When Digit spends an afternoon unloading boxes from a tractor-trailer in a heat of over 100 degrees, colleagues never hear a complaint. Digit, a blue and white humanoid robot, is designed to perform the arduous, menial and dangerous tasks in warehouses.

The robot’s movements, based on years of studying how birds walk, include a slight swing in the frame when it’s at rest, to dispel the awkward silence that bothers people. He doesn’t talk either, because the speech recognition technology is not yet advanced enough.

“Instead of designing the entire warehouse around the robots, we can now build robots that can work on our terms, in our spaces, in our environments,” said Jonathan Hurst, the chief technology officer and founder of Agility Robotics, the firm. behind digital.

Robotics and automation are not new to logistics; conveyors, scanners and other innovations have helped automate and accelerate the speed-obsessed industry for decades. But the pace of investment and change – fueled by the pandemic-era e-commerce boom, a tight labor market and a fragile supply chain – has exploded in recent years. Experts say robotics will change the way warehouses are managed and designed.

“We are entering a golden age,” said Tye Brady, chief engineer at Amazon Robotics. The e-commerce giant, which helped revolutionize the industry towards automation with its 2012 acquisition of robotics company Kiva Systems, has deployed more than half a million robotics units, including Proteus, the first fully autonomous mobile robot.

Labor organizations have a different perspective. Technology can make jobs safer and safer, but the industry is too focused on using it as a cost-cutting measure, said Sheheryar Kaoosji, executive director of the Warehouse Worker Resource Center, a California nonprofit.

“It has always wanted to reduce labor costs, and reducing human labor is something the industry has seen for decades as a way to save money,” he said.

The adoption of robotics in warehouses is set to grow 50 percent or more over the next five years, according to studies from the Material Handling Institute, an industrial trade group. The goal is mechanical orchestration, where a team of robots, controlled by advanced software and artificial intelligence, can move boxes and products in a seamless environment.

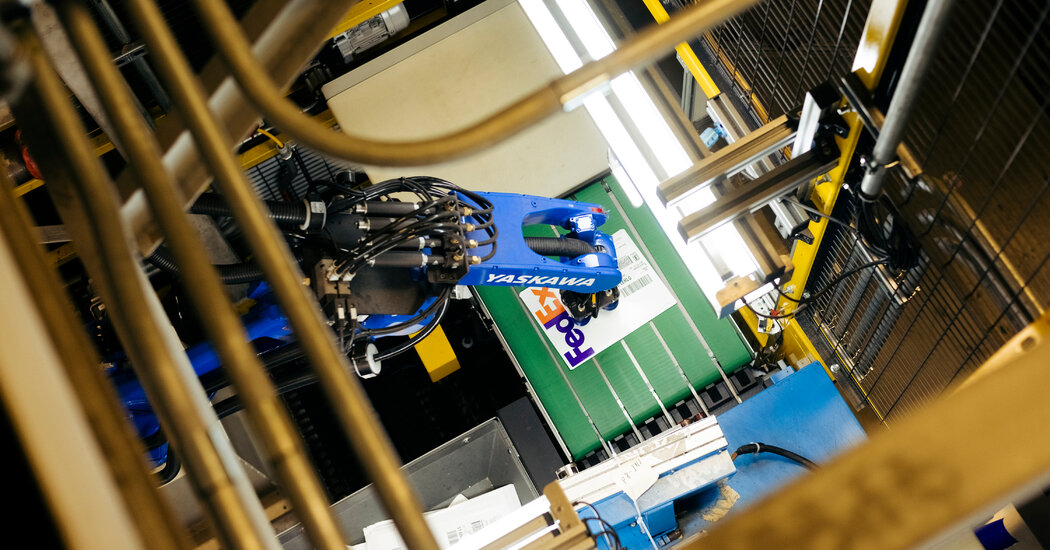

“I’m concerned about the owners who don’t,” said Erik Nieves, chief executive of Plus One Robotics, which partnered with Yaskawa America to bring robotic arms to a FedEx sorting facility in Memphis. “Even today, many warehouses are just racks, a cart, and a clipboard. They just can’t keep up.”

Billions are invested by major players who like to stay on the cutting edge. For example, Walmart recently announced a deal with Symbotic to bring its system of tires, pickers and autonomous vehicles to all 42 of the retailer’s main sorting facilities.

Amazon, which accounted for 38 percent of industry robotics investment last year, announced a $1 billion Industrial Innovation Fund in April to support robotics companies like Agility. And Kroger grocer has opened five of its 20 planned warehouses equipped with Ocado’s automated system for packing and shipping fresh groceries.

The germ of the warehouse robotics wave was planted during the recession of 2008, when automakers, which rely heavily on robotics, experienced a significant and prolonged downturn. Many current innovators have backgrounds in the automotive industry and saw logistics as ripe for innovation.

Read more about artificial intelligence

But unlike assembly line production, warehouses require a significant degree of flexibility. Only recently have systems like visioning and artificial intelligence become cheap and powerful enough to sort the tens of thousands of different products streamed through an e-commerce warehouse. This technological leap is part of a larger embrace of robotics: The industry saw a 28 percent increase in purchases from 2020 to 2021, according to the Association for Advancing Automation.

Now the technology is becoming more affordable and is filtering through the industry, past major players like Walmart and Amazon, said Rueben Scriven, a senior analyst at Interact Analysis who focuses on warehouse automation. He predicts a 25 percent increase in investments in robotics and automation this year alone.

Real estate companies also invest in robotics startups. For example, Prologis, an industrial giant with a global warehouse network, has poured tens of millions of dollars into robotics companies through its Prologis Ventures fund.

“Netflix is the only company that could come up with streaming video, and suddenly it wasn’t,” said Zac Stewart Rogers, a professor at Colorado State University who focuses on logistics and warehousing and who educates an emerging middle class of robotics users. seen in the industry. “Other companies will catch up with Amazon’s lead.”

There is an increasing demand for goods-to-person robots from companies like Fetch and Locus. These so-called cobots, which can look like Segways with garbage cans, move back and forth between employees throughout the facility. With the rising costs of raw materials such as steel, these robots are becoming cheaper and faster to deploy than automated transport systems. Some companies have even introduced ‘robots as a service’ business models to rent these machines out to warehouse workers.

Many industry analysts add that the increased interest in robots stems from a tight labor market due to high turnover and competitive wages in other areas. Automation is a lever that companies can use to tackle the problem.

Robots won’t replace workers in the near term, Mr. Scriven said, but rather they would make them more efficient and productive. Humans will be crew leaders, leading and maintaining teams of robots.

And robots can help recruit, says William O’Donnell, director of Prologis Ventures.

“It will improve the quality of the experience for the workforce because instead of doing something by heart, individuals will learn how to control the robot to keep it running,” he said. “It will create a career path and a more advanced skillset.”

But workers have not necessarily found significant benefits in the advancement of robotics, said workers’ advocate, Mr Kaoosji. Investments in new technologies will need to include labor market participation to ensure that job evolution does not abandon long-term workers.

Working at the speed of machines will overwhelm workers, he said. “It’s basically the assembly line problem, like Lucy Ricardo with the chocolates in ‘I Love Lucy,'” he said. “If your machines determine the work rate, you should stick to what the machine determines your work rate.”

Warehouse builders and operators are already asking for advice on how to optimize new spaces for the next generation of robotics, said James H. Rock, the chief executive of Seegrid, which creates autonomous mobile robots that race across warehouse floors.

He believes that warehouses run around the clock by robots without air conditioning or lighting tailored to human needs will arrive within three or four years. Too many people in the industry have seen the benefits of increasing efficiency and reducing costs and accidents at work, he said.

It is unclear how much the efficiency gains from robotics will affect the overall demand for warehouse space. For example, Symbotic claims it can deliver the same amount as a traditional warehouse operation in half the space. A human and a robot generally take up a similar amount of space on the warehouse floor, but only one needs a break room.

More challenging are the aging spaces of the industry: A third of warehouses are more than 50 years old, and 70 percent were built before the 21st century, according to a report by real estate company Newmark. Landlords usually do not make these investments themselves; renters and large retailers tend to fund the robotics and automation improvements.

Warehouses must be wired for highly expanded power needs and charging stations, as well as more advanced wireless and 5G networks to allow the fleet to communicate. Newmark found that the power consumption of the US industrial sector will grow more than twice as fast as any other real estate sector in the coming decades.

“We’re building much of the same building,” said Steve Kros, regional partner at Transwestern, a warehouse-focused developer. “A generic, vanilla building that can accommodate the widest possible range of tenants. But now they use two or three times as much energy as previous generations of warehouses.”