Inflation slowed for a 10th straight month in April, a closely monitored report on Wednesday found, good news for US households burdened by higher costs and Washington policymakers trying to contain rapid price increases.

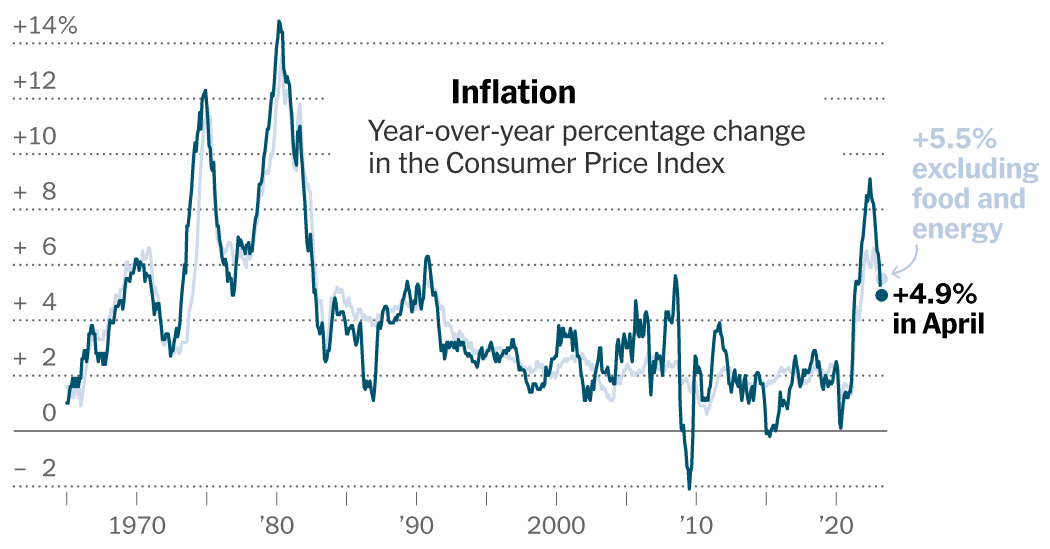

The Consumer Price Index rose 4.9 percent in April from a year earlier, less than the 5 percent economists had expected in a Bloomberg survey. Inflation has notably fallen after peaking at just above 9 percent last summer, though it has remained much higher than the annual gains of 2 percent that were normal before the pandemic.

After scrapping food and fuel to get a sense of the underlying trend in price increases — what economists call a core measure — consumer prices rose 5.5 percent from a year earlier, down slightly from the 5 .6 percent in the previous reading.

The slowdown in price increases last month came even as gas costs rose and rental costs continued to rise quite briskly. Prices of new cars, a measure of the price of medical care and airline tickets all fell in April, the report found, driving inflation lower.

Stock prices rose in response to the data, as investors hailed it as good news for the Federal Reserve. Economists and data analysts agreed the report provided further evidence that inflation is moderating meaningfully, but said the road back to normal prices would be a long one.

“Inflation is still sticky: I don’t think the Fed will look at this and cut rates, or breathe a particularly big sigh of relief,” said Priya Misra, head of Global Rates Research at TD Securities. “Not so fast. We cannot conclude that the inflation problem is over.”

For example, a closely monitored measure of services prices outside of housing costs meaningfully retreated, but in a way that may not be sustainable. The benchmark rose 5.2 percent year-on-year, a sharp drop from the 5.7 percent in the previous reading, based on a Bloomberg calculation.

That was an encouraging sign that a stubborn strand of inflation is finally about to burst, but it was also caused in part by a slowdown in travel costs that may not last, said Laura Rosner-Warburton, senior economist at MacroPolicy Perspectives.

That delay offered “a bit of good news, but probably also a bit of fake,” she said.

Although inflation has been gradually cooling for months, it is still too high for policymakers to be comfortable.

Much of the slowdown in price increases is due to the removal of bottlenecks in the supply chain, the easing of goods shortages and the moderation of gas prices following a surge in the summer of 2022 linked to the Russian invasion of Ukraine.

But underlying trends that could keep inflation persistently high over time have remained intact, including unusually strong wage growth, which could drive companies to charge more for products and services

Fed officials will likely pay close attention to April’s inflation report. They raised interest rates last year at the fastest pace since the 1980s to slow lending and weigh down the economy, but with borrowing costs above 5 percent, policymakers have signaled that they could pause interest rate movements once their midpoints are reached. – June meeting. That decision will depend on incoming economic and financial data, they said.

Policymakers will receive the consumer price report for May on June 13, the day before their decision, but officials usually give markets a hint of what they might do with the rates ahead of time. That puts a lot of emphasis on the April report.

“It probably keeps them on track to pause at the next meeting,” Ms Rosner-Warburton said of the latest inflation data, explaining that she doesn’t think the price slowdown is enough to convince policymakers to change course change and even lower interest rates. rates soon.

John C. Williams, the president of the Federal Reserve Bank of New York, told reporters in New York on Tuesday that the Fed’s next decision — whether to raise rates or pause its June meeting — would depend on incoming data.

He said it would have been appropriate for the Fed to raise interest rates in May to try and get them to take a restrictive stance, and now “we’ll adjust policy going forward based on what we see out there.”