One of the biggest events in the first quarter was undoubtedly GameFi, a $50 million blockchain-powered gaming startup that raised its ICO on Jan. 20. With games like CryptoKitties and Magic: The Gathering doing so well last year, investors hope to see this wave into 2019. Although not without competition – there is no shortage of new projects looking to make their mark in the space!

The “gamefi blockchain” is a decentralized gaming platform that brought in $1.1 billion in the first quarter. The company’s recent success is attributed to its focus on providing a fair and level playing field for gamers.

Every day, more than a million users are active in the GameFi market, playing the thousands of games that are now available and generating demand for dozens of new ones that are released almost every week.

The sheer number of players and total number of games available on the market shows that interest in this relatively young but rapidly developing part of the crypto business is growing.

However, there is another metric we can look at to evaluate how GameFi is perceived by the institutional crypto industry: funding.

In this series of articles, we examine one of the fastest-growing areas of the crypto industry and the money it got in the first quarter of 2022.

Taking a look at GameFi funding

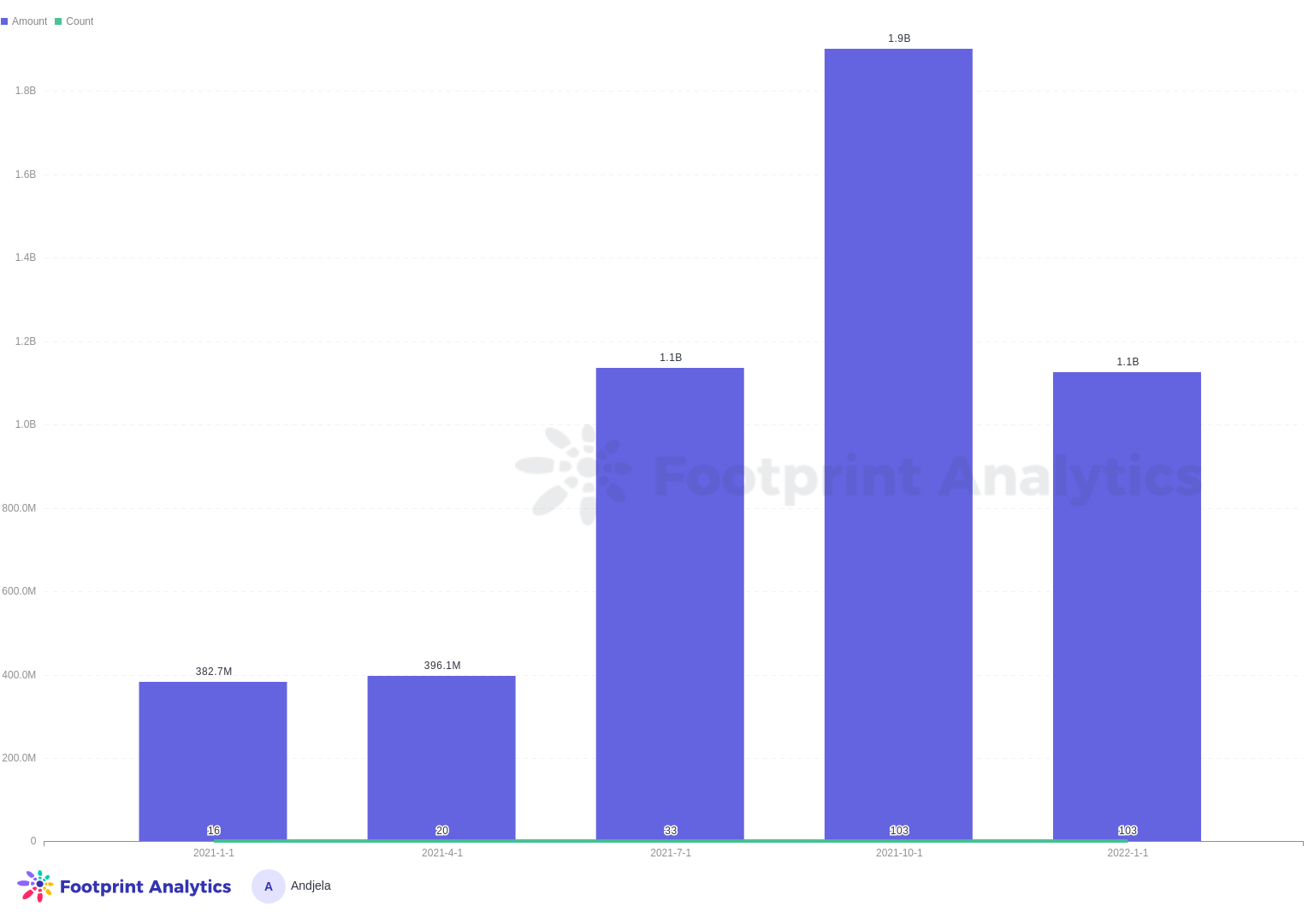

The GameFi received $1.13 billion in funding in the first quarter of 2022, according to a joint analysis by Footprint Analytics and DeGame. This investment reflects a 194.19 percent year-over-year increase and an 18 percent increase above the quarterly average funding level of $954 million in 2021.

Last quarter GameFi had a higher number of investment rounds than in previous quarters. The 103 funding rounds in the first three months of the year reflect a 139.54 percent increase above the quarterly average of 43 raised in 2021.

However, the $1.1 billion was a 40.78 percent drop from total industry funding in the fourth quarter of 2021, when it hit its all-time high — $1.9 billion.

Volume of GameFi investment and fundraising rounds from Q1’21 to Q1’22 (Source: Footprint Analytics)

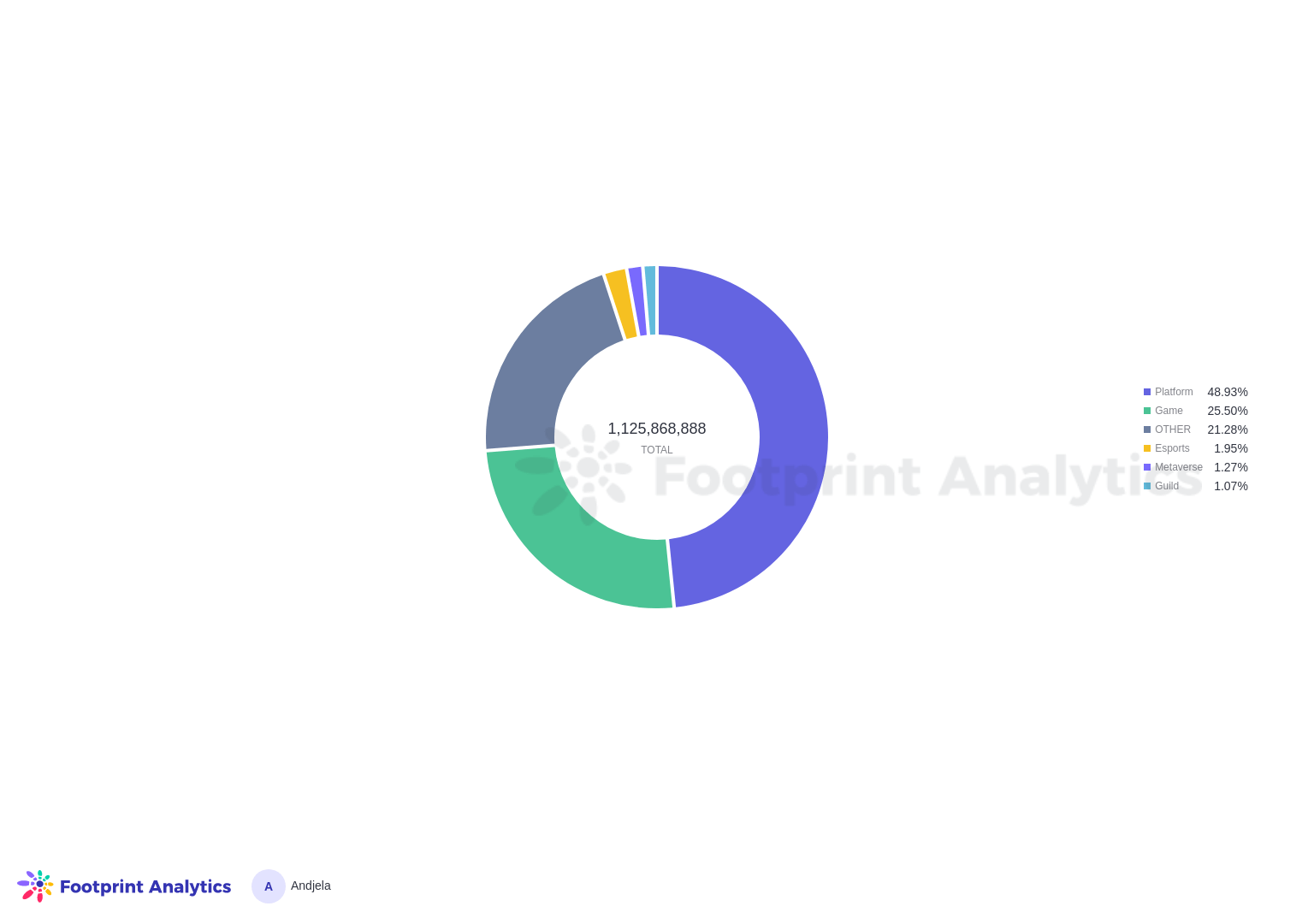

In terms of the types of projects that received the most funding, gaming platforms outperformed the road with $551 million in the first quarter. This is barely half the money made by the GameFi industry last quarter, when independent games received $287 million, or 25.5 percent of total funding.

GameFi funds projects based on their species (Source: Footprint Analytics)

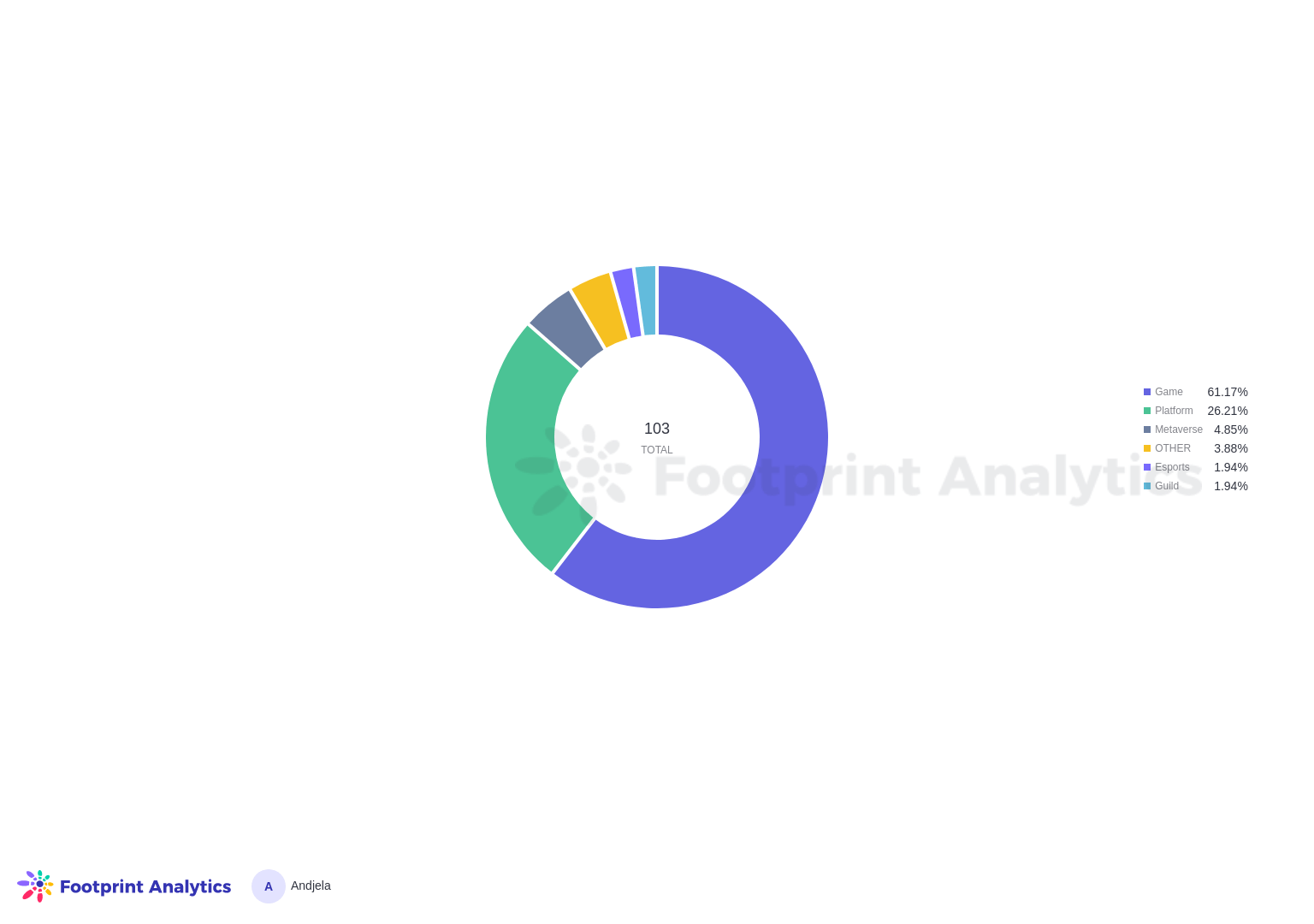

Independent games, on the other hand, led the way in total fundraising rounds. GameFi saw a total of 103 fundraising rounds in the quarter, 63 of which were investments in independent games. Gaming platforms, on the other hand, took in just over 26% of the total funding rounds, while the metaverse received 4.85%.

GameFi’s funding rounds are organized by project category (Source: Footprint Analytics)

Despite this, game platforms received an average of $20.4 million per funding round, compared to $4.55 million for independent titles. The number of rounds of funding and the total amount of investment received by metaverse, guild and esports ventures was all in the single digits last quarter.

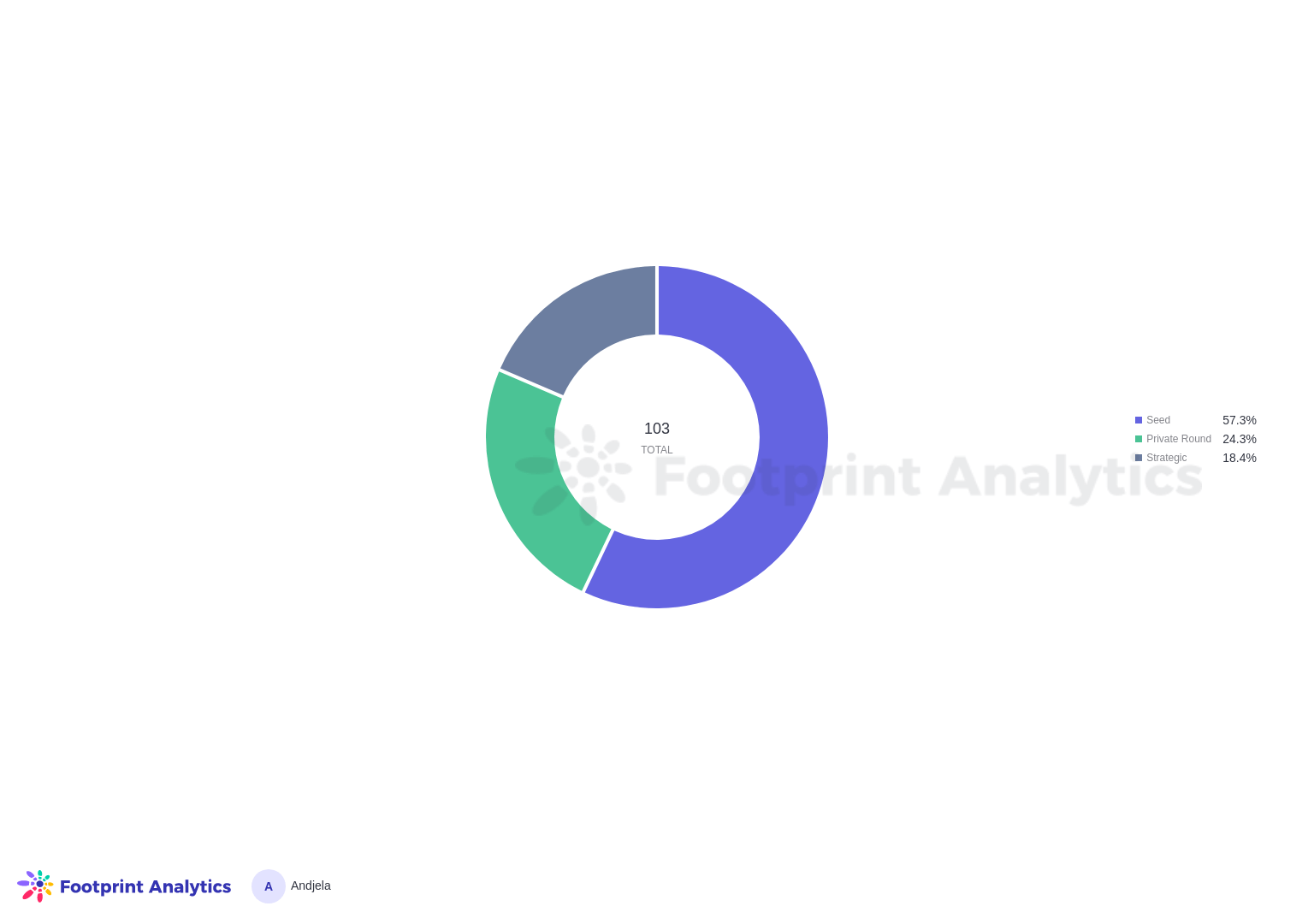

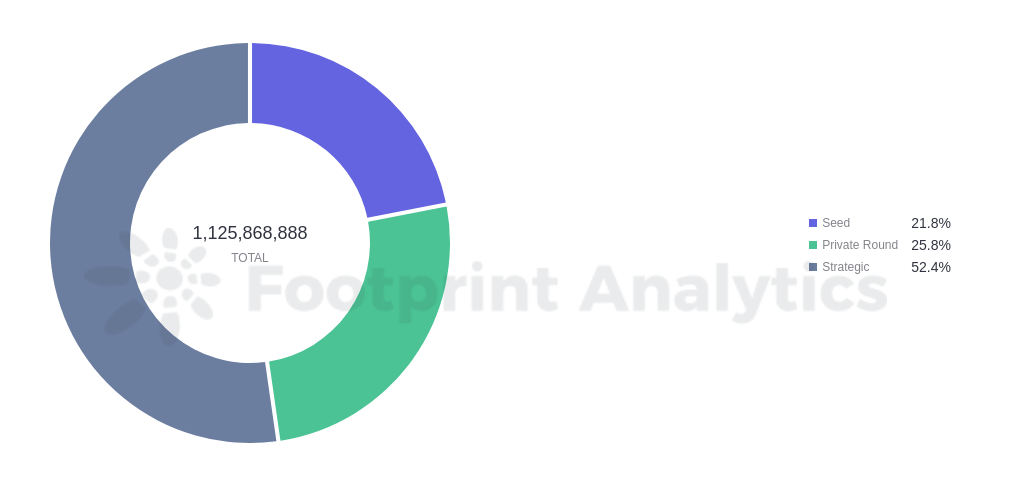

The majority of the GameFi market’s fundraising rounds were seed rounds, but strategic rounds brought in more money overall. Seed rounds accounted for 57.3 percent of all investment rounds, or 59 in total, according to the Footprint Analytics research.

Total fundraising rounds by category (Source: Footprint Analytics)

Seed rounds, on the other hand, accounted for just 20.76 percent of the total amount of industry investment, with average seed-round funding of just under $5 million per project. Strategic rounds, on the other hand, accounted for 52.4 percent of total fundraising.

Total amount of money raised by species (Image courtesy of Footprint Analytics)

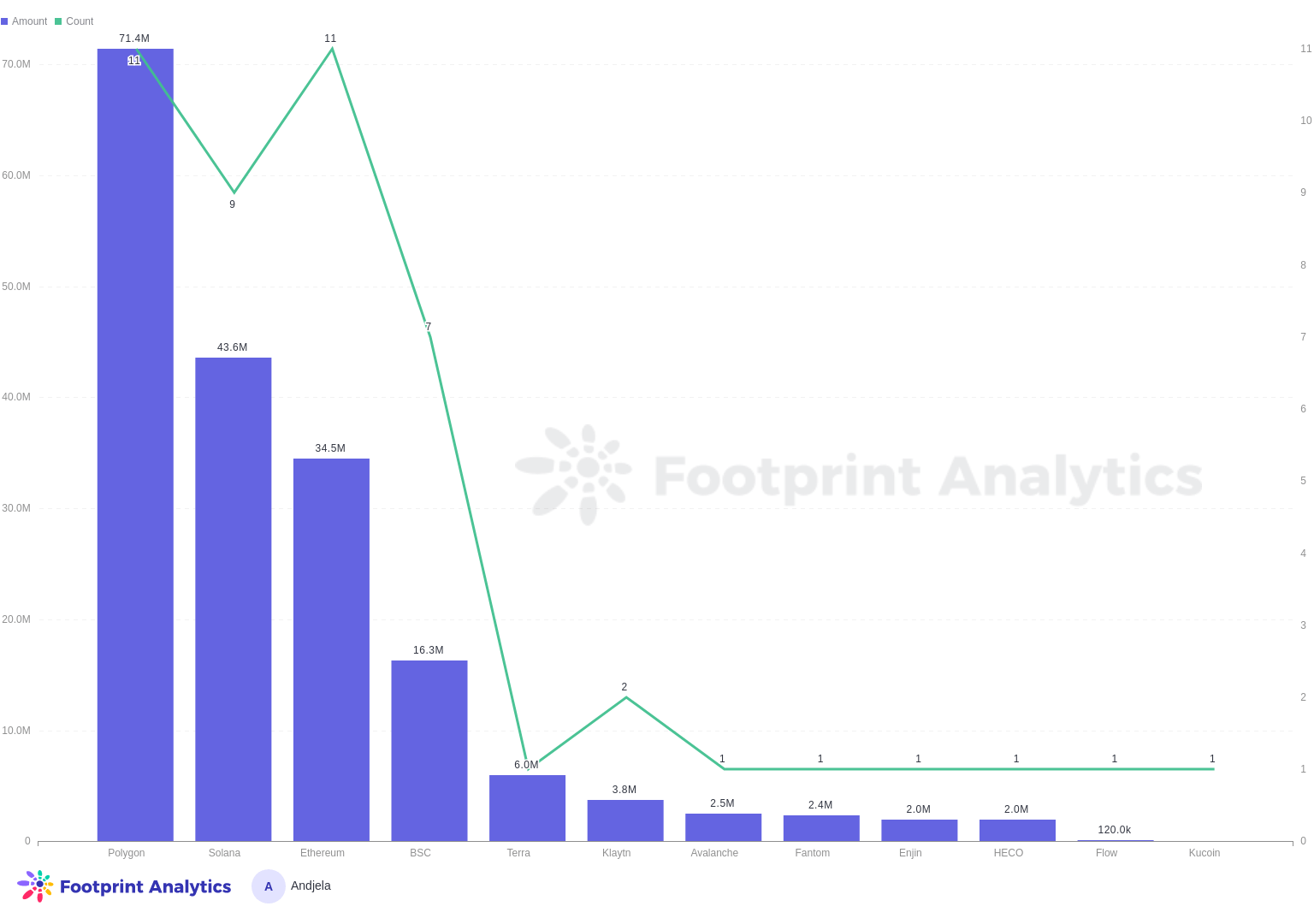

Polygon was the most successful in terms of both the number of fundraising rounds it received and the total amount of money it earned. In the first quarter, the chain amassed $71.4 million in investments, followed by Solana’s $43.6 million and Ethereum’s $34.5 million.

Polygon ranks first along with Ethereum in the number of rounds of funding it has received, with both chains getting money in 11 different rounds. Last quarter, Solana came in second with nine rounds of funding, followed by Binance Smart Chain and GameFi, all of which received seven rounds.

The average blockchain game investment announced on Polygon was $6.49 million per project.

The breakdown of funds by chain (Image courtesy of Footprint Analytics)

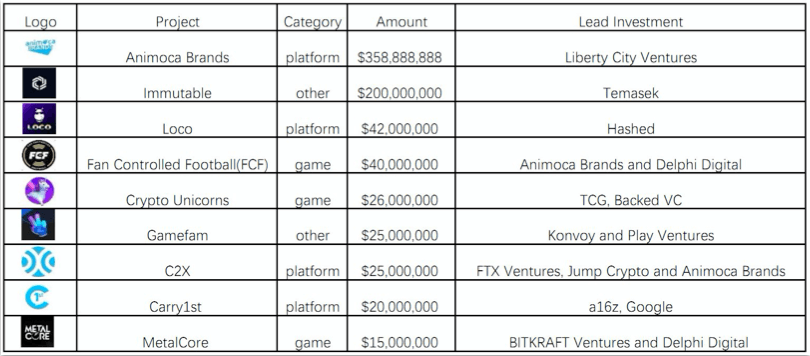

The $1.1 billion investment is unevenly distributed. While only nine projects received more than $15 million in funding in the quarter, half of the entire funding amount was split between just two projects: Animoca Brands and Immutable. Animoca Brands, a project platform, raised $358 million in the first quarter, making it the largest fundraiser in the GameFi industry. Immutable raised $200 million in funding, while another project platform, Loco, came in third with $42 million.

Only three of the nine initiatives are independent games, with Fan Controlled Football (FCF) receiving the most funding at $40 million. Both games, Crypto Unicorns and MetalCore, generated investments of $26 million and $15 million respectively.

Following are the nine best GameFi projects in terms of money received (Source: Footprint Analytics)

The post Inside GameFi: $1.1 Billion Invested in Blockchain Gaming in Q1 appeared first on .

Related Tags

- gamefi coin price prediction

- blockchain news

- what is blockchain