CrowdStrike Holdings (NASDAQ: CRWD) made a major, unforced error on July 19 when one of its software updates affected more than 8.5 million users of Microsoft Windows. The cybersecurity stock lost more than 20% of its value in two trading sessions as the botched update hampered operations at many of the world's largest companies.

A key question for investors is how it will impact the stock in the long run. In this article, three Motley Fool contributors share their thoughts on the state of CrowdStrike and where investors should go from here.

Make no mistake: CrowdStrike is in survival mode

Jake Lerch: Let's to make one thing clear: Mistakes happen. And boy, did CrowdStrike learn that lesson.

Some are calling the series of computer crashes the “world’s largest IT outage,” after banks, hospitals and airports were all shut down by a faulty CrowdStrike software update.

The real questions for investors are: How much reputational damage has the company suffered and should the bullish assumption about the stock be reconsidered?

Let's start with the reputational damage, which is extensive and potentially long-lasting.

First, not all of the problems caused by the outage were resolved. as of this writing — CrowdStrike says that as of July 26, 97% of affected users were back online. The outage caused flight delays and cancellations, postponed critical medical procedures, delayed cancer treatments and disabled 911 service in some areas.

In short, a CrowdStrike software update brought about a nightmare scenario that many experts thought was the result of a catastrophic hack attack. That's a big deal, because the business model is built around the ability to detect and prevent such disasters, they do not create.

Once all current issues are resolved, management will to have new challenges. There will undoubtedly be various investigations and lawsuits who jump up. Several members of Congress have already called for CEO George Kurtz to testify. None of this will help CrowdStrike focus on executing its business model or delivering shareholder returns.

Investors should therefore reassess the company’s ability to deliver revenue growth, which is key to the bull thesis. It will likely decline if customers abandon CrowdStrike altogether or cut back on subscription spending. New lawsuits would force the company to use all profits and cash flow to pay legal fees and settlements, not to deliver shareholder returns or grow the business.

In summary, investors would be wise to remain very cautious on CrowdStrike, at least for several quarters. The company has ended up in a huge mess — There is no reason for investors to get involved in this either.

Investors should take this issue more seriously than CrowdStrike apparently has

Justin Pope: Mighty CrowdStrike has been a standout stock and a favorite among growth investors since it went public five years ago. But the IT outage has left investors with a number of issues, and it’s important to understand the potential impact on the stock.

Fortunately for CrowdStrike, it was a faulty update that caused the IT outage, and not a security breach that would further damage the company's reputation as a leading cybersecurity provider.

The damage caused by the outage is staggering. Early insurance estimates put the direct financial losses for Fortune 500 companies alone at more than $5 billion. Those are tangible losses and do not include anything incalculable, such as reputational damage.

For example thousands Delta Customers were stuck at the airline’s hubs for days with no way to get home. Do you think those people will want to book with Delta again anytime soon?

Then, reports surfaced that CrowdStrike had supposedly offered $10 gift cards to customers as compensation for the inconvenience the outage caused. If true, it’s a ridiculously bad public relations misstep considering this is likely the most significant IT outage in history.

I’m not saying CrowdStrike is doomed, but it’s far too early to know how this will hurt the business. The cybersecurity industry is highly competitive and rest assured, other vendors will be poaching the company’s customers in the coming months. It may take a quarter or two to see what the damage is.

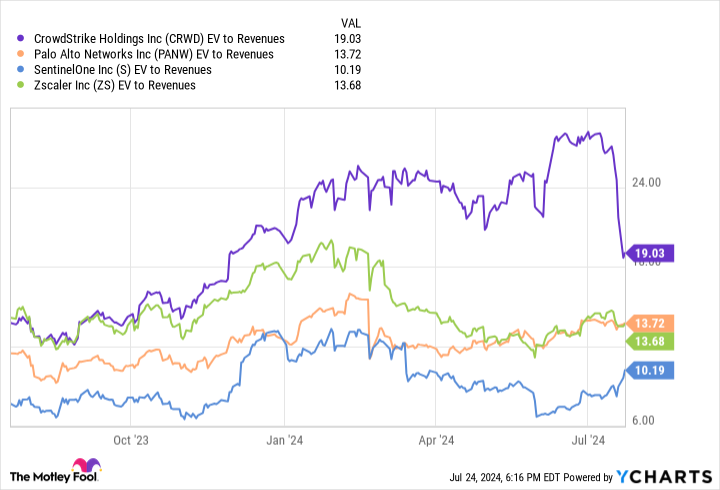

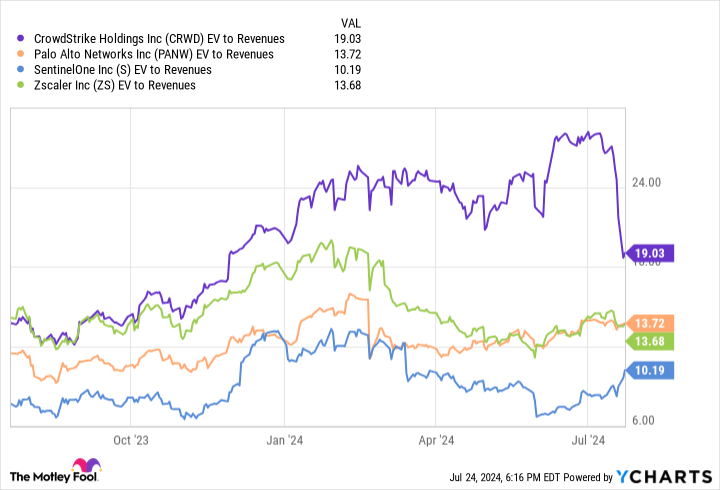

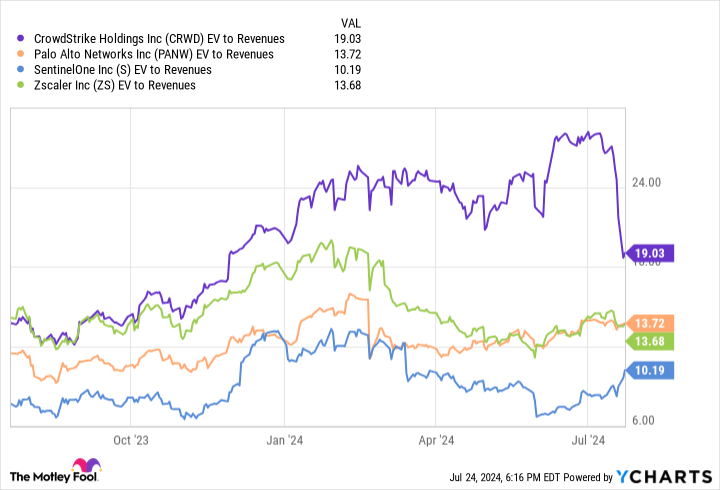

Meanwhile, the stock is still more expensive than its peers, despite the 30% drop:

I think the company can eventually overcome this, but the stock is still way too expensive. We are only a few days into the outage and no one knows yet how big the damage is.

Will CrowdStrike lose customers? How many? Will customers demand compensation or rebates? What about lawsuits? Better to be safe than sorry and stay on the sidelines until the dust settles.

How you manage CrowdStrike stock may be more important than when you buy it

Will Healy: CrowdStrike investors now face a difficult challenge. The service disruption has disrupted healthcare, airlines, banking and other industries, costing untold amounts of money. You have to expect lawsuits, and it’s unclear how those costs will hit CrowdStrike. That’s why investors would be wise to dump their shares.

But as painful as the idea of buying now may sound, history favors buying high-quality stocks when there’s “blood in the streets,” to borrow a phrase from Baron Nathan Rothschild, an 18th-century British nobleman. The current blackout probably qualifies as such an event.

And to its credit, CrowdStrike has admitted its wrongdoing and taken swift action to resolve the issue, a first step toward addressing the significant reputational damage that could result.

Also, the uncertainty is likely to eventually subside, which should bode well for the company, assuming the focus gradually returns to the fundamentals. Fortune Business Insights estimates a compound annual growth rate (CAGR) of 14% for the cybersecurity industry through 2032.

Additionally, the company forecast revenue in a range of $3.98 billion to $4.01 billion for fiscal year 2025 (ending January 31, 2025). That represents 30% annual revenue growth at the midpoint, and even if the disruption forces a downward revision, revenue growth should outpace the industry’s estimated CAGR.

Still, valuations don’t necessarily indicate that investors should buy now. Shares are currently trading at a price-to-sales (P/S) ratio of 19. While that’s down from a P/S of 29 just three weeks ago, the valuation still beats that of its closest competitors. And with the stock’s current woes, most investors are likely reluctant to pay a premium for the stock.

Still, investors buying now should consider dollar-cost averaging. Adding to CrowdStrike in small allocations over a longer period of time will minimize losses if the stock continues to decline. Conversely, if there is somehow a quick recovery, shareholders will hold at least some shares that are rising in value, increasing the opportunity to profit from this uncertainty.

Should You Invest $1,000 in CrowdStrike Now?

Before you buy shares in CrowdStrike, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $692,784!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 22, 2024

Jake Lerch has positions in CrowdStrike. Justin Pope has positions in SentinelOne. Will Healy has positions in CrowdStrike and Zscaler. The Motley Fool has positions in and recommends CrowdStrike, Fortinet, Microsoft, Okta, Palo Alto Networks, and Zscaler. The Motley Fool recommends Delta Air Lines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Should You Buy CrowdStrike During the Crisis? 3 Analysts Weigh In. was originally published by The Motley Fool