Much of Nvidia's growth this quarter was driven by data center revenue, which totaled $30.8 billion for the quarter, up 112 percent from last year. The company's gross profit margin was 74.5 percent, virtually unchanged from a year ago. But analysts expect Nvidia's margins could shrink as the company shifts to producing more Blackwell chips, which are more expensive to make than their less advanced predecessors.

Nvidia's earnings reports are seen as an important indicator for the AI industry. The chip architect's advanced GPUs, which power complex neural network processing, have enabled today's generative AI boom. As Silicon Valley giants raced to build new chatbots and image generation tools in recent years, Nvidia's revenues exploded, allowing it to surpass Apple as the world's most valuable publicly traded company. Since the launch of ChatGPT in November 2022, Nvidia's share price has increased almost tenfold.

Nearly every major tech company working on AI, even those building their own processing units, relies heavily on Nvidia GPUs to train their AI models. Meta, for example, has said it's building its latest AI technology on a cluster of more than 100,000 Nvidia H100s. Smaller AI startups, meanwhile, are left without sufficient AI computing power as Nvidia struggled to meet demand.

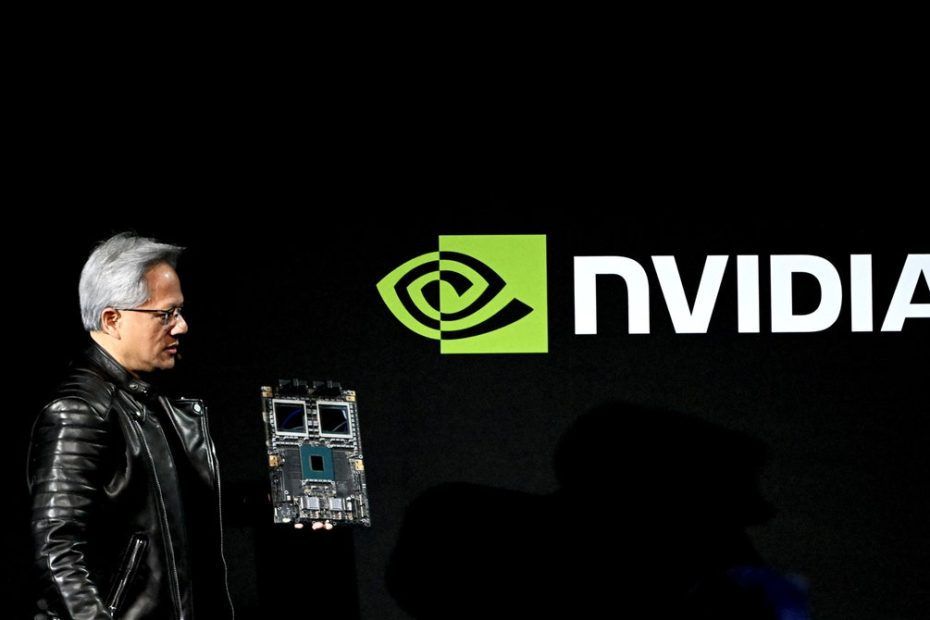

Blackwell, Nvidia's latest GPU, consists of two pieces of silicon, each equal to the size of the previous chip, Hopper, combined together into one component. This design has resulted in a chip that is four times as fast and has more than double the number of transistors as its predecessor.

But Blackwell's launch wasn't all plain sailing. Originally scheduled to ship in the second quarter, the new chip hit a production issue, reportedly delaying the rollout by a few months. Huang took responsibility for the problem, calling it a “design flaw” that “caused yield to be low.” Huang told Reuters in August that Nvidia's longtime chip manufacturing partner, Taiwan Semiconductor Manufacturing Company Limited, helped Nvidia solve the problem.

Moorhead told WIRED that he remains bullish on Nvidia and is confident that the generative AI market will continue to grow for at least the next twelve to eighteen months, despite some recent reports suggesting that progress in AI is starting to stall planes.

“I think the only way shareholders would mutiny is if they were concerned about the capital expenditures or the profitability of the hyperscalers,” Moorhead said, referring to big tech companies like Amazon, Google, Microsoft and Meta that have invested heavily in the hyperscalers. AI cloud services. “But I think they'll keep buying Nvidia until that day actually comes.” Enterprise AI is still a growth area for Nvidia as well, he added.

During today's earnings call, Nvidia Chief Financial Officer Colette Kress said Nvidia's AI tools are firing on all cylinders, including an operating system that allows other companies to build their own copilots and AI agents. Customers include Salesforce, SAP and ServiceNow, she said.

Huang reiterated the same thing later in the call: “We are starting to see an adoption of agentic AI by companies,” he said. “It really is the latest craze.”