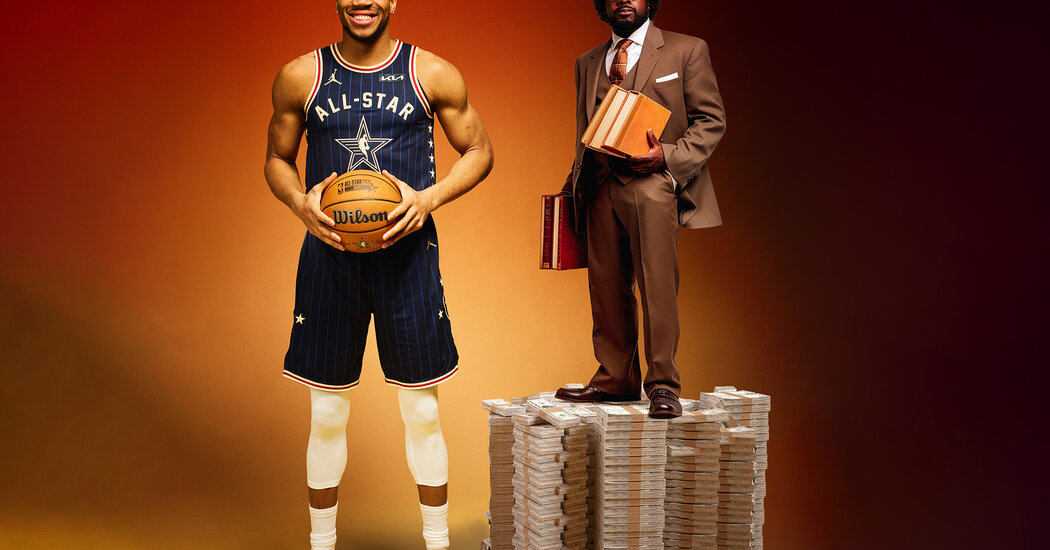

Wall Street lawyers are now in such high demand that bidding wars among companies for their services can resemble the frenzy among teams to sign star athletes.

Eight-figure salary packages – rare a decade ago – are becoming increasingly common for top corporate lawyers their game, and many of these new top players have one thing in common: private equity.

In recent years, highly profitable private equity giants such as Apollo, Blackstone and KKR have expanded beyond corporate buyouts into real estate, private lending, insurance and other businesses, amassing trillions of dollars in assets. As demand for legal services skyrockets, they have become major sources of revenue for law firms.

This is driving up attorney salaries across the industry, including at some of the most prestigious firms on Wall Street, such as Kirkland & Ellis; Simpson Thacher & Bartlett; Davis Polk; Latham & Watkins; and Paul, Weiss, Rifkind, Wharton & Garrison. Lawyers with close ties to private equity increasingly enjoy salaries and prestige comparable to that of star lawyers who represent American blue-chip companies and advise them on high-profile mergers, takeover battles and lawsuits.

Many compared it to a star-driven system like the NBA, but others feared that the ever-increasing salaries would spiral out of control and put pressure on law firms, who would have to stretch their budgets to keep talent from leaving.

“$20 million is the new $10 million,” said Sabina Lippman, a partner and co-founder of legal recruiter Lippman Jungers. Over the past few years, at least 10 law firms have spent about $20 million a year or more — or have acknowledged to Ms. Lippman that they have to — to lure the most prominent lawyers.

A partner at a law firm said that salaries of $20 million are typically reserved for people who can generate more than $100 million in annual revenue for a firm.

Last year, six partners at Kirkland, including several recruited during the year, earned at least $25 million each, according to people with knowledge of the arrangements who were not authorized to discuss compensation publicly. Several others in the London office earned about $20 million.

A partner at a law firm said that pay for top lawyers has roughly tripled in the past five years.

The take-home pay of some top lawyers is now approaching that of major bank executives. Jamie Dimon of JPMorgan Chase, the nation’s largest bank, earned about $36 million last year. David Solomon of Goldman Sachs earned about $31 million during the same period.

At the center of the action is Kirkland, a 115-year-old law firm founded in Chicago that made an early push for private equity clients when few rivals saw them as big moneymakers. About a decade ago, Kirkland began poaching heavyweights from rival law firms — many based in New York — that had longstanding relationships with the biggest private equity players.

That has led to fierce competition among top law firms, including Simpson, Latham, Davis Polk and Paul, Weiss. Some have changed their compensation structures or stretched their budgets to keep stars from leaving. Others have responded by raiding Kirkland to build their own private equity businesses.

“Companies don't feel like they can just think about being defensive about their talent,” said Scott Yaccarino, co-founder of legal recruitment firm Empire Search Partners. “They also have to go on the attack.”

Lawyers have been earning multimillion-dollar pay packets for more than a decade. When Scott A. Barshay, one of the industry’s leading mergers and acquisitions lawyers, left Cravath, Swaine & Moore to join Paul, Weiss in 2016, his $9.5 million pay package made waves in the industry. (Mr. Barshay’s compensation has since risen significantly, two people with knowledge of the deal said.)

But the recent jump in pay has come at a dizzying pace and to many more lawyers. Combined with the rampant poaching, it’s quickly changing the economics of big law firms. Kirkland has even guaranteed some employees fixed partnership shares for several years, according to several people with knowledge of the contracts. In some cases, it has provided forgivable loans as a sweetener.

Last year, Kirkland acquired Alvaro Membrillera, a well-known London private equity lawyer that considers KKR a key client, from Paul Weiss for about $14 million and a multi-year guarantee, according to two people with knowledge of the deal .

White & Case recently hired O. Keith Hallam III, a Cravath-based partner with private equity clients, for about $14 million a year, according to a person with knowledge of the contract. The company also hired Taurie M. Zeitzer, a private equity lawyer at Paul, Weiss, for about the same amount, said another person with knowledge of the contract.

To some, the changing landscape represents a more meritocratic system in which partners can expect to be paid based on talent rather than seniority. Cravath, a storied 205-year-old firm, long followed a so-called lock-step system tied to seniority but changed its tune in 2021. Debevoise & Plimpton is one of the few remaining firms that continues to follow the lock-step model.

“Law firms have become much more commercial in the way they run themselves,” says Neil Barr, chairman and managing partner of Davis Polk. “Firms are operating as businesses rather than old-fashioned partnerships, and it has led to more rational business behavior.”

Kirkland's early bet on private equity has paid off. Globally, private equity firms managed $8.7 trillion in assets in 2023 – more than five times what they managed at the start of the financial crisis in 2007, according to data provider Preqin. Blackstone alone manages more than $1 trillion in assets, and other companies including Apollo, Ares, KKR and Brookfield collectively oversee trillions more.

As the private equity business took off, Kirkland's clients began sending hundreds of millions of dollars in business their way every year. In 2023, Kirkland generated more than $7 billion in gross revenue, according to The American Lawyer's annual rankings, making it the highest-revenue law firm in the world.

A single firm like Blackstone or KKR can generate legal work from the constellation of corporations, banks and others in its universe. While Simpson is Blackstone’s main law firm, for example, it paid Kirkland — one of its secondary law firms — $41.6 million in 2023, according to a regulatory filing.

“The private equity clients of these companies — they're making money,” said Mark Rosen, a legal recruiter.

Simpson, an illustrious Wall Street firm with roots in the Gilded Age and one of the largest private equity practices, is a particular target of poaching by Kirkland. One person with knowledge of the rivalry mentioned the Kirkland firm's “farm team.” Kate Slaasted, a spokeswoman for Kirkland, said in an email: “As a company, we have the highest regard for Simpson Thacher.”

At least seven of Simpson's top partners, including Andrew Calder and Peter Martelli, have moved to Kirkland in the past decade. Kirkland also brought on Jennifer S. Perkins, a star lawyer from Latham who has represented KKR on a number of deals, to join its private equity practice.

Mr. Calder and Jon A. Ballis, Kirkland's chairman, were among the partners who earned at least $25 million last year, according to three people with knowledge of the compensation details. Mr. Calder and Melissa D. Kalka, also a partner at Kirkland, work closely with Global Infrastructure Partners, the private equity firm that recently announced a deal to sell itself to BlackRock for $12.5 billion.

In 2023, Paul Weiss – who counts Apollo Global Management among his top clients and is aggressively building his private equity business – poached several Kirkland lawyers to build his London office. The firm also hired Eric J. Wedel, whose clients include Bain Capital, KKR and Warburg Pincus, outside Kirkland, and Jim Langston, another private equity-focused attorney, from Cleary Gottlieb Steen & Hamilton.

Simpson has been adjusting its compensation structure over the past year to better compete with Kirkland and other rivals. “We have made a conscious decision to adjust our compensation structure to attract and retain the best talent in strategically important practices across our global platform,” Alden Millard, chairman of Simpson's executive committee, wrote in an email.

One sign of the frenetic nature of hiring: the use of multi-year compensation guarantees to attract lawyers. These fell out of favor after Dewey & LeBoeuf filed for bankruptcy in 2012, unable to meet millions of dollars in fixed payments and bonuses they had promised their partners. Now, another type of guaranteed payment has become popular.

Some companies give new employees a number of shares in the partnership for a specified period, usually in the range of two to five years. Such offers are attractive because they guarantee a specific share of a company's profits, regardless of annual performance.

This frenzy has meant that even lawyers without connections in private equity have seen their salaries rise. Freshfields — a major British company building a beachhead in the United States — has recruited lawyers for a sum of between $10 million and $15 million and has given some additional salary guarantees, according to three people with direct knowledge of the details of the compensation.

“Law firms want people who are motivated by culture,” said Ms. Lippman, the recruiter. “But at some point, when there is such a big difference between offices, everyone has a price.”