US employers added an unexpected barrage of workers in May, reaffirming the vitality of the job market.

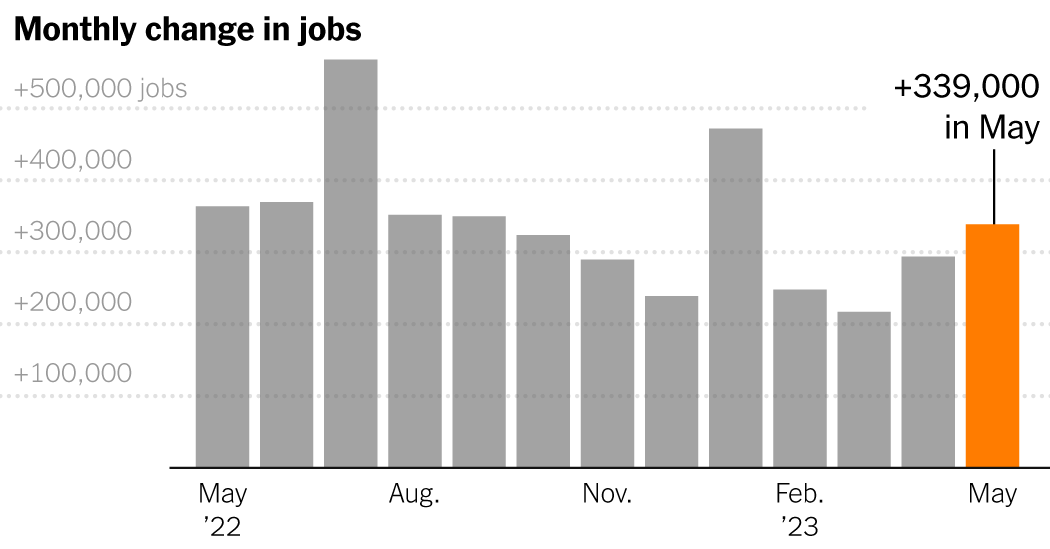

Despite expectations of a slowdown, payrolls grew by 339,000 on a seasonally adjusted basis, the Labor Department said Friday. The increase, the largest since January, suggested that the labor market was still red hot despite a whirlwind of economic headwinds.

But beneath the surface, the report also offered evidence of mitigation. The unemployment rate, while still historically low, rose to 3.7 percent, the highest level since October. In a sign that the pressure to entice workers with wage increases is easing, wage growth slowed.

The dissonance produced a somewhat confused picture that complicates the calculation for the Federal Reserve, which has been raising interest rates for more than a year to dampen labor market momentum and rein in price increases. Fed officials have indicated that the jobs report will be an important factor in deciding whether to raise rates again.

“We are still seeing a job market that is gradually cooling,” said Sarah House, an economist at Wells Fargo. “But it’s on a glacier site.”

President Biden applauded the report, saying in a statement that “today is a good day for the American economy and American workers.” The S&P 500 index rose 1.5 percent as the data showed an economic engine that was running strong but not overheating.

Above the report looms the debt ceiling deal passed by Congress, though economists largely expect the spending caps and spending cuts to have only a marginal impact on the labor market going forward.

The hiring numbers suggest that employers remain eager to hire even despite high interest rates and economic uncertainty. Many still hire workers to meet consumer demand, especially for services. The only major sectors to lose jobs were manufacturing and information services.

Job growth was driven by professional and business services, including accounting and bookkeeping, which generated 64,000 jobs. Leisure and hospitality businesses — buoyed by restaurants and bars — provided 48,000 jobs as Americans continue to enjoy dining out. Government employment, which is still catching up with pre-pandemic levels, has also increased significantly, mainly at the state and local levels.

As a surprise, the construction sector, which is sensitive to interest rate hikes, grew by 25,000 jobs.

“There’s still a lot of optimism,” said Tom Gimbel, the founder and CEO of LaSalle Network, a national staffing and recruiting agency. “If the Fed were to slow now, the consensus — from the small to medium-sized company CEOs I speak with — seems that the economy could remain strong for the next 24 to 30 months.”

Sean Harrell, a general manager at Southland, a family restaurant and shopping complex in Moyock, NC, said business was booming, with customers flocking to Southland’s store for ice cream, fudge and fireworks. Rather than being discouraged by the price hikes of recent months, Mr. Harrell, customers have largely shrugged them off.

As a result, the company can’t hire fast enough. On a recent weekend, he said, Southland was forced to close the restaurant’s dining room for dinner and only offer takeout orders because it didn’t have enough employees for table service.

“We have to work with a thinner staff than before,” he said.

The labor force participation rate remained relatively unchanged at 62.6 percent in May, while the share of people in their best working years – aged 25 to 54 – participating in the labor market rose to 83.4 percent, a level not seen since 2007.

The figures in Friday’s report are preliminary and will be revised at least twice. Upward revisions to the previous two months’ data added 93,000 jobs, appearing to increase the gradual slowdown in hiring even more.

At the same time, warning sounds are echoing through the labor market and the wider economy. Wage growth slowed in May, with hourly wages rising 0.3 percent from April and 4.3 percent year-on-year.

The number of hours worked ticked back slightly and is roughly in line with pre-pandemic levels. “If that number drops for any length of time, it’s seen as a sign that the job market is about to cool significantly,” said Nick Bunker, the director of North American economic research at the job site Indeed.

That would indicate that higher interest rates are reaching the Fed’s target, but not without pain. In particular, the unemployment rate for black Americans, which hit an all-time low in April, rose nearly a full percentage point in May to 5.6 percent.

“It appears that conditions are worsening and affecting the most vulnerable, low-wage, minority workers the most,” said Julia Pollak, chief economist at ZipRecruiter.

The uneven message in Friday’s report is partly because it consists of two surveys, one of employers and one of households. For example, the weakness in the household survey was partly due to a decline in self-employment, workers who are not counted in the count of payroll jobs.

Forecasters continue to expect the labor market to weaken in the second half of the year as interest rate hikes take root.

Consumer confidence is already weak. Sectors such as banking and manufacturing have shown clear signs of distress. In its most recent region-by-region survey, known as the Beige Book, the Fed reported that many companies said they were “fully staffed,” while some said they were “pausing hiring or reducing headcount due to a weaker actual or future demand or to greater uncertainty about the economic outlook.”

A big question is whether deeper cracks will form – and when.

Part of that puzzle is layoffs, which have remained low outside of a few big companies in the technology and media sectors. Instead, many companies remain reluctant to let employees go, preferring to reduce their workforce through turnover.

That’s how Doug Bassett, the president of the Vaughan-Bassett Furniture Company in Galax, Virginia, hopes to get through a slump. Like other manufacturers, Vaughan-Bassett saw sales of its domestically made wood furniture spike during the first phase of the pandemic. To cope, the company hired about 75 workers, bringing the total to about 575.

But as Americans eat out and vacation again, and higher mortgage rates slow the housing market, demand has fallen. As a result, Mr Bassett said, his workforce is back to pre-pandemic levels.

“We hope that things will pick up by the end of the year,” he said. “But we’re not going to change our approach until we see it in the numbers.”

Ben Casselman, Joe Rennison And Michael D. Shave reporting contributed.