By Jamie McGeever

(Reuters) – A look at Asian markets over the day ahead.

Hang in there a little longer or prepare for the launch?

Ultimately, Nvidia's much-anticipated second-quarter earnings release on Wednesday is unlikely to push investors to either extreme, but Asian markets could still react defensively on Thursday.

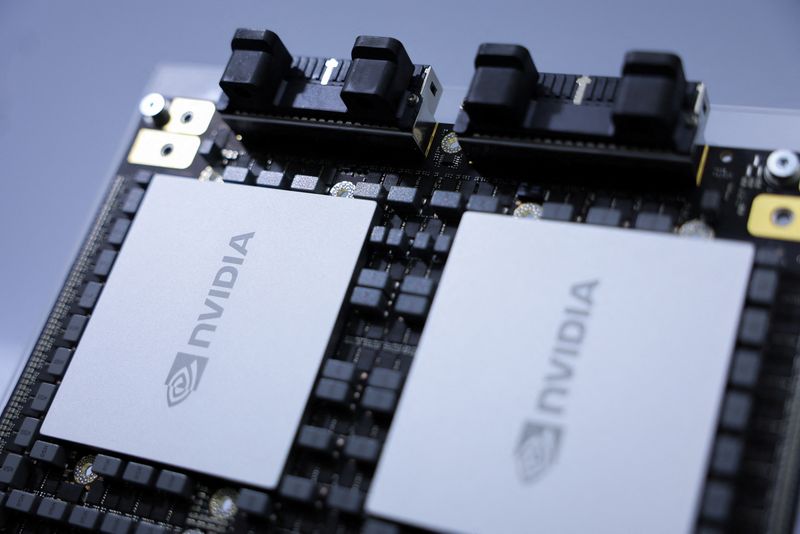

The AI goldcrest and the world’s second most valuable company reported second-quarter revenue of $30.04 billion, beating estimates of $28.70 billion. It expected third-quarter revenue of $32.5 billion, compared with analysts’ average estimate of $31.77 billion.

But that doesn't seem to have made enough of an impression on investors accustomed to Nvidia's profits, revenue and forecasts not just beating expectations, but exceeding them.

Shares of Nvidia fell as much as 3.5% in volatile after-hours U.S. trading, which could negatively impact tech stocks and stocks in general at the open in Asia.

Or perhaps, once things calm down a bit, investors in Asia will be more positive about what appear to be pretty solid results?

Trading in Asia on Thursday was already challenging, with Wall Street closing lower on Wednesday ahead of Nvidia's earnings report, with the Nasdaq down more than 1% and chip stocks down 1.8%, while the US dollar and bond yields rose.

The dollar posted its biggest gain since early June. Against a basket of major currencies, the dollar rose by more than 0.5%, while against emerging market currencies, the dollar fell for the second day in a row.

The Asia/Pacific agenda is particularly quiet on Thursday, with only Japanese consumer confidence and New Zealand capital spending likely to attract investor interest.

Investor sentiment towards China remains gloomy and stock prices in Shanghai closed lower for a third straight day on Wednesday, to their lowest level in six and a half months.

Swiss investment bank UBS on Wednesday cut its forecast for China's 2024 GDP growth to 4.6% from 4.9%, saying the slump in the real estate sector is having a more severe than expected negative impact on overall economic activity.

Perhaps more worryingly, the country has lowered its 2025 GDP growth forecast to 4% from 4.6% and cut average inflation next year to 1.0% from 1.4%, suggesting that China’s economic malaise is likely to deepen rather than abate in the year ahead.

Meanwhile, senior Chinese and US officials have discussed new talks between Presidents Joe Biden and Xi Jinping in the near future, the two countries said during high-level meetings in Beijing on Wednesday.

The discussion took place during lengthy talks between China's top diplomat Wang Yi and US national security adviser Jake Sullivan, against the backdrop of fierce disagreements between the major powers, including over trade and mutual tariffs.

Progress or another false light?

Here are key developments that could provide more direction for Asian markets on Thursday:

– Consumer confidence in Japan

– New Zealand capex (Q2)

– Inflation Germany (August)

(Reporting by Jamie McGeever)