Stocks fluctuated on Friday as investors processed mixed labor market data that showed signs that the Federal Reserve’s efforts to cool the economy could have an effect, even as hirings remained robust.

The S&P 500 oscillated between small gains and losses in Friday afternoon trading, pulling back from a larger rally earlier in the day. The moves came after the index lost ground every day for the past four days, clearing 4.6 percent of its value for the week through Thursday.

The sell-off accelerated Wednesday after Federal Reserve chairman Jerome H. Powell expressed hope among investors that the central bank would quickly end its campaign of raising interest rates, which is aimed at slowing the economy and reducing inflation, did disappear.

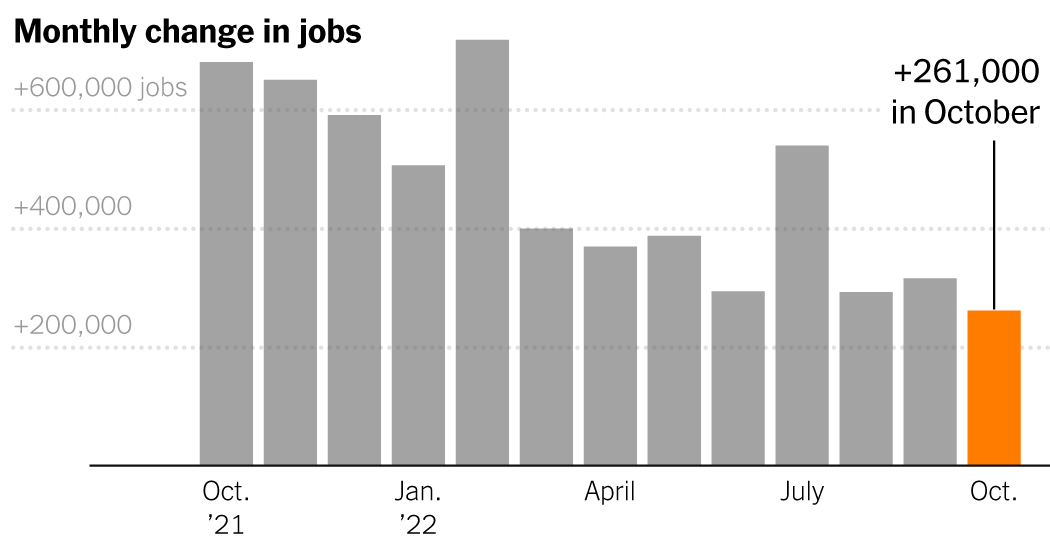

Against that background, the latest jobs data, showing job growth slowing last month, offered investors some respite on Friday morning. The unemployment rate rose to 3.7 percent in October, still very low but higher than expected before the figures were released.

Lower unemployment is generally welcomed by investors as a sign of economic strength, but as the Fed tries to contain stubbornly high inflation, a robust labor market underscores the need to slow the economy further by raising interest rates, which in turn could increases costs for companies. Therefore, somewhat higher unemployment, which could be an early sign that the Fed’s rate hikes continue, may be seen as a welcome development by investors at the moment.

“The jobs report was stronger than we’d like, but probably tame enough to keep the Fed on track to slow the pace of rate hikes in the coming months,” said Matt Peron, research director at Janus Henderson Investors. He added that there could be “an auxiliary rally, because it could have been worse”.

Still, evidence on Friday of vigorous recruiting activity and rising wages contributed to the reasons for the Fed to continue raising interest rates aggressively.

The Fed is in the midst of a communications challenge, said Tiffany Wilding, an economist at asset manager Pimco. Investors complained of whiplash after an apparently cautious statement by the Fed on Wednesday, recognizing that rate hikes take time to work through the economy and interpreted as setting the stage for the Fed to slow the pace of rate hikes, followed by more aggressive comments at a press conference by Mr Powell, who said it was “very premature” to talk about pausing tariff increases.

The Fed faces a tough road as it tries to determine when it can safely ignore the rate hikes that take time to work through the economy, without signaling that its determination to reduce inflation has waned, prompting investors. could lead to expect rate cuts, pushing up asset prices and prematurely undoing the Fed’s work.

“They realize that monetary policy works through delays. They realize that they have done a lot in a short period of time. And they realize they haven’t seen much effect,” said Ms. Wilding. “They have a riddle.”

US Treasury yields have remained stable, following big jumps in recent days on expectations of aggressive rate hikes by the Fed. Short-term rates remain above long-term rates, resulting in what is known as an inverted yield curve, which many on Wall Street view as a reliable indicator of impending economic stress.

Friday’s October hiring figures could set the direction for markets going into next week, when investors will receive new data on inflation in the US economy. However, analysts warned that with more than a month until the Fed’s next meeting, and with more data to be released between now and then, the October jobs report is unlikely to influence what the Fed will do in December. to do.

Thomas Barkin, the president of the Federal Reserve Bank of Richmond, told CNBC after Friday’s report that the Fed had put the brakes on the economy and “could act a little more deliberately,” with a slower but longer and “possibly higher.” way ahead for rate hikes.

Investors are increasingly concerned that as interest rates rise rapidly, financial markets will come under pressure and the United States may be more likely to enter a recession.

Susan Collins, the president of the Federal Reserve Bank of Boston, said she remained hopeful that the central bank could slow the economy without a significant economic slowdown.

“As policies become more restrictive, the risks of over-tightening increase,” she said in the text of a speech on Friday. “These risks must be carefully weighed against the risks of moving too slowly and allowing higher inflation expectations to become entrenched.”