Turo, a start-up of car rental in San Francisco, has been trying to become public since 2021. But a volatile stock market delayed the list at the beginning of 2022. Since then, the company has waited at the right time.

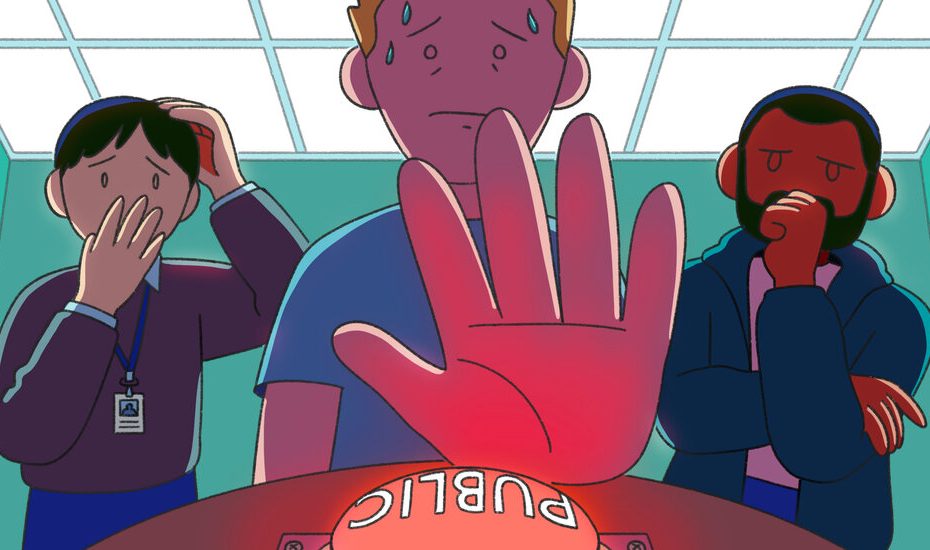

Last week, Turo took his entry completely. “This is not the right time,” said Andre Haddad, the chief executive of the company, in a statement.

For months, investors eagerly anticipated a wave of first public offers, encouraged by the new government of President Trump. Since his election victory in November, which ended a tumultuous campaign season, Corporate America and Wall Street have announced the start of a pro-business, anti-regulation period. The stock market rose in advance on an expected Bonanza from Deal.

But the rate announcements of the administration and change changes of quick -fire have created uncertainty and volatility. Dressing inflation has deported market jitters. And the rise of the Chinese artificial intelligence app Deepseek last month caused investors to question their optimistic bets on American technology, which led to a drastic sale between AI-related shares.

Everything that has influenced the first public offers. “The calendar just went from fully booked to wide open in a period of three weeks,” said Phil Haslett, a founder of Equityzen, a site that helps private companies and their employees to sell their shares.

Until now this year, the pace of the public offer is ahead last year, with companies that collect $ 6.6 billion for entries, an increase of 14 percent compared to this time last year, according to Renaissance Capital, which is aimed at IPO rating trade managed.

Yet there are no signs of the IPO golf that many had expected, especially from large companies that had been waiting for the past two years to become public. Apart from the canceled offer from Turo, Cerebras, an AI chip company that submitted its investment prospectus last fall, also delayed the plans to become public.

It is too early to know whether macro -economic concerns about inflation, interest rates and geopolitical risks ensure that other companies change their plans, according to IPO advisers and analysts. More entries are expected in the second half of the year.

“We have to allow a little more time to see where the administration is starting to land on some of these important topics that manage part of the uncertainty,” said Rachel Gerring, the IPO leader for America at EY, an accounting and Professional services sturdy. “IPO planning is still very common.”

Klarna, a start-up of a loan, and Etoro, an investment and trade provider, have submitted confidentially in recent months to sum up their shares. But many of the most valuable private technology companies, including Stripe and Databricks, have indicated that they are planning to remain private for the time being by attracting capital of the private market instead.

David Solomon, the Chief Executive of Goldman Sachs, said last month that a reason why IPO activity was slow was that start-ups could get the capital they needed from private investors. Goldman helped Stripe, the start-up of the payments worth $ 70 billion, to raise billions of dollars last year, he said.

“That is a company that would never have been a private company today, given their capital needs, but today you can,” he said at a conference organized by Cisco.

To further relieve the pressure to go public, Stripe has had its employees and shareholders sell part of their shares in recent years, so that they can cash in so that they do not put pressure on the company to mention. The transactions, known as offers, also solves the problem that employees will expire and help employees pay tax accounts with regard to sales.

The number and size of the range grew in 2024, according to Carta, a site that helps start-ups to manage their shareholders. Carta's customers made 77 offers in 2024, an increase of 68 in 2023. They raised $ 3.5 billion last year, more than double the $ 1.7 billion in 2023.

Databricks, an AI data company, picked up $ 10 billion from investors in December. Part of the money went to operations, but Databricks said that part of it would also be used to have the current and former employees pay and pay their taxes.

Also in December Veeam, a data company, said that it collected $ 2 billion in financing that went to existing investors. This year, Plaid Goldman hired Sachs to pick up up to $ 400 million in an offer that would enable shareholders to cash in, according to a person who is familiar with the case.

Mr. Solomon said that he has often told start-up founders that there are three reasons to become public, and two of Hen money collect and have shareholders sell their shares resolved by private markets.

He advised founders to become 'with great caution' because this will change the way they run their business. “It's not fun to be a public company,” he said.

Companies that want to go to public have been waiting. Many postponed their plans in early 2022 when interest rates rose and the war in Ukraine markets rattled.

Justworks, a software provider for wage and benefits, was days removed from pitching public investors on a list in January 2022 when it decided to postpone. Mike Secler, at the time the Chief Operating Officer, said it was tempting to penetrate the shares and sum up the shares, because so much work had gone to prepare for a public offer.

But as 2022 progressed, the market volatility and poor performance of companies mentioned that Justworks made the right call, he said. Justworks did not need the capital – it had $ 125 million in the bank – and it was profitable.

“It started to feel like we were to force something, unlike a moment of great enthusiasm for our company,” said Mr. Seckler, who became Chief Executive at the end of 2022.

Justworks ultimately deleted his listing plans and is not going to try again quickly. “Our time will come,” said Mr. Secler.

Navan, a software maker of travel and cost management, confidentially submitted to become public in 2022, but later achieved his plans, said a person who was familiar with the case. The start-up recently went on a “non-deal” road show to meet investors and lay the foundation for a list in the second half of the year, the person said.

Stubhub, the ticketing company, which submitted itself in public in 2022, also wants to mention his shares somewhere this year, a person who is familiar with the case said.

With the volatile market, bankers technology companies, which are often driven unprofitable to find a way to make money, people who are familiar with the conversations. Bankers want start-ups to generate at least $ 200 million in annual income to appeal public investors. If a company is smaller or loses money, investors want to see high sales growth, people said.

“The bar went up for the kind of companies that can be public,” says Amy Butte, financial director of Navan.

Sanjay Dhawan, the Chief Executive of Symphonyai, a software company, said that bankers told him to achieve $ 200 million to $ 300 million in income before he becomes to the public way. The company surpassed $ 400 million last year and made a profit, he said.

Mr Dhawan added that he had waited for clarity of the elections before he made IPO plans.

“Now everyone knows what the economic policy will look like,” he said. “Everyone feels a bit relieved to start planning.” The volatility of Deepseek was just a short-term reaction, he added.

At least one technology company recently reached the public markets. On Thursday, Sailpoint Technologies, a cyber security company, supported by the Private Equity company Thoma Bravo, gained $ 1.38 billion in a public offer that it appreciated at around $ 12 billion. But the shares fell 4 percent under the IPO price of $ 23 per share on its first trading day.

For the public offer market to really get started, “a few brave companies are needed to come out,” said Mr. Haslett of Equityzen.