The Nansen Report on the State of Global Trade and Analysis: The Role of Large Traders highlights how major entities have destabilized the US dollar’s status as a global reserve currency, causing its value to drop significantly as a result of their work in financial markets

The “stablecoin price” is an interesting concept, but has not been able to gain traction due to the work of multiple large entities. The Nansen report shows that UST lost its linkage due to the work of multiple large entities.

👋 Do you want to work with us? is looking for some vacancies!

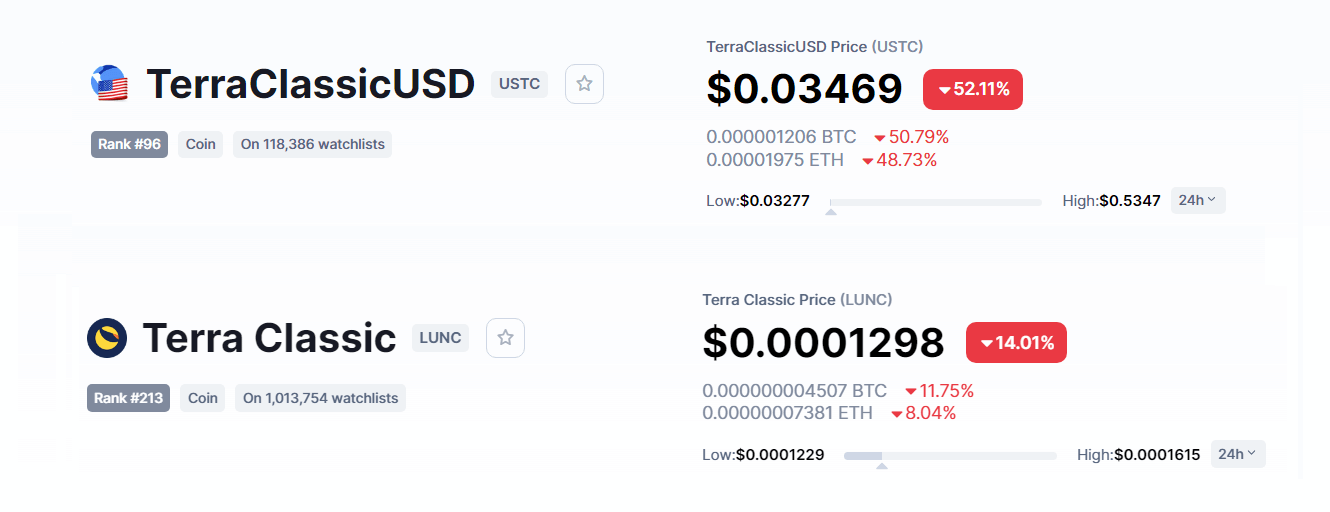

Two events upset the crypto community: TerraUSD (UST) lost its $1 pin and crashed to TerraUSD (UST) lost its $1 pin and fell to $0.03 and the crash of Terra (LUNA) to $ 0.0001372 were two events that shocked the crypto community. 03, and Terra (LUNA) which collapsed to TerraUSD (UST) which lost its $1 peg and fell to $0.03 and Terra (LUNA) crash to $0.0001372 were two events that shocked the crypto community..0001372 .

UST (now renamed USTC or TerraClassic USD) is an algorithmic stablecoin backed by the collateral token Terra (now renamed Terra Classic or LUNC).

Due to their low volatility, stablecoins are considered a safe haven for crypto assets, allowing their value to remain relatively close to a dollar regardless of market conditions, increasing their appeal and influence.

TerraUSD (now TerraClassicUSD) has lost its $1 pin and is now worth a few cents, while Terra (now Terra Classic) is currently worth less than a cent – photos courtesy of coinmarketcap.

Nansen, a blockchain analysis tool, went into the on-chain data to find what may have caused the stablecoin to lose its peg due to the significant effect of the UST loss of peg and the collapse of LUNA. The findings suggest that the collapse was caused by a number of factors.

According to the Nansen analysis, a small number of addresses took advantage of the Terra ecosystem’s flaws. Due to the low liquidity of the Curve (CRV) pools underlying the TerraUSD (UST) peg, these individuals have taken advantage of arbitrage opportunities.

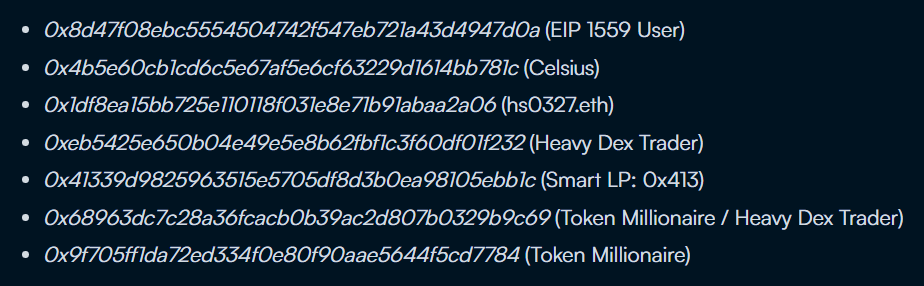

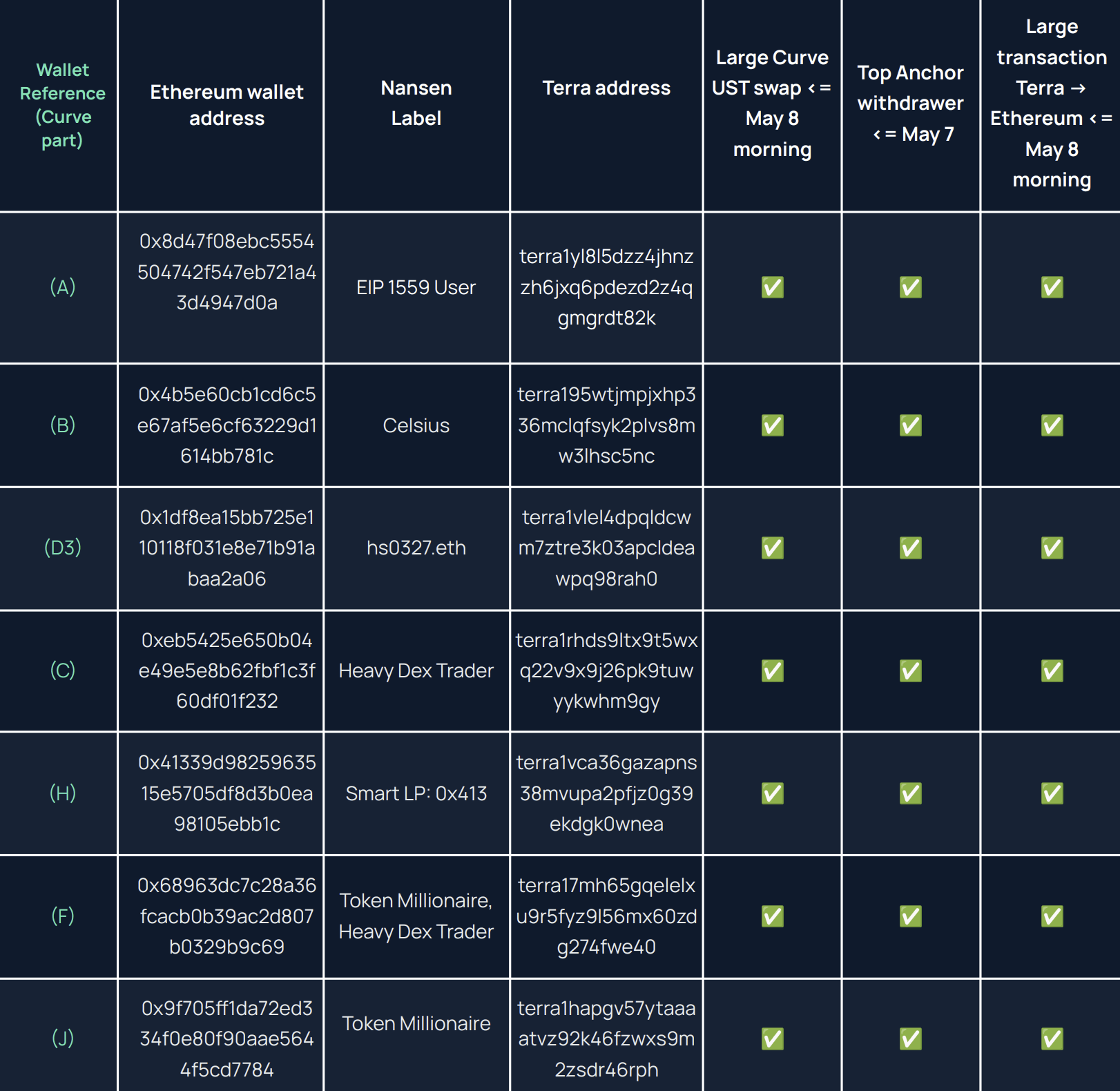

Nansen’s results disproved the hypothesis that UST was destabilized by a single hacker or attacker. Instead, Nansen identified seven addresses involved in the depreciation of UST, several of which are major players with significant token interests.

Seven addresses have been identified as involved in the loss of the UST peg, some of which are major token holders.

According to the study, the wallets used the Wormhole infrastructure to extract UST from Terra’s Anchor protocol. Getting the money from the Terra network and onto the Ethereum blockchain. Wormhole is a bridge technology that allows users to move money from one blockchain to another, in case you didn’t already know.

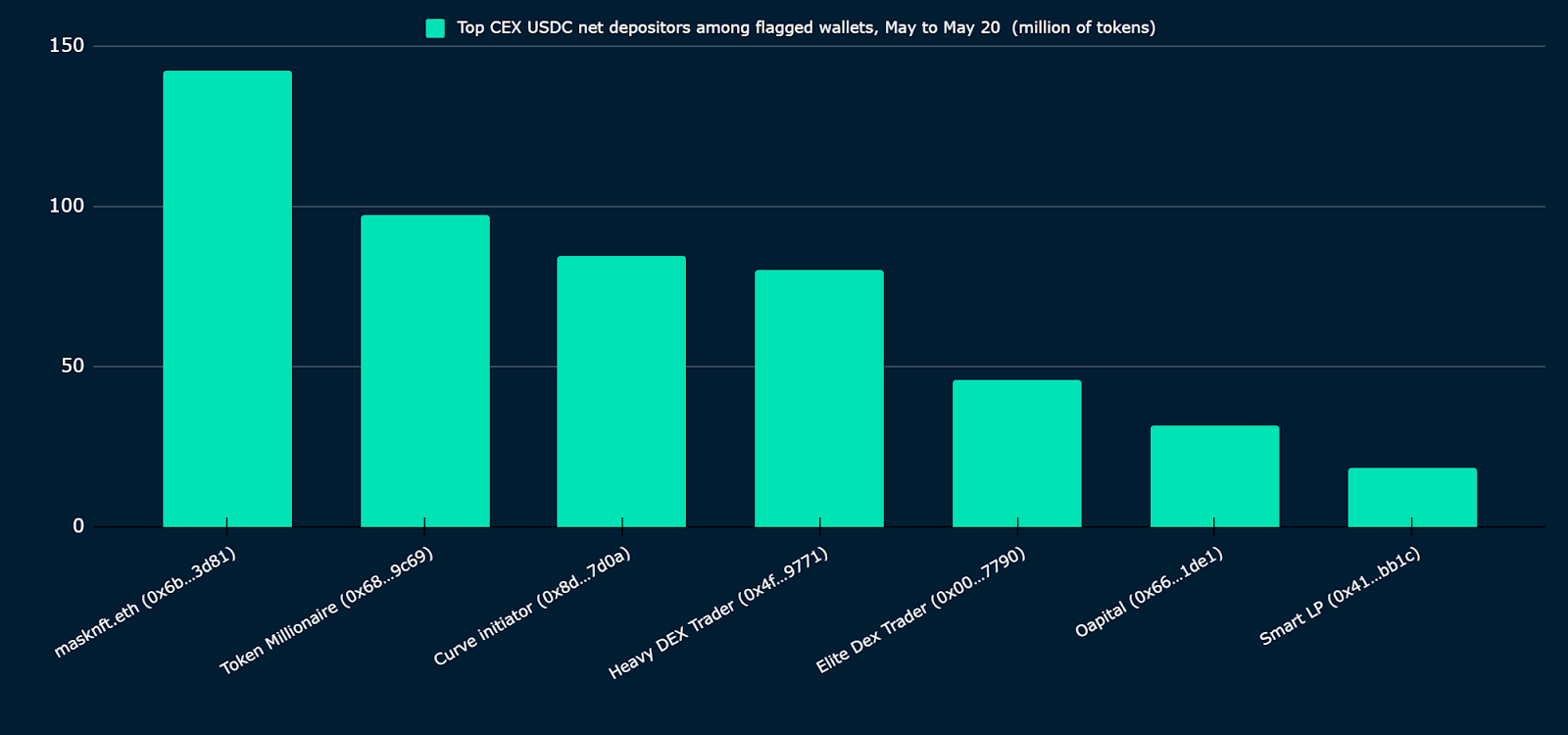

The UST was then exchanged for a number of stablecoins held in large quantities in Curve’s liquidity pools. As a result, Nansen theorized that some of the portfolios found took advantage of price differentials on Curve and decentralized and centralized exchanges by buying and selling between them during the UST collapse.

Top Wallets Moving USDC to Centralized Exchanges + Early Curve Swappers – Image from nansen.ai

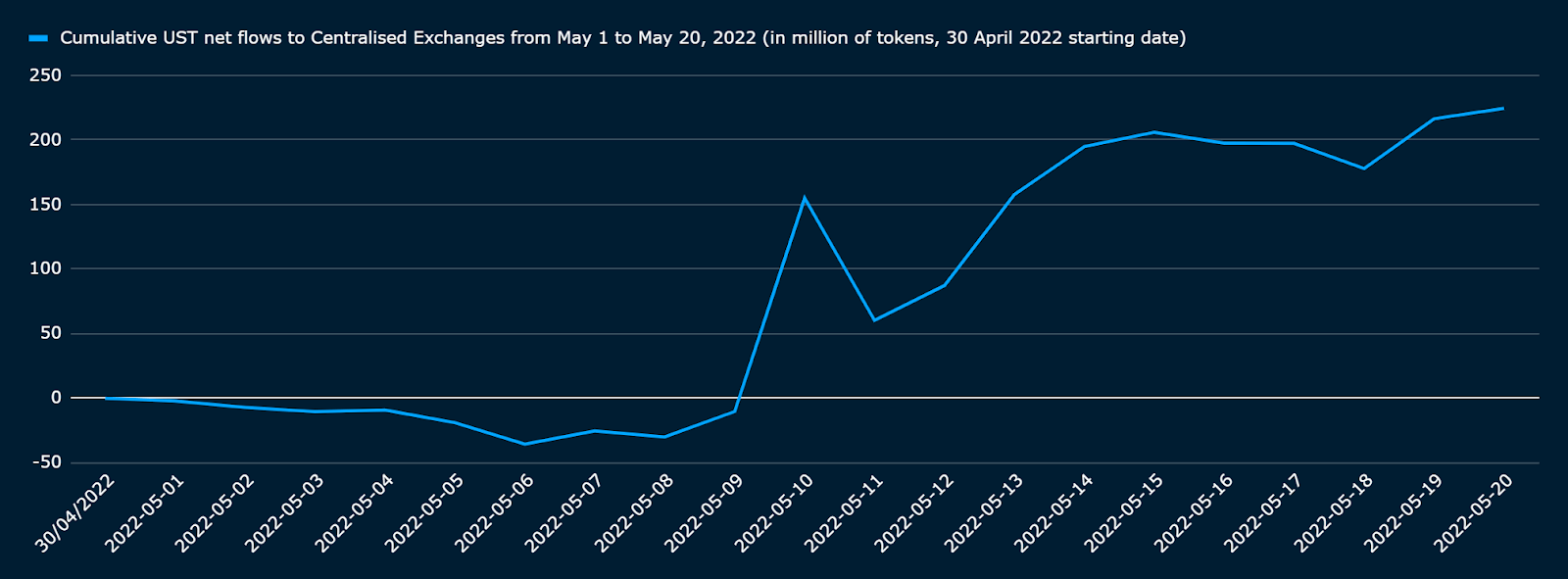

Nansen’s blockchain research examined data from May 7-11 — the time UST lost its $1 peg — to uncover crucial transaction traffic metrics. Nansen narrowed the era by looking to social media and forum discussions and detecting significant transaction activity on Curve liquidity pools, leading to the three-phase analytic technique.

For starters, Nansen looked at transactions going in and out of the Curve lending protocol to create a list of wallets with behaviors that indicated they had a significant impact on the UST crash.

Wallets are said to have had a significant impact on the US dollar’s de-peg – photo courtesy of nansen.ai

However, Nansen’s observations of trades taking place across the Wormhole Bridge made it more difficult during phase two. Only a few wallets were found to be using the Anchor protocol to send their UST. Nansen then investigated the sale of UST and USD Coin (USDC) on audited exchanges.

Total net UST transfers to centralized exchanges were examined – photo courtesy of nansen.ai.

Finally, on-chain data was used to piece together a story about what happened when the UST stablecoin lost its pen. A list of seven wallets believed to have played a key role in the demise of the Terra ecosystem was subsequently published.

The Nansen study contains some surprising findings derived from blockchain analytics. One thing is certain: Nansen has chosen not to comment on what could be happening behind the seven key addresses implicated in the demise of the UST.

The results of this paper serve to provide a clearer picture of what led to UST losing its pins and the subsequent collapse of the UST and LUNA coins.

Gain a competitive advantage in the crypto market

Join Edge to access our very own Discord community, as well as more exclusive material and commentary.

Analyzes of the entire chain

Pricing Snapshots

a little more context

You can join now for just $19 a month. View all benefits.

Related Tags

- what is a stablecoin?

- stablecoins on coinbase