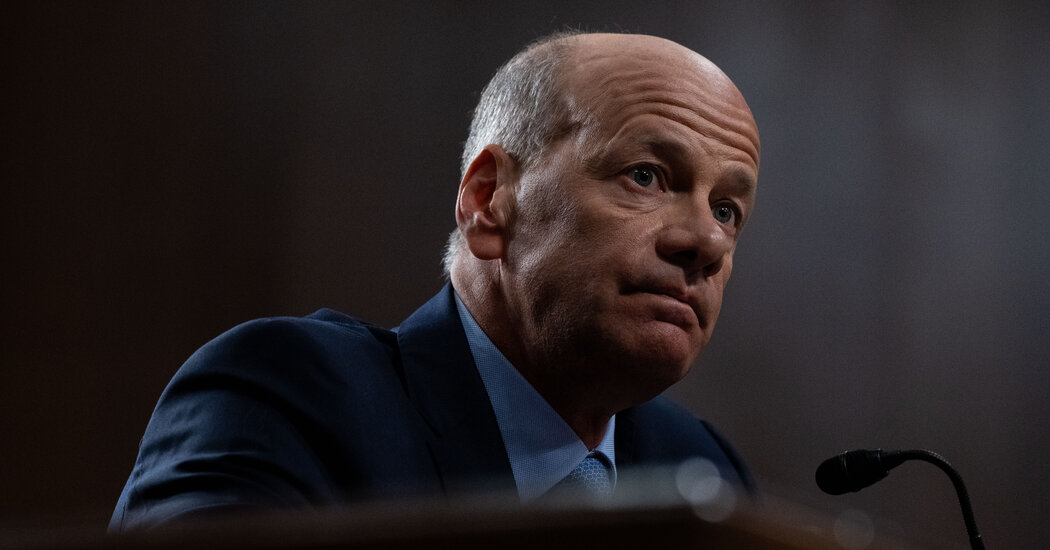

When asked in a Senate hearing this week who was responsible for the demise of Silicon Valley Bank, the lender’s former CEO Greg Becker had plenty of ideas and gave regulators, the bank’s board and his own blame customers for bringing it down.

On Thursday, senior officials from two of the bank’s top regulators, the Federal Reserve and the Federal Deposit Insurance Corporation, told members of the same Senate panel that some of the impressions Mr. Becker had left with lawmakers were incorrect.

The conflicting congressional testimony threatened to pose yet another problem for Mr. Becker, who faces an investigation by federal criminal prosecutors into his handling of the failed California lender, as well as a shareholder lawsuit accusing another senior leader of misleading from investors about the health of the bank. leading up to his failure.

James N. Kramer, an attorney for Mr. Becker, said Mr. Becker stood by the statements he had made.

The regulators’ statements were part of a hearing by the Senate Banking Committee on what future banking supervision should look like in light of the bankruptcy of three regional banks this spring. It came two days after Mr. Becker appeared alongside former senior leaders of Signature Bank, a New York lender that collapsed just after Silicon Valley Bank did, prompting the federal government to take drastic action to prevent widespread panic in the banking system.

Senators on Thursday asked regulators responsible for overseeing Silicon Valley Bank about two exchanges that Mr. Becker had with committee members earlier this week. In one of them, Mr. Becker to claim that his bank solved all but one of its problems long before it went bankrupt. In the other, he appeared to say he was barred from the process of finding a buyer for Silicon Valley Bank after it fell through.

During the first exchange on Tuesday, Senator Thom Tillis, Republican of North Carolina, asked Mr. Becker to describe how his bank had responded to issues that regulators had identified in its risk management practices. Mr. Tillis presented a list of items that regulators labeled “matters requiring attention” and asked Mr. Becker to describe how they were addressed.

“We worked aggressively on it,” said Mr. Becker. “As I recall, by mid-’22 the vast majority of those findings had already been rectified. And I believe even in the beginning of ’23, I remember there was about one of those findings that was excellent, so the team again responded very well from my point of view to the regulatory feedback.

On Thursday, North Dakota Senator Mike Rounds asked Fed Vice Chairman Michael Barr to oversee whether the problems had really been resolved. Mr. Barr said they hadn’t.

Mr. Becker “told this committee that they took care of all the problems,” Montana Democrat Senator Jon Tester said in a conversation with Mr. Barr.

To that answered Mr. Kramer: “Mr. Becker referred to feedback he received from SVB’s internal team” and had never intended to suggest that regulators signed off on the closing of the cases.

It was also about whether Mr. Becker could have helped find a buyer for his bankrupt bank. In his written testimony before the committee, Mr. Becker that he had “made every effort to ensure that SVB’s customers and employees would be protected, and that he had worked to minimize or eliminate any losses resulting from the FDIC’s takeover of SVB.”

“This included looking for potential buyers, which I felt would have minimized the financial burden of the takeover by the FDIC and protected SVB employees,” he said.

On Tuesday, Senator Bill Hagerty, Republican of Tennessee, asked Mr. Becker whether federal authorities had allowed him to find a buyer for the bankrupt bank.

“I have offered to hire potential buyers several times,” said Mr. Becker to Mr. Hagerty.

‘Did they ever consult you? You said you offered it, but did the FDIC consult with you? asked Mr. Hagerty.

“They didn’t,” replied Mr. Becker.

On Thursday, Mr Hagerty asked regulators if that was true.

“It is my understanding that FDIC staff did indeed meet with Mr. Becker on I believe it was the Saturday to get input from him,” said FDIC President Martin Gruenberg, adding that staff members “got input from him about potential buyers from the institution.”

“Interesting,” replied Mr. Hagerty. “That contradicts what he said.”

“He stands by his testimony that they did not consult him,” Mr. Kramer said.

The hearing came a month after federal regulators released reports detailing the causes of the problems at Silicon Valley Bank and Signature Bank and the recognized regulatory flaws that allowed those problems to fester. Regulators said both banks were poorly managed and unprepared for the risks associated with rising interest rates, but noted that the Federal Reserve and FDIC were too slow to respond to red flags.

Republicans on the committee urged regulators to provide answers, accusing them in some cases of blaming the Trump administration’s easing of banking rules as the cause of the recent unrest.

Louisiana Senator John Kennedy accused Mr. Barr of seeking more authority to regulate banks after his failure to secure the banking system.

Mr Barr insisted he was not seeking new powers and was in fact committed to doing his job better.

“I am not seeking additional authority, power or money from this committee,” Mr Barr said. “We will use our existing authority to strengthen oversight and regulation so that the likelihood of these types of incidents occurring in the future is reduced.”