Softbank said on Wednesday that it had agreed to pay $ 6.5 billion for the Silicon Valley Chip Start-Up Ampere Computing, double a bet that will dominate the data centers of the world in smartphones.

The deal also reflects the conviction of the Japanese conglomerate that the chips of Ampere can play an important role in artificial intelligence, in which Nvidia has so far picked the most rewards.

Ampere was founded eight years ago to sell chips for data centers based on technology from Arm Holdings, a British company that is happy to read chip designs that have driven almost all mobile phones. Softbank, which bought Arm in 2016, worked on chips based on arm technology that is used wider and for various tasks.

“The future of artificial super intelligence requires breakthrough from the computer,” said Masayoshi Son, chairman of Softbank and Chief Executive, in prepared comments. “Ampere's expertise in semiconductors and high-performance computing will help accelerate this vision and to deepen our dedication to AI innovation in the United States.”

Softbank said it would work as a complete subsidiary under its own name.

The sale comes in the midst of a flurry of deals and shifting alliances driven by a furious demand for the chips used to provide AI applications such as OpenAi's chatgpt with power. Softbank in particular has announced a series of transactions in an attempt to play a greater role in the field.

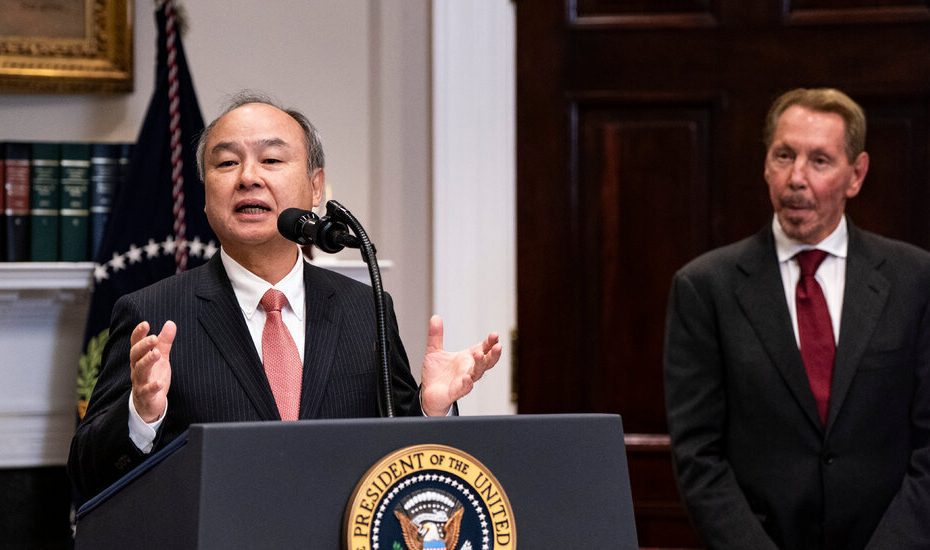

In his spectacular step so far, Mr Son came to President Trump in January to announce an initiative called Stargate, alongside Sam Altman, the Chef of OpenAi, and Larry Ellison, chairman and founder of the software maker Oracle, who is the largest investor and customer of Ampere.

Mr. Son, Mr. Altman and Mr Ellison said that Stargate would invest no less than $ 500 billion to build a series of American data centers to feed the activities of OpenAi, start with a location in Texas. Nvidia was mentioned as an important technology partner for the company; It delivers chips called graphic processing units, or GPUs, which are responsible for most of the AI calculations.

Another kind of chip also plays central roles in AI These are the microprocessors designed by Intel, advanced micro devices and arm that deal with the calculations of general compose. These chips, which work together with GPUs and are called “host” processors, manage AI jobs such as building special software programs called models. One microprocessor is usually used for every four NVIDIA GPUs that are sold.

These microprocessors are sometimes also used to be able to handle an AI task with the name 'Inference', including providing answers to questions in chatbots. So far, Chips from Intel and AMD were good for almost all AI host processors and microprocessors that were used for inferences.

But some influential companies want to change that. NVIDIA has started pushing arm -processors as an option for host -microprocessors instead of Intel or AMD chips.

There is a lot of money at stake. IDC, a market research agency, predicts that the market for Microprocessors sold for AI will grow to $ 33 billion in 2030 in 2025 in 2025 in 2025.

AMD and Intel have pointed out that moving to the arm switching of software can be changed. They added that Nvidia did not only support the arm technology and still supported their chips as an option, together with the latest GPUs.

“Nvidia is still an important partner of ours,” said Ronak Singhal, head architect of Intel's Xeon line from DataCenter -Chips.

Ampere has mainly put his microprocessors on the market for jobs for the general data center. But it has recently announced plans for a chip, called Aurora, with a maximum of 512 small calculation engines, a design that, according to the company, is especially suitable for AI inserting applications.

The company, led by Renée James, a former Intel director, has had some successes. But the biggest spenders in the sector-giant companies such as Amazon, Google and Microsoft Hebben recently focused more on developing their own microprocessors based on arm technology, rather than trusting the start-up.

Oracle is an exception. It has offered online services that are powered by Ampere chips and has announced stock and debt investments in the company. From May Oracle said that it had a 29 percent interest in Ampère; It set the value of his investments, after approval for losses, at $ 1.5 billion.

As part of the purchase, Oracle and Carlyle Group, the large private equity company that is also a large Ampere investor, agreed to sell in their interests in Ampere, Softbank said.

Bloomberg reported last month that Softbank was near a deal to buy Ampère.