Silicon Valley got its name from computer chips, but it no longer plays a central role in shaping how they are made. A major supplier to the industry hopes to change that.

Applied Materials, the largest maker of semiconductor manufacturing machinery, said Monday it planned to build a massive research facility near its hometown, Santa Clara, Calif., to enable chipmakers and universities to collaborate on progress to make more powerful chips. According to industry analysts, Silicon Valley has not seen a comparable semiconductor construction project in more than 30 years.

The company expects to invest up to $4 billion in the project over seven years, with some of that money coming from federal grants, while creating up to 2,000 tech jobs.

The plan is the latest in a series of chip-related projects boosted by the CHIPS Act, a $52 billion grant package that Congress approved last year to reduce U.S. reliance on Asian factories for its critical components. What sets Applied Materials’ move apart is that it focuses on research, rather than manufacturing, and is a substantial new commitment to the industry’s original hub.

Chipmakers raised in Silicon Valley have long chosen to build new “factories,” the high-end factories that make chips from silicon wafers, in lower-cost states and countries. But Applied Materials is betting that engineering talent at nearby universities and the local chip design companies will quickly spur innovation, offsetting cost differences with other locations.

“You can connect more leaders in this ecosystem here than anywhere else in the world,” said Gary Dickerson, Applied Materials CEO. “There’s no place like this.”

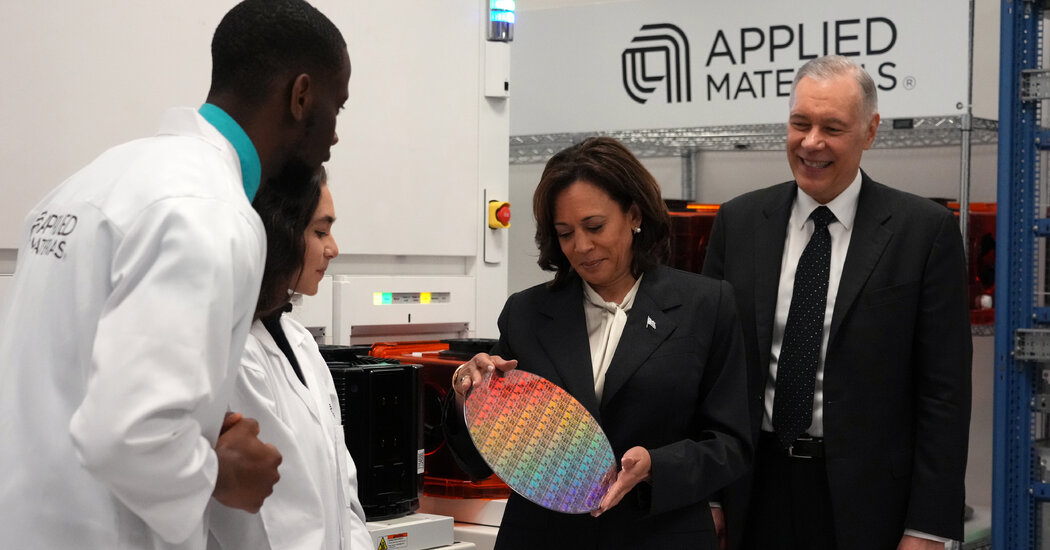

Applied Materials hosted an event Monday in Sunnyvale, California, to discuss the project, drawing a large audience including employees, customers, city officials and Vice President Kamala Harris.

The company said it would use a 150-pound piece of silicon, which one executive called “easily the largest piece of silicon in Silicon Valley,” as the cornerstone for the new center.

Politicians from both sides supported the CHIPS bill, in part out of fear that China will one day control Taiwan and factories there that produce the most advanced chips. In addition to boosting domestic chip production, the legislation allocated about $11 billion to boost related research and development.

Chip research is now taking place in several phases at multiple locations, including university labs and collaborative centers such as the Albany NanoTech Complex in New York. Applied Materials participates in that center along with other companies and operates a research fab in Silicon Valley where chipmakers can work with their machines and those of other toolmakers.

But many of the core tasks in developing new manufacturing processes are performed by chip manufacturers in factories equipped with a wide variety of equipment. The proposed center, which Applied Materials is calling Epic, will have an ultra-clean manufacturing space larger than three football fields and is designed to give university researchers and other engineers similar resources to experiment with new materials and techniques for making advanced chips.

One of the goals is to shorten the time it takes for new ideas to flow from the research labs to companies designing new manufacturing equipment, information that is now often delayed as it is filtered by the chipmakers.

“The problem is that those customers need time to figure out what they need,” says H.-S. Philip Wong, a Stanford professor of electrical engineering, who was briefed on the company’s plans. “There’s a big hole in it.”

Applied Materials also said chipmakers can reserve space at the center and try out new tools before they are commercially available.

The plan hinges in part on whether Applied Materials can win grants under the CHIPS Act, which the Department of Commerce says has already sparked interest from more than 300 companies. Mr Dickerson said the company had at least planned to build the center but government funding could affect the scale of the project.

Assuming the center evolves according to plan, it could significantly bolster Silicon Valley’s role in chip evolution, said G. Dan Hutcheson, vice president at market research firm TechInsights.

“It’s really a vote of confidence for the Valley,” he said.