Bitcoin maximists were wrong. Bitcoin is not the only cryptocurrency, there are many other cryptocurrencies with different goals in mind and each of them has its own merits.

The “bitcoin maximalist list” is a list of people who are bitcoin maximalists. The meaning of the word “maximalism” is to be extreme in your beliefs and opinions. Bitcoin maximalists believe that bitcoin will eventually become worthless and that only then will it reach its maximum potential.

At one point, all cryptocurrencies were traded against Bitcoin (BTC). When they saw reliable tokenomics or promising buzz, speculators dived into other currencies, but Bitcoin was their settlement currency of choice.

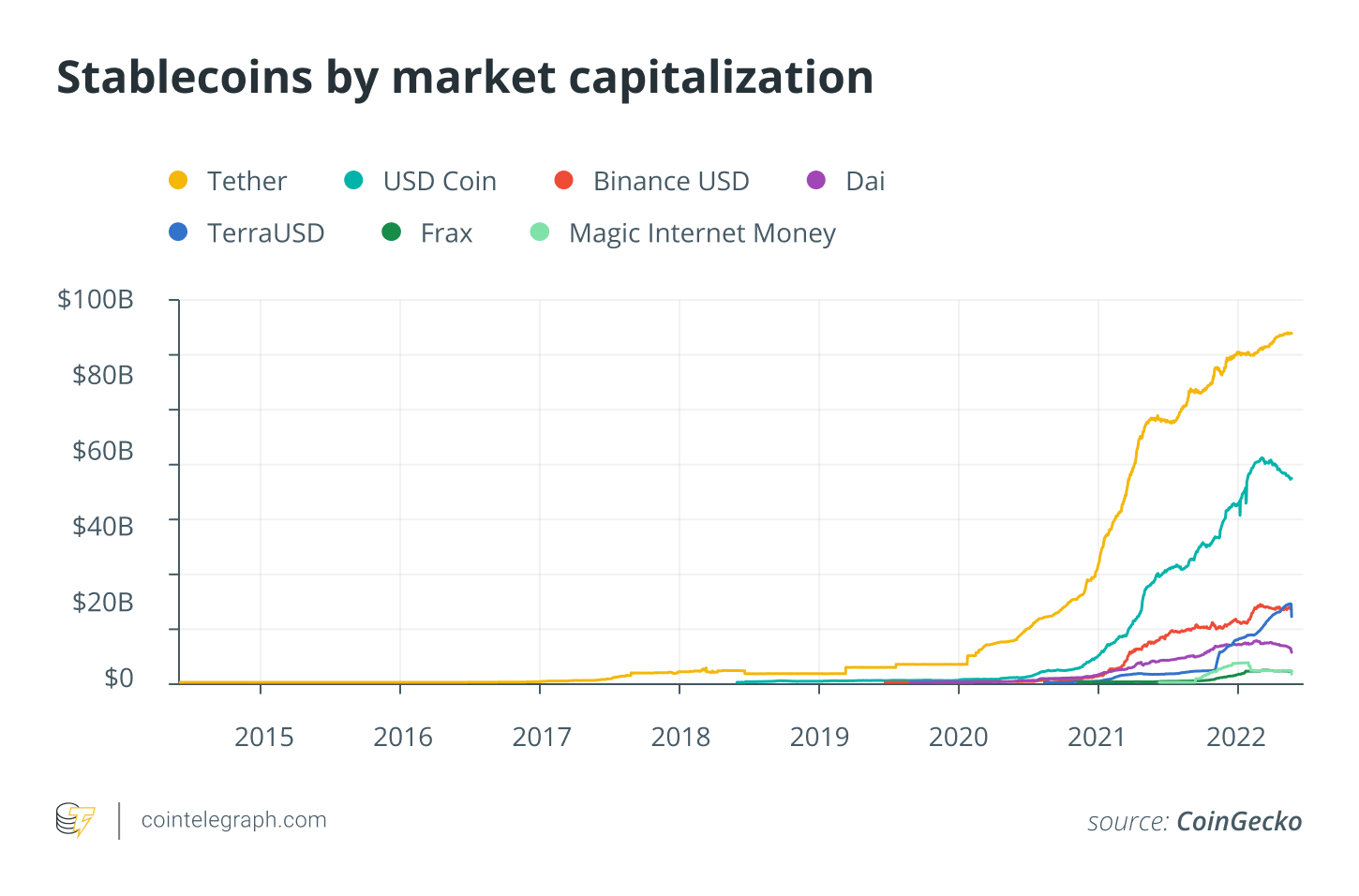

Everything has changed. In the cryptocurrency market today, stablecoins are a $150 billion pillar. Perpetual futures exaggerate market emotion and in many cases control price behavior. Much more money has recently entered the market, especially from institutional investors, with only a minor impact on the price of Bitcoin. As a result, several former bulls now dismiss Bitcoin as boring.

Will Bitcoin Maximalism End? Most likely not. However, additional realism may be required.

How can investors protect themselves against inflation with gold, bitcoin or DeFi?

Bitcoin among the memes

New digital-native brands like the nonfungible token (NFT) project Bored Ape Yacht Club (BAYC) can climb alongside Bitcoin in the digital asset sector, just as Disney stocks can. The BAYC symbolizes a new method of branding, just as investors would be willing to pay top dollar for the rights to a nearly 100-year-old Mickey Mouse. It might even work.

However, this may not be the case. It is speculative, which is attractive to traders.

The volatility of ApeCoin (APE) is different from that of Bitcoin today. Bitcoin is now trading on a macroeconomic backdrop as monkeys chase the brand hype. It is safe to say that Bitcoin is establishing itself as a key position not only among digital asset investors, but even among certain daring institutional investors who traditionally avoid risk. Bitcoin is the established base layer of the market, but can it also serve as the ultimate reserve asset?

Frankly speaking, sovereign wealth funds do not start investing in Ripple (XRP), Shiba Inu (SHIB) or Bitcoin Cash (BCH). They are also not picked up by large pension funds. Realists believe Bitcoin stands out from its competitors because it has proven to be sustainable in the face of many crises and because it is truly decentralized and beyond the control of any government.

Bitcoin’s supremacy in the “payments” sector is clear, with a $750 billion market cap dwarfing the next in line. Similarly, we cannot dismiss the growth of other “cryptocurrencies” as a worthless countermeasure to Bitcoin just because they are not Bitcoin. Realism facilitates communication and understanding, which is the main driver for adoption.

For Baby Boomers, Bitcoin

Bitcoin is only boring in terms of price for people who enjoy the adrenaline rush of speculative trading. Bitcoin is gaining popularity as people’s attention shifts elsewhere, which could lead to even greater growth.

Haven’t we seen the debate around Bitcoin grow so much more mature and focused on basics, as YouTube influencers sprint from farming and breeding to staking and beating?

In 2021, we did not witness a $100,000 Bitcoin. But if we haven’t even reached the 5% global adoption rate, do we really have to be that greedy? Yes, Bitcoin, like other assets, can benefit from human greed and speculation in a less boring world, but those same impulses can cause any asset value to fall.

Is it a boom or a failure? Is it possible for Bitcoin to reach $100,000 in 2022?

Bitcoin requires patience.

A Bitcoin maximalist often strives to have enough Bitcoin to live comfortably in time and space. They also presumably desire a more equitable and equitable economy, which is why they embrace Bitcoin in the first place. A maximalist should also believe that it is preferable to have billions of individuals owning a small amount of Bitcoin than a few million owning everything.

Indeed, buy-the-dip opportunities not only benefit those most committed to Bitcoin, but they also aid in its wider diffusion by attracting new recruits. That’s great news.

In this regard, it is helpful to think about how much Bitcoin you should own or aim for. Then take appropriate measures.

Most ardent Bitcoin supporters, such as Michael Saylor, spent months or years coming to their inspired conclusions. Ray Dalio, a well-known investor, is constantly evolving. Most politicians have no idea what Bitcoin is, and I’m sure El Salvador’s President Nayib Bukele, who declared Bitcoin to be legal money in his country, gets anxious looking at the charts.

El Salvador’s Bitcoin Law: Understanding Alternatives to Government Intervention

Anyone entering the crypto market for the first time because a cute puppy or pixelated monkey presented itself as a hypersonic will take a significant amount of time. However, Bitcoin maximalism is not always the ultimate consequence.

Since Bitcoin is a fundamental holding company, most industry players are already familiar with it. Most digital asset investors know it makes sense to have “some Bitcoin” based on the game theory set in emerging economies and in the context of the current sanctions regime, as well as inflation.

Too toxic?

Some argue that Bitcoin Maximalists are dangerous. However, there are poisonous individuals around. In addition, Bitcoin maximalists excel at reciting basic concepts, which helps to ground the discussion. Bitcoin does not need you; you need Bitcoin, they say. TRUE? True or not, the point is that you should not invest your savings in a memecoin because the community is so great for you.

Let’s be honest. The world struggles with the depreciation of the currency, Bitcoin mining can and does serve environmental purposes too, the US and its allies have frozen Russian foreign assets, the future is deeply digital, inflation is not temporary and it makes perfect sense to put Bitcoin in a love these contexts. †

Bear markets reveal the true nature of programs and standards. Axie Infinity’s Smooth Love Potion (SLP) is now trading at nearly 40 times its all-time high. Bitcoin is almost two-thirds of the way down from its all-time high. It wouldn’t be uncommon or unusual to exceed $69,000 sooner or later.

Finally, banking “getting into Bitcoin” is a bit of a contradiction in terms, and while some might argue that Bitcoin doesn’t need it, it’s equally reasonable to argue that integrating Bitcoin into global finance and existing infrastructure will increase the assets. strengthened by bringing in more long-term investors.

Everyone should be a realist rather than a Bitcoin maximalist.

This message does not provide investment recommendations or advice. Every investment and trading choice has risks, which is why readers should do their own research before making a decision.

The author’s views, ideas and opinions are his or her own and do not necessarily reflect or represent those of Cointelegraph.

Ben Caselin is the head of research and strategy at AAX, the crypto exchange that will be powered by LSEG technology from the London Stock Exchange Group. Ben generates insights into Bitcoin and decentralized finance and provides strategic direction at AAX, with a background in creative arts, social research and fintech. He is also a member of the Global Digital Finance (GDF) Working Group, a leading industry association dedicated to accelerating the adoption of digital finance.

“Bitcoin maximalist reddit” is a website dedicated to Bitcoin maximalism. The website has been around for quite some time and has seen a shift in the meaning of “maximalism”. Reference: bitcoin maximalist reddit.

Related Tags

- bitcoin maximalist vs minimalist

- bitcoin maximalist argument

- famous bitcoin maximalists

- what is a bitcoin minimalist

- bitcoin maximalist meme