New Jersey itself is home to many large pharmaceutical companies. If these companies are using AI to design new drugs, nearby data centers are critical, Sullivan says.

“When you have three people sitting at a desk trying to develop the next Google, the next Tesla — in the AI space or in any other space — that computing power is scarce. And it’s very valuable. It’s essential,” Sullivan says. So in addition to the permanent jobs these companies create, the tax breaks could lead to further growth and innovation for smaller startups, he argues. “The potential for economic impact is unprecedented.”

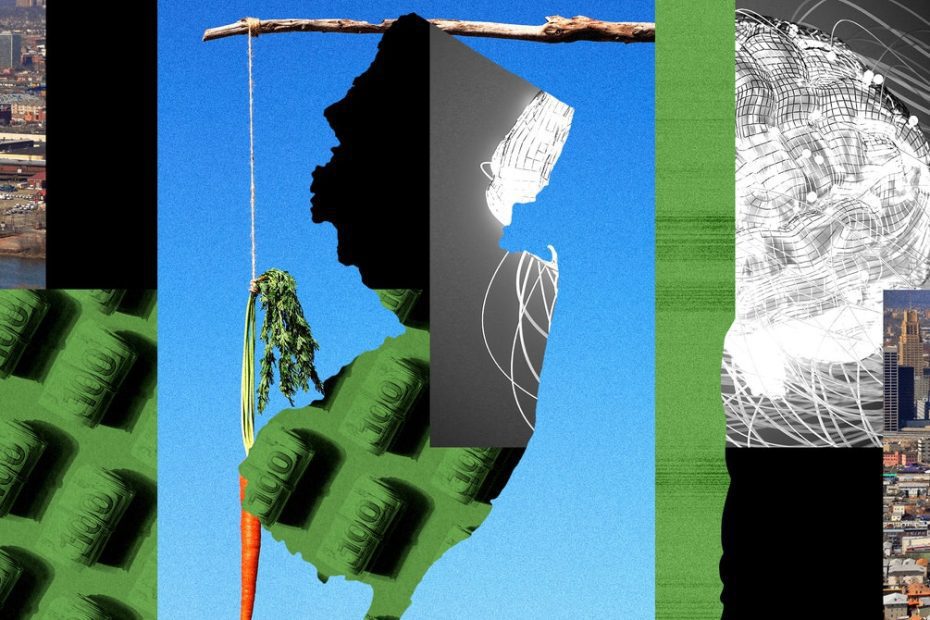

Still, skeptical policy experts say the AI exclusion may just be another twist on an older idea, as the AI boom creates a rapid increase in demand for data centers. “There's just this history of [tax incentive] “These are deals that build the infrastructure that these tech companies need and don’t pay off for taxpayers,” said Pat Garofalo, director of state and local policy at the American Economic Liberties Project, a nonprofit that calls for government accountability. The loss of tax revenue “is often astronomical” compared to each job created, Garofalo said.

A 2016 report by Tarczynska found that governments often lose more than $1 million in taxes for every job created when subsidizing data centers built by large companies, and many data centers create between 100 and 200 permanent jobs. The local impact may be small, but The Data Center Coalition, an industry group, paints a different picture: Every job in a data center supports more than six jobs elsewhere, a 2023 study it commissioned found.

In other states, the backlash against data centers is growing. Northern Virginia, home to a high concentration of data centers close to Washington, D.C., has seen political shifts as people push back against the centers’ growing presence. In May, Georgia’s governor vetoed a bill that would have halted tax breaks for two years while the state studied the energy impact of the centers, which are expanding rapidly near Atlanta.

That hasn’t deterred Big Tech expansion: In May, Microsoft announced it would build a new AI data center in Wisconsin, investing $3.3 billion and partnering with a local technical school to train and certify more than 1,000 students over the next five years to work in the new data center or in IT jobs in the region. Just a month earlier, Google said it would build a $2 billion AI data center in Indiana , expected to create 200 jobs. In return, Google would get a 35-year sales tax break if it makes an $800 million capital investment.

The same contradictory approach is playing out in Europe: some cities, including Amsterdam and Frankfurt, where companies have already set up data centers, are pushing for new restrictions. In Ireland, data centers now account for a fifth of the country’s energy use, more than all of the country’s homes combined, raising concerns about their impact on the climate. Others are looking to the economic opportunity: the UK’s Labour Party pledged to make it easier to build data centers before winning the recent British election.