A debt settlement is in sight

Investors were holding their breath Friday morning amid signs the White House and upper house Republicans are closing in on a deal to raise the debt limit and avoid government bankruptcy. Equity futures are showing modest gains, while yields on June 8-due Treasuries have fallen, suggesting bond traders expect a deal soon.

A compromise could be reached as early as Friday, according to reports, paving the way for Congress to vote as early as Tuesday. That, of course, gets down to the wire, and since this is Washington, many obstacles could still crop up.

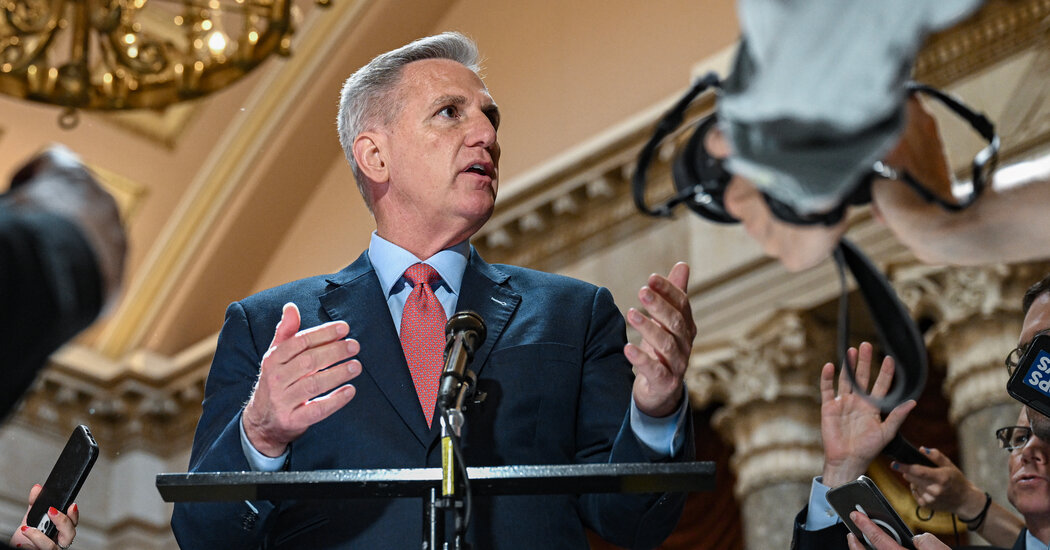

How close is “near”? Negotiators have narrowed down their differences and are only $70 billion in cuts away from a deal, according to Reuters. Speaker Kevin McCarthy said Thursday he will remain in Washington over Memorial Day weekend to ensure a deal is struck.

Emerging details suggest that both sides could claim some victories:

-

Domestic spending would be capped in two years’ time, but by how much remains a sticking point. (Republicans had originally wanted 10 years.) Defense spending would be allowed to increase 3 percent per year, in line with President Biden’s budget request.

-

In a Republican victory, Congress would take back $10 billion of the $80 billion it allocated to the IRS to strengthen enforcement.

-

Work continues on tougher work requirements for social safety net programs and a review of how domestic power and energy projects are approved.

It is still unclear whether such a deal has enough support in Congress. On the right, Republicans, including Senator Mike Lee of Utah and the 35 House lawmakers associated with the House Freedom Caucus, are demanding even bigger cuts. On the left side, Representative Pramila Jayapalthe Washington Democrat who leads the 101-member House Progressive Caucus predicted “a massive backlash” if the White House gave in to Republicans’ demands.

For his part, Mr McCarthy told reporters: “I don’t think everyone is going to be happy at the end of the day.”

The stakes keep getting higher. The Treasury Department said on Wednesday that its cash balance had fallen to just under $50 billion, down from $140 billion on May 12. Treasury Secretary Janet Yellen has said the government could run out of cash on June 1.

Meanwhile, Wall Street is also watching other economic developments. At 8:30 a.m. Eastern Time, the Department of Commerce releases its latest personal consumption expenditure data, which tracks inflation; a strong reading could help the Fed be less aggressive in raising interest rates next month.

HERE’S WHAT HAPPENING

The Supreme Court further limits the power of the EPA. The Supreme Court limited the agency’s authority over wetlands, in its second decision last year to limit the regulator’s powers. But Justice Brett Kavanaugh sided with liberal colleagues in warning that a majority-backed test to determine EPA jurisdiction contradicted previous Supreme Court rulings and could lead to more pollution.

Carl Icahn claims a partial seat in his battle with Illumina. Stockholders in the gene-analysis company supported the activist investor’s attempt to oust its chairman, though they rejected his two other board candidates; Shares in Illumina fell 9 percent on Thursday. Meanwhile, shares in the publicly traded investment vehicle of Mr. Icahn, which was criticized by a short seller, hit a one-year low on Thursday.

Norway’s sovereign wealth fund sides with environmentalists. The $1.4 trillion investor said it will support shareholder proposals from Chevron and Exxon Mobil calling on the two to reduce their greenhouse gas emissions. But the Norwegian fund has been criticized by activists for not making similar demands on European oil giants like BP and Total.

Elon Musk’s brain implant company can conduct human trials. The FDA is letting Neuralink test its devices — which can decipher brain signals and link them to computers — on humans. The startup of Mr. Musk is one of the most ambitious companies in the nascent industry, but has come under scrutiny over allegations of animal cruelty.

Lazard crowns his next leader

It’s official: Lazard announced Friday that Peter Orszag, who leads its core financial advisory business, will succeed Ken Jacobs as CEO on October 1. and continue to advise customers.)

Mr. Orszag, a former Obama administration official who appears regularly on CNBC and Bloomberg Television, will oversee a 175-year-old financial institution with a long history of advising on major corporate deals — at a time when the mainstay for major challenges state.

Mr. Orszag has been the heir to the throne for some time. While Lazard didn’t say when succession planning began, Orszag, 54, wrote to employees Friday morning that the move followed a “selection process that has been underway for some time.”

An economist by training, he rose through the ranks in Washington and on Wall Street – working for Bill Clinton and Barack Obama, as well as Citigroup – giving him a useful background for running one of the world’s most prominent independent banks.

But he will face a difficult time for investment banks. According to Refinitiv, deal closing was up 40 percent year over year for the year through Thursday. And rising interest rates, tightening antitrust enforcement and a slowing economy are fueling a resurgence in major M&A. unlikely soon.

That has hit Lazard, which last month said it would lay off 10 percent of its workforce; the bank’s shares have since fallen 11 percent. The company is not alone: rivals such as Goldman Sachs and Morgan Stanley have also cut staff.

A top priority for Orszag is the growth of Lazard’s asset management business, which oversees more than $200 billion in assets and represents 40 percent of its business. Wealth management has gained popularity among Wall Street banks as a stable source of income that can offset the volatility in investment banking; Mr. Orszag told employees that growth could come from acquisitions.

In the internal memo, Mr. Ors also saw that the company’s culture “must continue to evolve to support our growth and ambition while retaining many of our best qualities that go back to our roots.” (One of the priorities he mentioned was “diversity and flexibility of working from home”.)

The company will announce other management changes before October. One name to keep an eye out for is Ray McGuire, the former Citi rainmaker who hired Lazard in March.

“Our industry is obsessed with these huge batteries and I think maybe that’s not the right approach. We have to make the battery as small as possible.”

— Jim Farley, the CEO of Ford. Speaking at a Thursday Twitter Spaces event with Tesla CEO Elon Musk to announce an alliance with charging stations, Farley acknowledged that EV manufacturers may need to rethink battery design to reduce charging times and vehicle prices.

Microsoft joins AI’s “regulate us” campaign

Brad Smith, the president of Microsoft, became the latest tech executive to call on governments to come up with new rules to monitor the development of artificial intelligence. His calls come amid an explosion of commercial efforts to advance technology that sparks an impressive stock market rally.

It’s the latest sign that the tech industry is betting on reaching out to regulators as the best way to cope with tougher regulation, but it’s unclear whether governments will create rules that these companies would like.

‘Government must act faster’ Mr Smith told The Times’ David McCabe, proposing steps such as mandating an emergency brake for AI systems used in critical infrastructure and licensing the creation of “highly capable” AI models.

But Mr. Smith also acknowledged that AI developers should be cautious about creating new products with potentially wide-ranging and negative social impacts, saying Microsoft was not trying to shift responsibility onto government regulators. “There’s not an ounce of responsibility abdicated,” he said.

The message echoes calls from other top AI executives. Sam Altman, the CEO of OpenAI (which Microsoft considers a top investor and business partner), told lawmakers last week that Congress should create a new AI regulator. And Sundar Pichai, the head of Alphabet, called on transatlantic regulators to work together to create effective new rules.

Proactively calling for more regulation is a playbook used by other industries, including social media and crypto, with mixed results: Congress has largely failed to write many new laws to oversee social networks, to the consternation of several lawmakers.

But the tolerance of AI managers for new regulations does not go further. Altman warned on Thursday that OpenAI could pull services like ChatGPT from European markets if Brussels makes progress with extensive AI legislation. “We will try to comply, but if we cannot comply, we will stop working,” he said.

In other AI news: According to CNBC, JPMorgan Chase is reportedly developing a chatbot to help clients make investment decisions. And tech evangelist Cathie Wood missed out on $560 billion in paper profit by selling his holdings in Nvidia early this year.

READING THE SPEED

Offers

Policy

-

The Supreme Court ruled that states cannot keep windfalls gained from seizing private property and selling it to recoup tax debts. (NYT)

-

Trade Secretary Gina Raimondo and her Chinese counterpart, Wang Wentao, met amid tensions over China’s ban on US chipmaker Micron. (WSJ)

-

The SEC’s record-breaking $279 million whistleblower award was reportedly paid to a tipster whose evidence led to a bribery settlement against Ericsson. (WSJ)

The best of the rest

-

A judge dismissed a lawsuit against Leon Black, the billionaire co-founder of Apollo, accusing him of sexual misconduct. (FT)

-

Unpaid taxes and missing bottles of expensive wine: customers want to know what happened at Sherry-Lehmann, the iconic New York wine store. (NYT)

-

Within a plan by Sergey Brin, the billionaire co-founder of Google, to bring back airships. (Bloomberg Business Week)

-

Finland was so inundated with nuclear and hydropower this week that some of its spot energy prices turned negative. (Insider)

We want your feedback! Email your thoughts and suggestions to dealbook@CBNewz.