Investors are rethinking the premise that justified Tesla’s astronomical stock price and made its founder, Elon Musk, the richest person in the world.

Tesla’s $1 trillion valuation only made sense if investors believed the electric car company was on track to dominate the auto industry the way Apple rules smartphones or Amazon commands online retail.

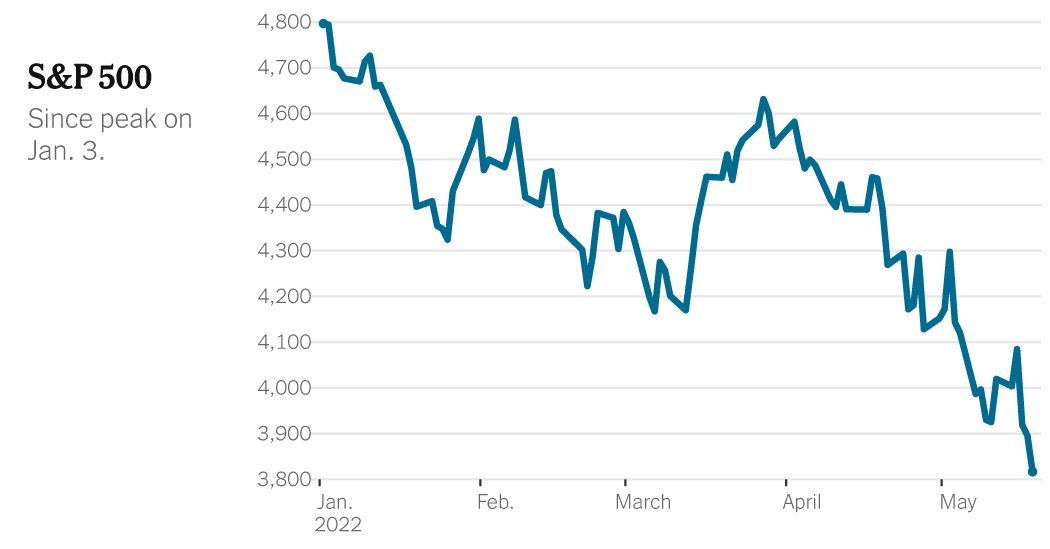

But Tesla shares have fallen more than 40 percent since April 4 — a much steeper decline than the broad market, evaporating more than $400 billion in market cap. And the fall has drawn attention to the risks facing the company. These include increasing competition, a lack of new products, lawsuits accusing the company of racial discrimination and significant manufacturing problems at Tesla’s Shanghai factory, which it uses to supply Asia and Europe.

Mr. Musk has not helped the stock price by turning his bid to buy Twitter into a financial soap opera. His antics have reinforced the perception that Tesla does not have an independent board of directors that could stop him from doing things that could harm the company’s business and brand.

“From a corporate governance perspective, Tesla has a lot of red flags,” said Andrew Poreda, a senior analyst who specializes in socially responsible investing at Sage Advisory Services, an Austin, Texas-based investment firm. “There are almost no checks and balances.”

Even old Tesla optimists have doubts. Daniel Ives, an analyst at Wedbush Securities, was one of the most steadfast believers in Tesla on Wall Street. But on Thursday, Wedbush lowered its target price for Tesla — the company’s estimate of the stock’s fair market value based on future earnings — from $1,400 to $1,000. Mr Ives cited Tesla’s problems in China, where lockdowns have curbed the supply of critical parts and materials and demand for cars.

“There is a new reality for Tesla in China, and the market is rethinking the risks,” said Mr. ives.

Manufacturing problems in China have undermined one of the reasons for making Tesla the most valuable auto company in the world. Tesla vehicles are a hit with Chinese buyers, fueling hopes for accelerated growth in the world’s largest auto market. Tesla’s market share in China was 2.5 percent in the first quarter of 2022, bringing luxury carmakers Mercedes-Benz, BMW and Audi close.

But the supply chain headache in China is compounded by dwindling consumer demand, said Michael Dunne, chief executive of ZoZoGo, which advises companies on the electric car market.

Chinese consumers “are tense, they are worried about the future,” Mr Dunne said. “It’s a double whammy that Tesla is facing in China.”

Tesla stocks are responding in part to the same forces that are plaguing stock markets around the world: war in Ukraine, rising interest rates, the threat of a recession, supply chain chaos and rising inflation. But Tesla shares have fallen much more than other Silicon Valley giants like Apple or Alphabet, the company that owns Google.

Tesla accounted for three quarters of all electric cars sold in the United States last year. The company is several years ahead of its competitors in battery technology and software. But two models — the Model 3 sedan and the Model Y SUV — accounted for 95 percent of Tesla’s sales. The next consumer vehicle, a pickup truck, has been delayed many times and is not expected until next year at the earliest.

It is an axiom in the automotive industry that new models drive sales. And competition from Hyundai, Ford and Volkswagen, among others, is increasing, giving drivers much more choice.

Jesse Toprak, an auto industry veteran who is chief analyst at Autonomy, a company that offers electric cars via subscription, said Tesla’s market share will drop below 40 percent by the end of 2023, although its sales will continue. grow as the overall market expands.

“They will have a smaller share of a bigger pot,” said Mr. Toprack. “But their near-monopoly on electric vehicle sales in the US will slowly decline.”

Tesla already faces stiff competition in Europe, where electric vehicles account for 13 percent of new car sales. That’s a harbinger of what could happen in the United States, where sales of battery-powered cars are just starting to pick up. According to figures from Schmidt Automotive Research in Berlin, Volkswagen, which has invested heavily in electric vehicles, sold 56,000 battery-powered cars in Western Europe in the first three months of the year, just behind Tesla, which has sold 58,000.

Tesla’s ability to serve the European market will improve as a new factory near Berlin ramps up production. In the United States and elsewhere, the company has benefited from fanatically loyal buyers who consider Mr. Musk a visionary and willing to wait months or years for the company’s cars.

But as electric cars gain popularity due to skyrocketing gas prices, the next wave of customers may not be as tolerant or enamored with Mr. musk. “The next generation of buyers will be average Joes buying EVs because it makes financial sense to them,” said Mr. Toprak. “Tesla’s brand image will be less useful.”

Tesla’s image is under pressure in ways that could hurt the automaker among the environmentally conscious, politically liberal customers that have long been its largest customer base. The California Department of Fair Employment and Housing is suing Tesla, accusing it of allowing racial discrimination and harassment at its factory in Fremont, California, near San Francisco. Tesla is fighting the lawsuit.

In another blow, the S&P 500 ESG index, a list of companies that meet certain environmental, social and governance standards, was ejected from Tesla last month. S&P said it was alarmed by claims of racial discrimination and poor working conditions at the company’s Fremont plant.

Mr. Musk responded to S&P’s decision by writing on Twitter that the move to apply environmental, social and governance standards to companies is a “scam” “armed by fake social justice fighters.”

Mr. Musk followed that Twitter post by declaring that he traded his allegiances for the Democratic Party, which he said had become “the party of division and hatred,” and would now vote for the Republicans. Such politically charged statements are sure to alienate some car buyers.

“The more political he gets, the more that can affect buyers,” said Carla Bailo, chief executive of the Center for Automotive Research in Ann Arbor, Michigan.

Mr. Musk and Tesla did not respond to requests for comment.

Management turnover is another risk. Mr Musk is a notoriously demanding boss who has warned Twitter employees that “the work ethic would be extreme” if he takes over the social media platform.

The churn at Tesla is clear. Many of his former senior executives are prominent in the San Francisco Bay Area start-up scene. Examples include Celina Mikolajczak, head of manufacturing at fledgling battery maker QuantumScape, who previously helped develop batteries at Tesla, and Gene Berdichevsky, another former Tesla battery developer who is CEO of Sila Nanotechnologies. Sila announced this week that it will supply materials for advanced batteries to Mercedes-Benz.

Lucid, maker of the only electric model that beat Tesla in the Environmental Protection Agency’s tests of how far an electric car can go on a full charge, was founded by Peter Rawlinson, a former top Tesla engineer, until he got into an argument with Mr. . musk. Lucid’s headquarters are in Newark, California, a short drive from Tesla’s Fremont factory.

Mr. Musk’s admirers say he helped promote zero-emission vehicles by seeding the industry with talent. But critics see a risk that Tesla will never develop a stable echelon of experienced executives to lead the company if anything ever happens to Mr. Musk.

“You can’t mistreat your employees in a tight job market like we’ve done,” said Mr. Poreda from Sage Advisory. “A smart man can’t make his vision come true without a lot of really smart people.”

Amid this litany of problems and risks, Mr. Musk has spent time acquiring Twitter, though he seems to have doubts about the deal lately. Some investors wonder why the boss spends so much time writing messages on Twitter while the world is on fire.

“There’s just a feeling,” said Mr. Ives of Wedbush, “that the pilot on the plane is watching a Netflix show while you’re going through a huge thunderstorm.”