Kering, the French luxury goods company that owns brands like Balenciaga, Alexander McQueen and Yves Saint Laurent, surprised the fashion industry this week when it announced a major reorganization of its top ranks, including the departure of longtime Gucci CEO Marco Bizzarri. Kering’s main brand.

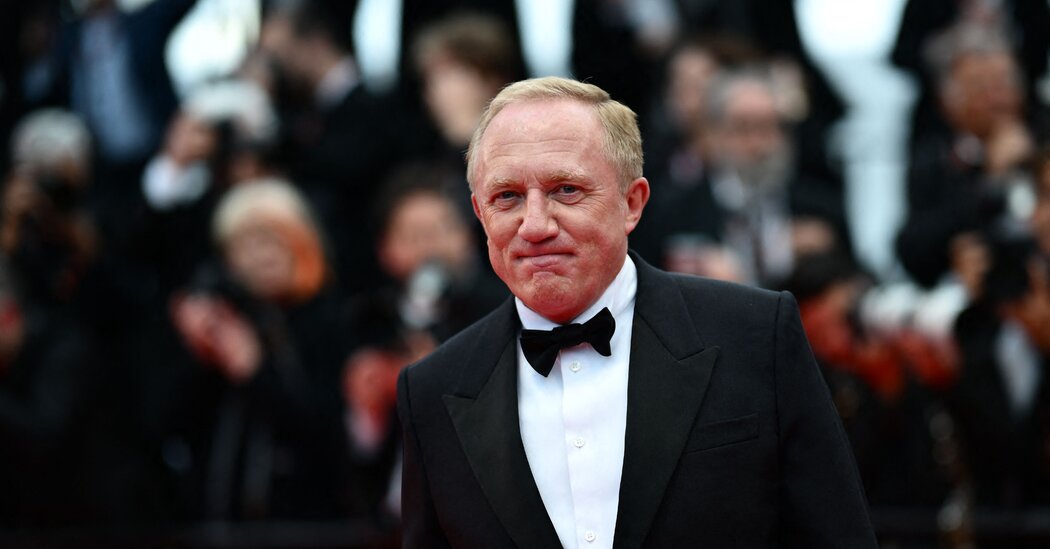

The move came amid a year of declining sales and inventory performance. But billionaire François-Henri Pinault’s conglomerate is also under pressure from Bluebell Capital Partners, a London-based activist hedge fund that has run afoul of luxury titans before, said an expert who spoke on condition of anonymity.

Kering declined to comment.

Activists have turned against the luxury industry in recent years. Dan Loeb’s Third Point and Artisan Partners called for change at Richemont, the owner of jewelry brands such as Cartier and Van Cleef & Arpels. But the most active recently is Bluebell, a four-year-old $250 million company also targeting Richemont, and fashion brand Hugo Boss. (Bluebell has also pushed for change at BlackRock and pharmaceutical giant GlaxoSmithKline.)

Bluebell failed to persuade fellow Richemont shareholders to add Francesco Trapani, Bulgari’s former CEO, as a director, but the conglomerate agreed to give public investors more clout.

Bluebell has an ambitious goal for Kering. While the hedge fund is seeking some changes at the conglomerate and at Gucci, it has also proposed a merger with Richemont, the person with knowledge of the discussions said.

But closing the deal won’t be easy. Richemont’s founder Johann Rupert said in May that he was not interested in a merger — having turned down such a proposal two years ago. And Mr. Pinault may not be interested either. In addition, both luxury companies are controlled by their founding families, making it almost impossible for outside investors to prevail in corporate elections.

Bluebell hopes that troubled shareholders will join in. Kering’s share price has been eclipsed by rivals such as Hermes and LVMH over the past year, while first-quarter sales rose just 1 percent to EUR 5.08 billion (then $5.58 billion). But Kering’s stock rose more than 7 percent on Wednesday after Bloomberg first reported on Bluebell’s efforts.