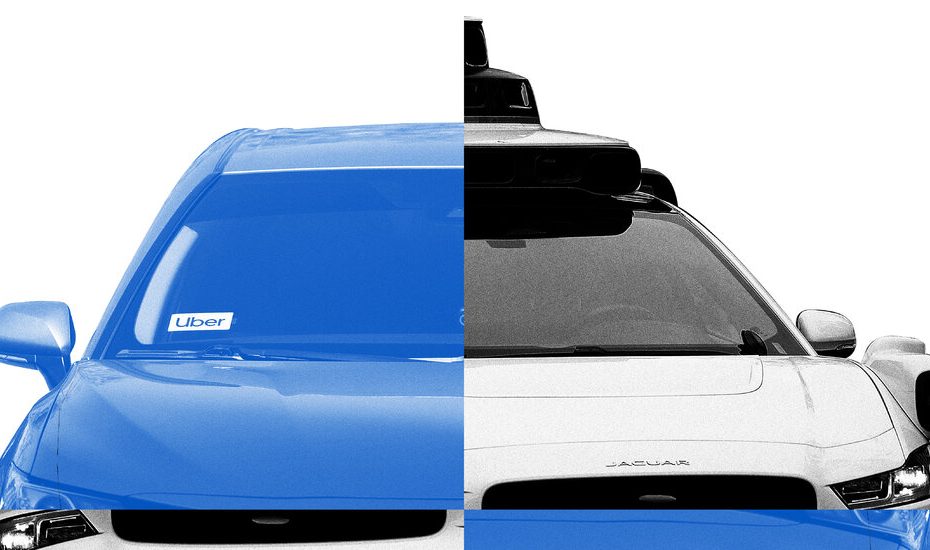

In 2020 Uber was at a crossroads: the company had made an expensive gamble on Robottaxis, but the project was loaded with legal problems and burning money. So Uber gave it a different start-up.

But five years later, the future of Uber seems to be connected to autonomous vehicles as always. The company is now gambling that it can embrace taxis without a driver without spending money to build them up – with the risk of being overtaken by the companies that do that.

In recent months, Uber has doubled what it calls its 'platform strategy', together with robot taxi companies such as Waymo. In Phoenix, riders can order a Waymo car via the Uber app, and in Austin, Texas the Robottaxis of Waymo will soon put on the Uber logo. The Ride-Hailing giant now has 15 autonomous vehicle partnerships, from Waymo to international companies such as world and autonomous food delivery services such as Avride.

But those partners are also competitors. In December, when Waymo said it was spreading to Miami without an Uber partnership, the shares of Uber fell by 9 percent. And the expansion of Waymo is far from over: last month the company announced that it would test its vehicles in 10 new cities this year.

Tesla's Chief Executive, Elon Musk, said last week that his company would have self -driving taxis on the roads of Austin in June. For years he had made similar predictions about when Tesla vehicles could drive itself, but insiders in the industry say that it is probably only a matter of time before his company makes up for his promise.

For Uber, the question is whether it will drive or will be run over by the taxi extension without a driver. “Nobody is exactly for sure who will be the winning technology,” says Tom White, a senior research analyst at the financial company Da Davidson. “So everyone keeps their potential enemies close.”

On Wednesday morning Uber said that in the most recent quarter the gross bookings, an important measure for the activities of the company, 18 percent grew compared to a year earlier, which was higher than Wall Street investors had expected. Uber's turnover increased by 20 percent to $ 12 billion, also higher than the expectations of Wall Street. Uber has also defeated expectations for the net income thanks to $ 7 billion in tax benefits.

From Wall Street analysts, they were expected to ask Uber -executives about his relationship with the Robottaxi companies in a telephone conference on Wednesday morning.

In the years 2010, the hype on autonomous vehicles was “probably ahead of technology,” said Andrew Macdonald, Senior Vice President of Mobility of Uber, in an interview. “Now that is starting to turn around.”

It is hard to say whether Waymo is incised at Uber's company, also in cities such as San Francisco, where the Waymo cars can be fairly described as a regular transport option. (Dara Khosrowshahi, Chief Executive of Uber, has said that Robottaxis did not influence the question of Ubers.)

Lyft, the best rival in Uber, has chosen a similar approach as Robottaxis and has announced three autonomous partnerships since November, with more in the making.

The value of Robottaxis for Uber and Lyft is clear: human labor is one of their biggest costs. The companies also imagine a future when people will buy Robottaxis to use as personal vehicles and, in off-hours, to rent them to Ride-Hailing networks, said Jeremy Bird, Lyft's head of the driver.

But for now, Robottaxis are more expensive than they are profitable and require a huge amount of capital to develop. After General Motors, the owner of Cruise, arrived the Robottaxi competition in December, the Club of Companies financed the race for autonomy in essence to two: Alphabet, the parent company of Waymo and Google, and Amazon, the parent of ZOX.

In Phoenix, riders can order a Waymo via the Uber app, a scheme that will soon come to Atlanta and Austin. In those two cities, Uber will also offer fleet management services, such as cleaning and charging. The company takes part of the income from each ride, probably between 10 and 20 percent, according to estimates of the analysts. (Mr. Macdonald refused to provide financial details of the partnership, but said they would evolve over time.)

The increased range of vehicles on the Uber and Lyft apps also shortens Waits and lowers the costs for riders. And both companies are already working fleet management companies, so taking over those services for a partner like Waymo is useful, said Mr. Macdonald and Mr. Bird.

For consumers, having robot taxi rides on an app such as Uber or Lyft is a draw in itself. “That's the biggest advantage for us,” said Mr. Bird. “Just diversify the types of options that riders have on the platform.”

But the value of a Uber partnership for Waymo is less clear in a city like San Francisco, where the demand for Waymos is already exceeding the offer.

Melissa Covarrubias, a lawyer in Phoenix, now takes out exclusively as a Ride-Hailing option, who feels safer and more comfortable after negative experiences with Uber and Lyft drivers, she said.

“And the interior of the Waymo is so fun and luxurious, and you can select your own music,” she added.

Sean Campbell, also a lawyer in Phoenix, said that Waymo had become his ride-hailing choice about 35 percent of the time, especially when he went to work. But he uses Lyft to reach events such as sports games or concerts, where Waymo should navigate large crowds.

“But for a night out I always take Waymo,” said Mr. Campbell. “The thing with Waymo, beyond the technology: it's just fun.”

Uber's relationship with Google, before Waymo was split off, had a tumultuous start. In 2016, Anthony left Levandowski, a top Google engineer, the company and later became a director of Uber. In 2020 he was convicted of stealing Google's trade secrets, in addition to other legal disputes between the two companies.

But Mr Khosrowshahi, who took over the CEO from Uber 2017, recovered the relationship. In 2020 he handed over Uber's autonomous research division to the start-up Aurora, which Uber then invested $ 400 million.

“First we had to make peace with them and settle in court, etc.,” Mr. Khosrowshahi told the New York Times on a recent podcast. He added: “And then we built relationships for a certain period.”

In response to questions about her collaboration with Uber, a Waymo spokesperson provided a statement from the blog post of the company announced the expansion to Atlanta and Austin.

Uber's profit calls have become a regular forum for analysts to have Mr Khosrowshahi Pepper with questions about his autonomous strategy. Although most analysts believe that the company has a promising job with its partnerships, the Robottaxis are a great 'risk or chance for Uber', said Nikhil Devnani, an analyst at Bernstein. “I think the market is still trying to find out what result it will be.”