Meanwhile, the demand for magnets embedded in decarbonization tools, such as cars and wind turbines, is rising. Currently, 12 percent of rare earths go to EVs, according to Adamas Intelligence, a market that is only now taking off. At the same time, rare earth prices have skyrocketed recently due to internal Chinese markets and political interventions that external companies cannot always predict.

All in all, if you’re in a company where you can create an alternative work, it probably makes sense to do so, says Jim Chelikowsky, a physicist who studies magnetic materials at the University of Texas, Austin. But there are all sorts of reasons, he says, to look for better alternatives to ferrite for rare-earth magnets. The challenge is to find materials with three essential properties: they must be magnetic, retain that magnetism in the presence of other magnetic fields, and tolerate high temperatures. Hot magnets are no longer magnets.

Researchers have a pretty good idea of which chemical elements can make good magnets, but there are millions of potential atomic arrangements. Some magnet hunters have taken the approach of starting with hundreds of thousands of possible materials, discarding those with drawbacks such as rare-earth metals, and then using machine learning to predict the magnetic properties of the remaining materials. Late last year, Chelikowsky published the results of using the system to create a new strong magnetic material containing cobalt. That’s not ideal geopolitically, but it’s a starting point, he says.

Often the biggest challenge is finding new magnets that are easy to make. Some newly developed magnets, such as those containing manganese, show promise, explains Vishina of Uppsala University, but they are also unstable. In other cases, scientists know that a material is extremely magnetic but cannot be made in large quantities. That includes tetrataenite, a nickel-iron compound known only from meteorites that must cool slowly over thousands of years to arrange the atoms in just the right state. Attempts to make it faster in the lab are underway, but have yet to bear fruit.

Niron, the magnet startup, is a little further along, with an iron nitride magnet that the company says is theoretically more magnetic than neodymium. But it is also a fickle material, difficult to make and to keep in a desirable form. Blackburn says the company is making progress, but won’t produce magnets powerful enough to transform EVs in time for Tesla’s next-generation vehicles. The first step, he says, is to put the new magnets in smaller devices like sound systems.

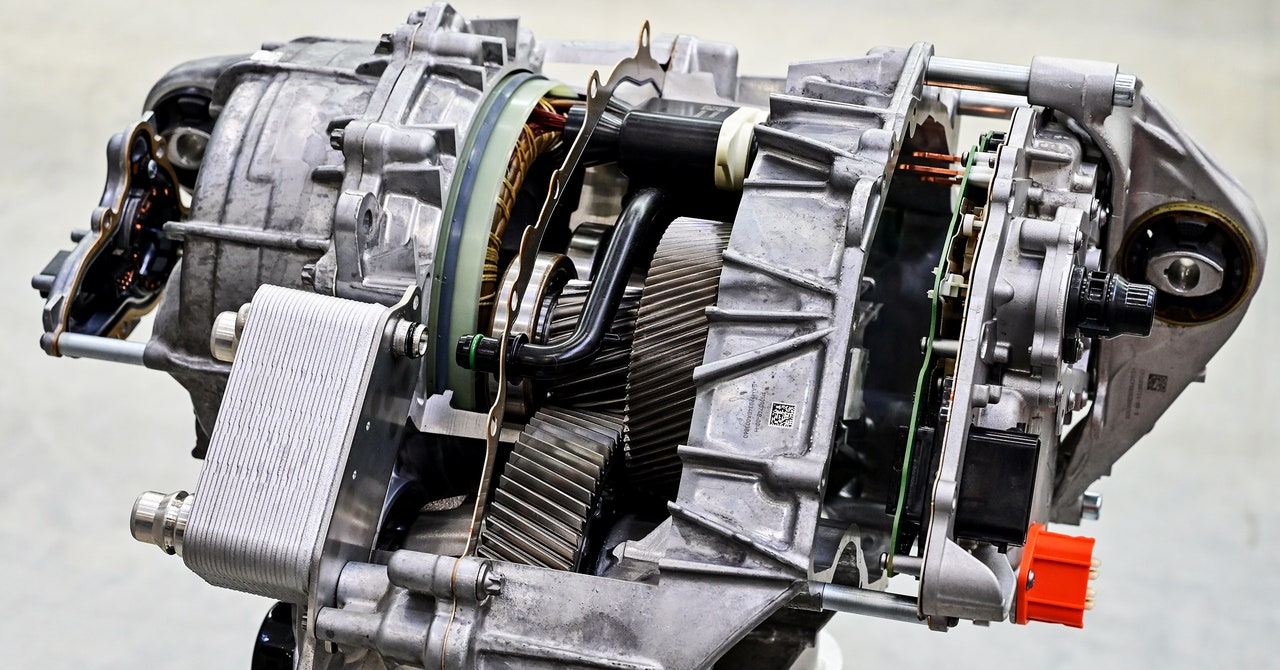

It’s unclear whether other automakers will follow Tesla’s consideration of rare-earth metals, Kruemmer says. Some may stick with the baggage-laden materials, while others may go for induction motors or try something new. Even Tesla, he says, is likely to sprinkle a few grams of rare-earth metals into its future vehicles, spreading across things like automatic windows, power steering and windshield wipers. (In a possible sleight of hand, the slides of contrasting rare-earth content at Tesla’s investor event were actually comparing an entire current-generation car to a future engine.) Despite workarounds such as those in the works at Tesla, rare earth magnets sourced from China will stick with us – including Elon Musk – especially as the world pushes for decarbonisation. It might be fun to replace everything, but as Kruemmer says, “we simply don’t have the time.”