shaunl | Getty Images

David Cottrell got his $39,999 Tesla Model Y last February. The compact electric hatchback was a great car, he says. But just a few months later, he decided to enter the make and model on the website of an online used car seller. Surprise! The Tesla was already worth $10,000 more than he and his wife paid for it. They thought about buying a home in their hometown of Seattle, and the extra cash felt like a no-brainer. By June, they had sold for $51,000 – a tidy profit.

Now Cottrell looks back on the transaction with some regret. He loves his new home and is excited about his reservation for a more spacious electric Rivian truck, which will be delivered this summer. But when he put the same Model Y back in the online thrift store this month, he found that the car would be worth only about $2,000 less than it sold it for, even taking into account the 20,000 miles it’s driven since then. “If we could have kept it, I could have been riding here for a year and got out of there pretty evenly,” he says.

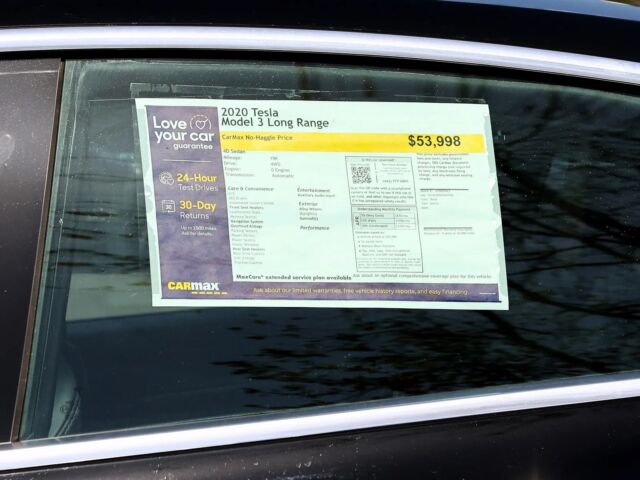

This is not the way a car’s life is supposed to work. They should lose value over time. This is why used cars are generally cheaper than new ones. But now everything is turned upside down. According to the US Bureau of Labor Statistics, used car and truck prices rose 35 percent in March compared to the same time last year. It’s not uncommon for certain used luxury cars, such as Porsches and Corvettes, to go for more than their original sticker prices, says Luke Walch, the owner of Green Eyed Motors, a dealership outside of Boulder, Colorado that specializes in electric and hybrid vehicles. Now, “it has trickled down into the common citizen’s car,” he says.

Things have gotten extra weird in the land of electric vehicles, where used cars seem to be getting newer. Figures tracked by Recurrent, a company that tracks battery health in EVs, and data agency Marketcheck suggest that last year the majority of used electric cars for sale were four or five years old. Today, just under a third of EVs used are three years old. EVs sold in 2020 or 2021 will make up 17.5 percent of the inventory. “It is weird,” said Brian Moody, editor-in-chief of Autotrader, an online car marketplace. In fact, the whole situation is almost unparalleled, he says.

Mario Tama | Getty Images

If you’re someone who hopes to go electric now, that’s too bad. Despite the high prices, EVs and hybrids are going out faster than they can get in, Walch says. Carvana, a company that buys and sells used cars online, says 90 percent of its electric vehicles are currently bought, compared to 45 percent just over a month ago.

The rise of the new used car started with the shortage of microchips, which began to seriously affect car production in 2021. Today’s vehicles each use at least 100 chips to control their complex electronic systems, and electric vehicles, which are particularly complicated, can carry as many as 1,000. But when the COVID-19 pandemic first hit in 2020, automakers cut back on their sales forecasts and on their chip purchases. Chipmakers sold their wares elsewhere. Then came federal incentive checks, sending thousands of dollars into American bank accounts. Some Americans sought large, chip-filled purchases, such as computers, game consoles, and cars. But automakers no longer had the silicon to make cars and were forced to slow down or even shut down production. The mess drove up the price of new cars and sent more cost-sensitive buyers to the used market, where prices also rose.

The Russian invasion of Ukraine – and subsequent sanctions on Russian exports – created new bottlenecks in the supply chain. The price of nickel, a component of some chemicals for electric vehicle batteries, has fluctuated wildly over the past month. And in the US, skyrocketing gasoline prices made car buyers look for electric vehicles. “Prices of [electric vehicles] were sneaking for a while, and then there was a big jump with the war and high gas prices,” said Al Bastanmehr, the owner of Green Light Auto Wholesale, which sells used EVs and hybrids in Daly City, California. “It’s just crazy. It’s at a record high.”

The new and used EV crunch — and the temptation for EV owners to flip over their new Teslas, Ford Mustang Mach-Es, and even cheaper vehicles like Nissan Leafs — could last for a while. New cars are getting a bit cheaper, with transaction prices for new vehicles dropping 0.3 percent between February and March, according to Kelley Blue Book, an auto research firm. But transaction prices for new vehicles remain stable – and are even rising – for electric vehicles (which saw a 1.8 percent increase over the same period) and hybrids (8.6 percent). In other words, new green cars are not getting cheaper at the moment.

And here’s the big problem for electrics: some of the new cars that were supposed to hit the market in 2020 and 2021 were never made. That means less used cars will trickle onto the market this year, next year and next. “At some point, new car prices will recover, but that will take a long time,” said Scott Case, the co-founder and CEO of Recurrent, the battery health company. “This whole system — it’s going to take a long time to work through and get to a new normal.”

This story originally appeared on wired.com.