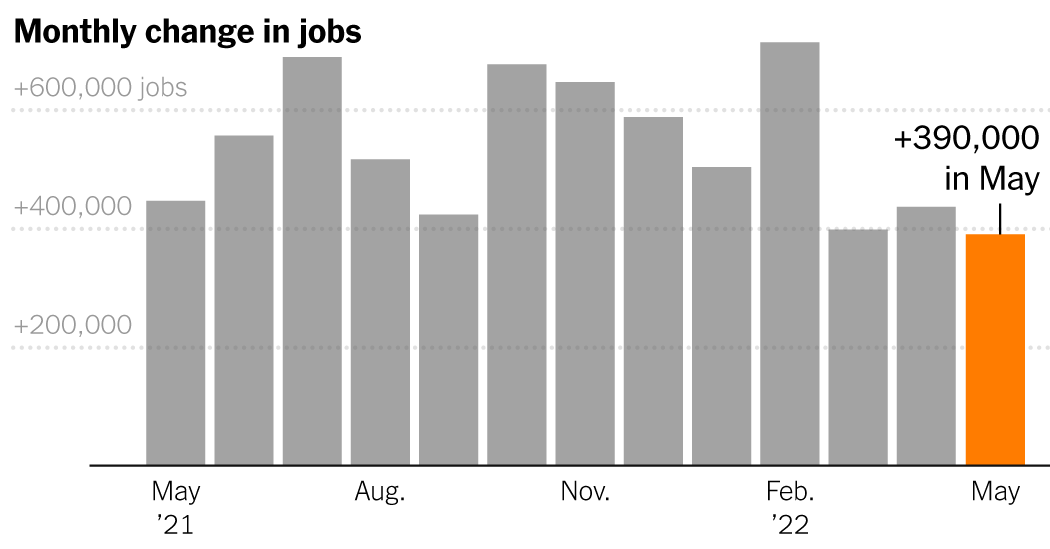

Job growth remained impressive in May, even as government policymakers took steps to cool the economy and reduce inflation.

The Labor Department reported Friday that employers added 390,000 jobs, the 17th monthly gain in a row.

The unemployment rate was 3.6 percent for the third straight month, nearly a half-century low. Average hourly workers’ wages rose 10 cents, or 0.3 percent on a monthly basis, and was 5.2 percent higher than a year earlier.

Job growth has been broad-based, led by the leisure and hospitality sectors, as consumers continued to shift their spending patterns from goods to services such as travel, dining and entertainment.

The shortfall in overall employment compared to prepandemic levels is about 800,000.

“We’re at home here — we could be about two months away from the level of employment we had in prepandemic times in February 2020,” said Andrew Flowers, a labor economist at Appcast, a company that helps companies improve their online recruiting efforts.

Record levels of consumer spending, which makes up about 70 percent of the economy, have fueled business expansion and job creation as companies try to keep up with demand for a wide variety of goods and services. The hiring pressure has given some workers a degree of discretion regarding wages and benefits unknown to job seekers and employers alike.

But the Federal Reserve is concerned that rising labor costs will be passed on to consumers, limiting efforts to curb inflation, which has been high for nearly 40 years.

Last month, Fed chairman Jerome H. Powell emphasized that his institution’s attempts to cool prices were part of a more sustainable form of full employment. “We need to get back to price stability so we can have a labor market where people’s wages aren’t being swallowed up by inflation,” he said. “And where we can expand for a long time to come.”

Throughout the year, price increases and general volatility in the economy have led to a dissonance between sour consumer confidence and relatively positive raw data. Current accounts are still above 2019 levels for nearly all income groups, and the number of households under duress as a result of debt is at an all-time low. New bankruptcies and debt collection proceedings are both at their lowest levels since the investigation began in 1999.

For some economists, Friday’s report is the first evidence that the Fed’s ambitious plan to bring about a modest economic slowdown that avoids a painful recession could potentially materialize. The Ministry of Labor announced on Wednesday that the number of layoffs is at an all-time low. But it also showed that the wide gap between vacancies and job seekers has narrowed.

“Companies with high profitability, easy access to capital, the ability to automate and price power are still eager to hire people,” said Bill Adams, chief economist at Comerica Bank, a major commercial bank in Texas. “But companies that see margins squeezed by rising costs, such as hospitality, or that see demand decline, such as retail, are withdrawing job openings as their prospects deteriorate. And competition for workers is pushing lower-paid employers out of the job market. .”