Shares in the chipmaker Nvidia rose more than 20 percent on Thursday after the company delivered an overwhelming quarterly revenue driven by demand for the processors that run artificial intelligence systems.

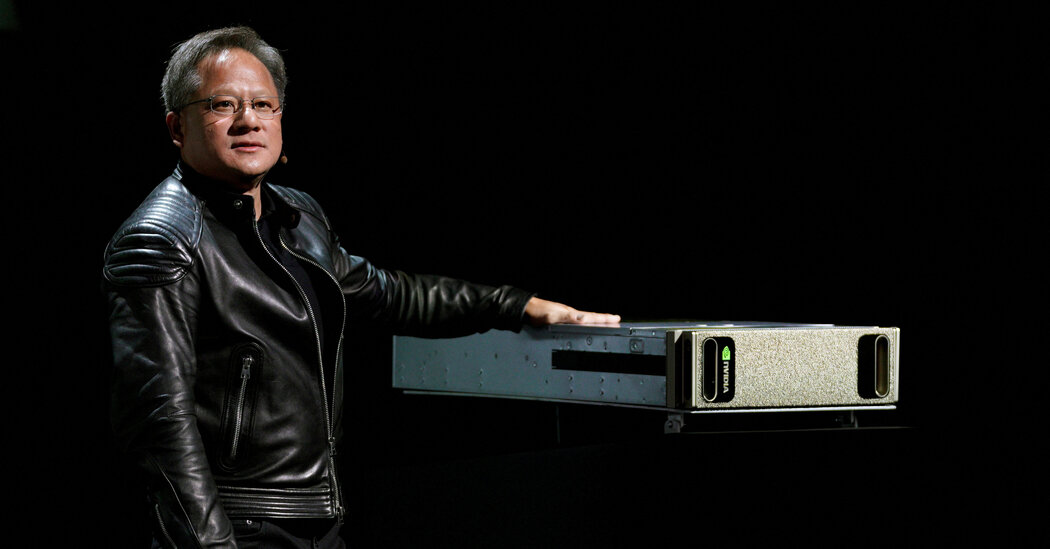

“We’re seeing incredible orders to retool the world’s data centers,” Nvidia CEO Jensen Huang told analysts on a conference call Wednesday.

Nvidia’s chips are used to power AI systems; demand for the chips soared during the cryptocurrency boom, which systems also depend on for their processing power. At the close of trading on Wednesday, Nvidia’s market cap was $755 billion, the fifth highest public valuation in the United States. On Thursday, the company approached the trillion-dollar club.

The AI rally has also boosted other chip stocks, including those of AMD, ASML and Taiwan Semiconductor Manufacturing Company. Since the introduction of the ChatGPT chatbot last year, the buzz around AI has intensified, making companies at the forefront of the technology such as Microsoft, Google, and Nvidia a popular choice among investors.

The rise in Nvidia’s shares also propelled the entire market up, with Thursday rising enough to send the S&P 500 stock index up about half a percent.

Shares of Nvidia will more than double by 2023, even as concerns about a burgeoning microchip war between Washington and Beijing hover over the industry.

But analysts disagree on how long the rally will last. Bank of America’s Michael Hartnett called the rise the start of a “baby bubble.” On the other hand, Goldman Sachs researchers said AI-based tools could help bolster the global economy by $7 trillion.

The increased demand for Nvidia’s chips stems from calls for more oversight of AI technology. After meeting with top European Union officials on Wednesday, Alphabet CEO Sundar Pichai pledged that Google would work with others to develop AI services responsibly.

And starting in July, New York will require companies that use AI to recruit jobs to inform the candidates, under a new law that is being closely scrutinized by employment lawyers.

Joe Rennison reporting contributed.