Inflation illuminated more than expected in February, a welcome sign for the Federal Reserve while it is struggling with the prospect of higher prices and a slower growth due to President Trump's trade war.

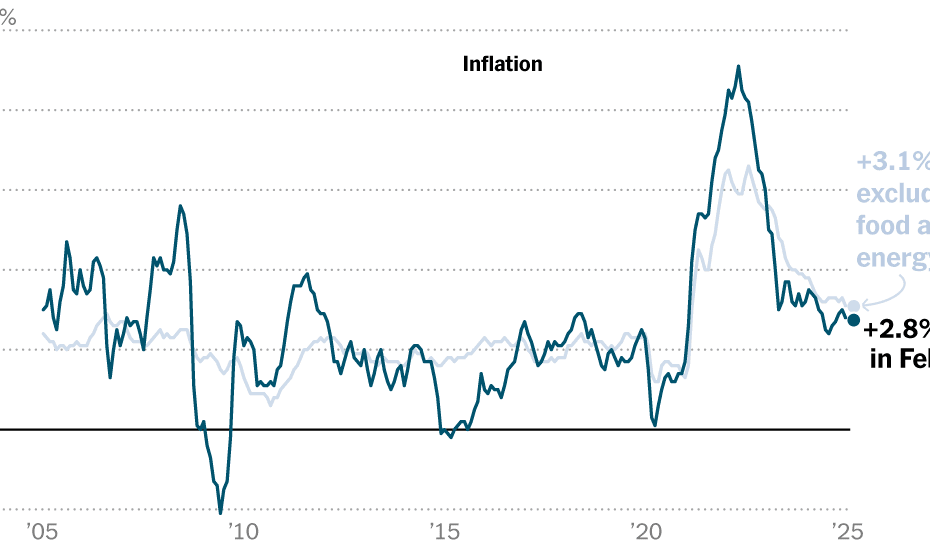

The consumer price index rose by 2.8 percent compared to a year earlier, after an increase of another 0.2 percent on a monthly basis. That was a step down from January Surprisingly large increase of 0.5 percent and came up with the expectations of economists.

The “core” measure of inflation, which spends volatile food and fuel prices to give a better picture of the underlying trend, also tapped lower. The index rose by 0.2 percent compared to the previous month, or 3.1 percent compared to a year earlier. Both were lower than the January increase.

The data from the Bureau of Labor Statistics underline the bumpy nature of the progress of the Fed in the direction of the goal of 2 percent. The prices for staples for consumers, such as eggs and other supermarket items, rise steeply again, but the costs for other categories such as gasoline are falling. A 4 percent fall in airline tickets in February was a primary engine of the better than expected data.

Egg prices rose another 10.4 percent in February, because an outbreak of Aviaire Influenza continued to worsen a national egg shortage. The prices for eggs have risen almost 60 percent since last year. Food prices rose wider 0.2 percent, or 2.8 percent compared to the same time last year.

The costs for used cars also increased 0.9 percent in February, although the new vehicle prices fell slightly. Car insurance, which was a huge engine of the unexpectedly large increase in the index in January, rose again, but at a much slower pace of 0.3 percent. It is slightly more than 11 percent higher in the past year.

Housing -related costs also achieved the smallest profit of 12 months since December 2021, with the Shelter Index with 4.2 percent. Between January and February it rose by 0.3 percent.

The big question mark is when Mr. Trump's rates will start to influence consumer prices in a more noticeable way. The only rates during the period that fall under the data of February were the first levy of 10 percent that Mr Trump imposed on Chinese import. Ryan Sweet, head -American economist at Oxford Economics, said that there was no “observable impact on the CPI in February, including clothing, furniture and electronic prices.” On the contrary, he expects the taxes on China, which were doubled earlier this month, together with the other rates that Mr Trump is now set up to increase consumer prices in the coming months.

Peter Tchir, head of the macro strategy at Academy Securities, said that the greatest effect will probably appear in the coming months if Mr. Trump runs through with mutual rates for trading partners. The president has threatened to abolish American rates to agree with what other countries charge in the import, what the costs of products that buy Americans from abroad can increase.

In addition to possible price increases, Mr. Tchir said that he was very concerned about the prospects for the economy as a result of rates and the plans of the administration to lower government spending.

“The growth fear is real,” he said.

Uncertainty about the President's policy has also strengthened the fear that companies will assume in a more important way and start investments, because they are waiting for the clarity at the scope and scale of Mr Trump's plans.

These concerns are also in recent measures to follow how consumers think about the future. According to the last survey of the Federal Reserve Bank of New York, consumer expectations about their financial situation 'considerably disadvantaged' in the coming year, because they deleted for inflation that held around 3.1 percent. Consumers' share now expects to be in a worse situation in a year in a year in a year in a year, since November 2023 has risen to the highest point.

A combination of delaying growth and reviving price pressure brings the Fed to a difficult position, given its mandate to pursue a low, stable inflation and a healthy labor market.

From January, FED officials justified their ability to limit a different interest rate cuts and to wait for more progress on inflation because the economy was doing well. If that resilience signs of cracking starts to show before inflation is completely overcome, the FED can be more limited in how it responds.

When the FED had to deal with a trade war during the first term of Mr Trump, it reduced interest rates with a total of three -quarters of one percent in 2019 in an attempt to protect the economy against further weakening.

In his most detailed comments so far about Mr Trump's rates, Jerome H. Powell, the FED chairman, recognized last week that the economic background this time was different. “We came from a very high inflation and we did not completely return to 2 percent on a sustainable basis,” he said during an event on Friday.

Mr Powell added that the typical response of the FED to rates would be to 'see through' every one -off increase, but emphasized that officials would look forward to shocks and how long -term inflation expectations. “While we dissect the incoming information, we are focused on separating the signal from the noise as the Outlook evolves,” he said. “We don't have to be in a hurry and are well positioned to wait for more clarity.”

This suggests that the FED will expand its break with interest rate letings when civil servants gather next week, so that the current reach of 4.25 to 4.5 percent is maintained.

Traders on Futures -markets bet that the FED can lower the rates three times this year, each with a quarter point. That is more cuts than just a few weeks ago predicted, which is a reflection of the increasing fear of the economic outlook.