The job market is still defying gravity – for now.

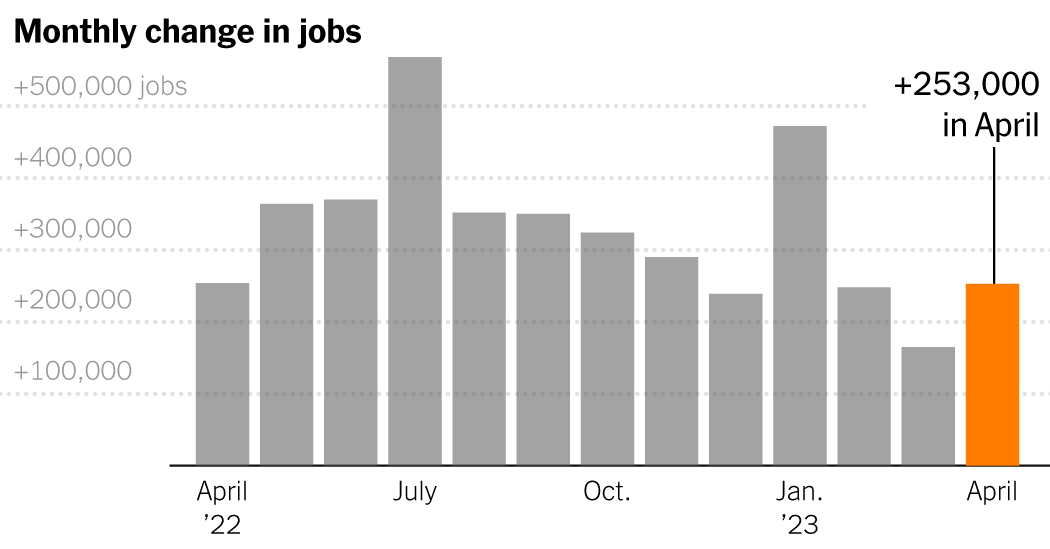

Employers added 253,000 jobs in April on a seasonally adjusted basis, the Labor Department reported Friday, a departure from the cooling trend that had characterized the first quarter and is expected to continue.

The unemployment rate was 3.4 percent, up from 3.5 percent in March, matching the January level, which was the lowest since 1969. Wages also rose slightly, growing 4.4 percent over the past year .

Higher-than-expected job growth complicates the Federal Reserve’s possible shift to a pause in rate hikes. Fed Chairman Jerome H. Powell said Wednesday that the central bank could continue to raise rates if new data shows the economy is not slowing enough to keep prices down.

It is also an indication that the failure of three banks and the ensuing withdrawal of lending, which is expected to hit smaller firms in particular, has not yet hampered job creation.

“All of these things tell us it’s not a hard stop; it creates headwinds, but not debilitating headwinds,” said Carl Riccadonna, chief economist at BNP Paribas. “There is a gradual downturn going on, but it’s definitely stubborn and persistent in the trend.” Despite strong results in April, the labor market continues to slide slowly from blistering highs.

Downward revisions to the previous two months’ data produced a meaningful change in the employment picture in the spring, subtracting a total of 149,000 jobs. That brings the three-month average to 222,000 jobs, a marked slowdown from the 400,000 average in 2022. Most economists expect a sharper decline later in the year.

Job growth was broad-based, even if less robust than the eye-popping numbers of 2022, when the country was quickly digging out of a deep pandemic deficit. Leisure and hospitality added 31,000 jobs, down from the average of 73,000 jobs over the past six months, but another step towards peaking in early 2020.

Even sectors that are typically more sensitive to interest rates and have been stabilizing in recent months, such as construction, retail and manufacturing, made gains.

“There seems to be an underlying force in the labor market that has puzzled analysts and policymakers alike,” said Karin Kimbrough, chief economist at LinkedIn. “Even when you see these pockets or cracks of weakness, they seem to close again.”

The job market has been unusually tight since early 2021 as employers struggled to reverse a sudden mass layoff and deal with massive shifts in demand for goods and services. This will benefit groups that have traditionally been at a disadvantage in the labor market.

Wages for those at the lower end of the pay scale rose faster than in decades. The unemployment rate for black Americans reached an all-time low of 4.7 percent in April, and the gap between white and black unemployment rates was also the smallest on record.

The proportion of people in their best working years – aged 25 to 54 – participating in the labor market reached 83.3 percent, a level not seen since 2008. never seen before, at 77.5 percent.

This exceptional mismatch between supply and demand of labor has become increasingly balanced in recent months.

The number of vacancies, which had almost doubled the number of available employees, plummeted in the first quarter. According to job search website Indeed, which has more granular data, listed positions in marketing and human relations — which are most correlated with a company’s growth plans — are up 43 percent and 45 percent over the year. decreased.

At the same time, an uptick in immigration reduced labor shortages, especially in areas such as leisure and hospitality, and health care, allowing these to continue to grow rapidly. And declines in sectors that had surged during the pandemic, such as transportation and warehousing, may have pushed more people to other areas with many vacancies for jobs that don’t require a college degree, such as hotels and restaurants.

The outflow of blue-chip internet companies like Google and Meta has mostly been a boon to other industries desperate for people with digital skills. United Airlines, which plans to hire 15,000 people this year, said this week it had already picked up 120 people laid off by big tech employers.

That’s why the turmoil in Silicon Valley, sparked by a rapid rise in borrowing costs that dried up venture capital, has largely failed to derail those who were relatively lucky enough to lose jobs while the economy is still robust.

Katie Li, a 26-year-old software engineer in Palo Alto, California, was offered a job at a health technology company in late 2022. But after she quit her previous job and before she could start the new one, she withdrew the offer, saying a few contracts had been interrupted and it was unsure if it could keep the position. In a panic, she started applying elsewhere and sent out 200 applications in a few months.

That effort produced three new offers, and Ms. Li chose one that she felt had a compelling mission, serving people on Medicaid. She started in March and was making 71 percent of her old salary — but like many of her friends who’ve lost jobs recently, she’s glad she’s back to work and has health insurance.

“Most people have slightly lower salaries, but compared to the normal person, they are still super high,” said Ms. Li. “I think I realized that other things are more important than career.”

Given the surprising durability of the labor market, most economic forecasters argue that the Federal Reserve’s 10 consecutive rate hikes have yet to seep fully through the economy. If they do, the likelihood of workforce cuts increases, but the distribution may look different than in previous recessions.

The Conference Board recently published an index assessing the risk of job losses in different parts of the economy. Those with the most acute labor shortages, such as health care and local government, are at relatively low risk. Those that thrive on low borrowing costs, such as construction, continue to be at higher risk.

“We expect a more negative and profound impact of interest rates on the labor market in the second half of the year,” says Frank Steemers, a senior economist at the Conference Board, noting that the recent banking turmoil probably hasn’t translated either in payrolls.

“If there’s anything that would make you adjust your forecast to make it a deeper recession,” he said, “this would definitely be it.”

For now, however, most employers are taking a cautious approach rather than intentionally downsizing. Many fire indentured servants first; employment through temporary emergency services has fallen over the past year.

Erin Doehring is the human resources director of TAL Holdings, a collection of hardware and building materials stores in the Pacific Northwest that employs about 650 people. The business grew rapidly in 2021 and 2022 as more people moved to the small towns where the stores are.

But that slowed during the winter and early spring as higher borrowing costs – and heavy snowfall – hampered home building and remodeling. The company hasn’t fired anyone yet, but is thinking about reducing hours and downsizing through attrition. That reflects an overall plateau in its retail category, which jumped in 2020 but has since declined. Ms Doehring also said she had seen a higher number of better qualified applicants for the open positions.

“We’re definitely being more strategic about the positions we’re hiring for, really keeping a close eye on, ‘Do we really need to fill this position?'” said Ms. Doehring. “Should we leave this job open at this time and reconsider at a later date?”