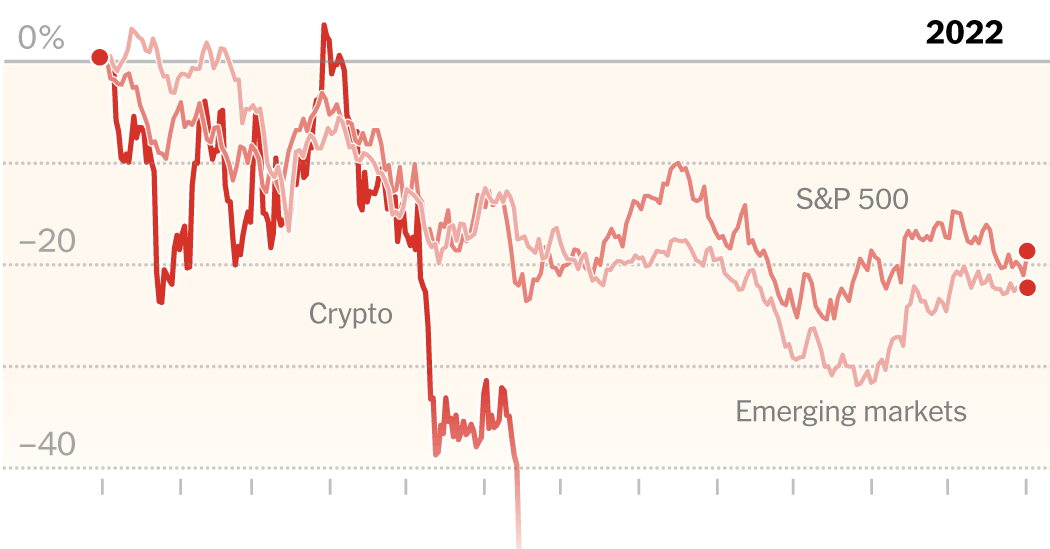

Neither the S&P 500 nor Tesla have since reached the heights they reached on January 3. The S&P 500 began its last trading session of the year on Friday nearly 20 percent lower than where it was that day — marking the year for its worst annual performance since 2008. Cryptocurrency giants like FTX have fallen and debt is no longer cheap.

Inflation FAQs

What is Inflation? Inflation is a loss of purchasing power over time, meaning your dollar won’t go as far tomorrow as it did today. It is usually expressed as the annual change in prices for everyday goods and services such as food, furniture, clothing, transport and toys.

But even as the US economy heads for a potential recession, the Federal Reserve has said its job is far from over. Although inflation has begun to cool, it is still far too high and interest rates are expected to continue to rise, predicting more pain to come.

“Central banks have stimulated markets this year because of inflation and will continue to do so through 2023,” said Kristina Hooper, chief global market strategist at Invesco. “This is a very, very dramatic moment in time that makes history. We have all witnessed a sequence of events, starting with the pandemic, which has been extraordinary.”

The Fed’s challenge was made even more difficult in late February, when Russia’s invasion of Ukraine drove up food and energy costs, sparking a crisis in poorer countries dependent on oil and grain imports. In March, the Fed began raising interest rates.

Higher interest rates are central banks’ main tool to fight inflation. Raising interest rates also raises borrowing costs, reducing demand in the economy and theoretically curbing further price rises. Yields on 10-year U.S. Treasury bonds, which support global borrowing costs, have risen 2.3 percentage points this year, the largest annual increase ever recorded for data going back to 1962. In turn, interest rates on mortgages, corporate bonds and other debt rose higher.

Higher costs also mean lower profits for companies, driving stock prices down. This was especially true for technology companies, whose growth was supported by low interest rates. Packed with tech stocks, the Nasdaq Composite index is down more than 30 percent in 2022.

As investors lost money in the stock market and households faced rising costs from inflation, other more speculative markets also blew air. The price of Bitcoin, one of the most well-known cryptocurrencies, tumbled and so-called meme stocks like GameStop and AMC Entertainment, whose stock prices were boosted by a new breed of amateur investor during the pandemic, fell steadily throughout the year.