The US Federal Reserve raised its interest rates last week and the market reacted accordingly with some minor price drops, but the cryptocurrency markets have been hit hard by this news. Bitcoin fell below $36K as Argentina’s central bank said it will not allow financial institutions to offer crypto services. A quick summary of recent events that could affect the future of blockchain-powered games:

The “bitcoin price” is the world’s most popular cryptocurrency and has been on a wild ride in recent weeks. The US Fed has announced it will raise interest rates, which could have an impact on the Bitcoin market. Argentina’s central bank said no to financial institutions offering crypto, but this was not enough to stop the Bitcoin plunge.

Every Saturday, Hodler’s Digest updates you on all the key news from the past week. A week on Cointelegraph in one link: the best (and worse) comments, adoption and regulatory highlights, top currencies, forecasts and much more.

Top stories of this week

To fight inflation, the Fed is raising interest rates by 50 basis points.

The Federal Open Market Committee (FOMC) of the United States on Wednesday decided to raise interest rates by 0.5 percent, the largest increase in almost two decades. It was the second rate hike in 2022, with a total of seven rate hikes for the year.

After the FOMC meeting, Federal Reserve Chairman Jerome Powell reiterated in a news conference that interest rates must continue to rise to fight inflation.

Goldman Sachs has provided Coinbase with the first Bitcoin-backed loan.

By using Bitcoin as collateral for a loan from Goldman Sachs, Coinbase has taken an important step towards bridging the gap between the mainstream and crypto sectors. Under the agreement, Coinbase is taking a loan from Goldman Sachs that was backed by a portion of the exchange’s Bitcoin assets. However, figures were not given.

According to Brett Tejpaul, CEO of Coinbase Institutional, “Coinbase’s partnership with Goldman represents a first step towards the recognition of crypto as collateral, strengthening the bridge between the fiat and crypto markets.”

Binance and Elon Musk will invest $500 million in Twitter.

Tesla CEO Elon Musk announced his intention to buy Twitter in April 2022 for $44 billion, subject to certain approvals. The $44 billion comes not only from Musk’s wallet, but also from 19 other investors. Binance and Sequoia Capital Fund are two of the largest donors, each with $500 million and $800 million.

The founders of BitMEX must pay a civil fine of $ 30 million, according to the court.

Following a court ruling on Thursday, BitMEX co-founders Benjamin Delo, Arthur Hayes and Samuel Reed, were ordered to pay a total of $30 million in civil fines ($10 million each) for legal violations related to the BitMEX exchange.

Among the alleged violations was failure to comply with certain consumer data obligations and failure to obtain required legal consents. The $30 million legal saga follows a series of legal troubles from the past.

The SEC has increased the number of units regulated by the agency.

The Securities and Exchange Commission (SEC) is seeking to expand its Crypto Assets and Cyber Unit, which is responsible for overseeing crypto activities. The unit will be expanded by 20 staff, increasing the total team size to 50.

In terms of personnel, the new employees will approximately double the existing size of the unit. SEC chairman Gary Gensler praised the measures, although one of the committee members, Hester Peirce, expressed reservations.

Losers and winners

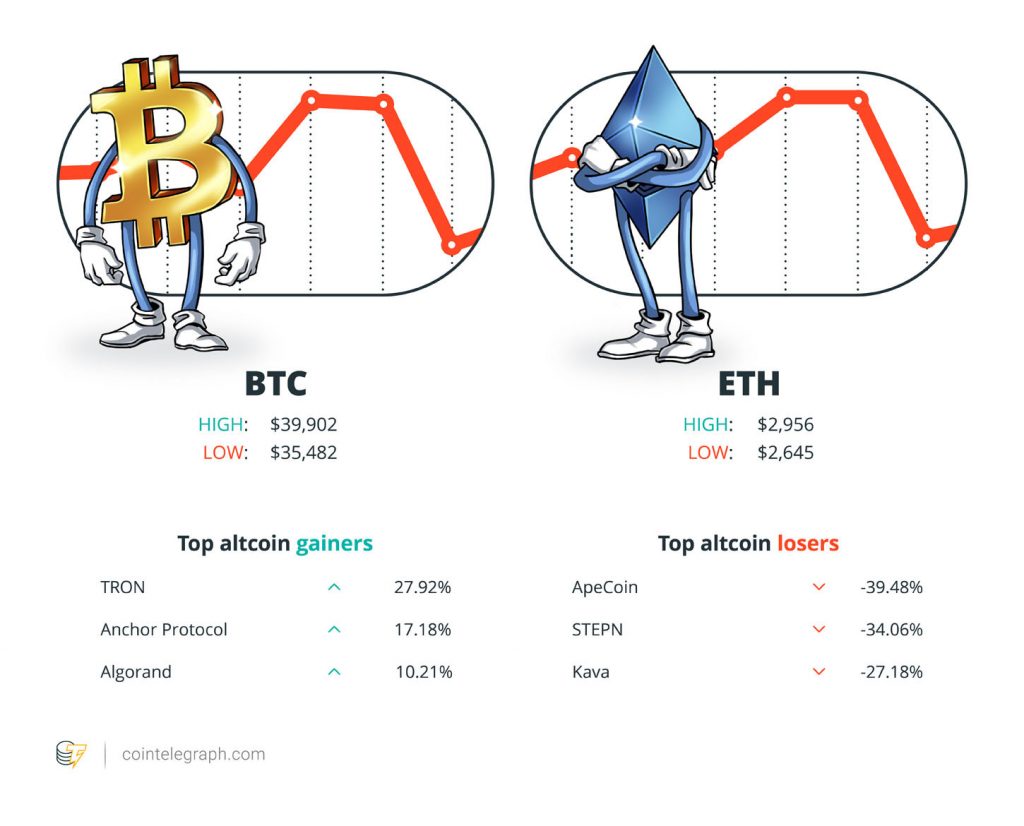

Bitcoin (BTC) is at $35,983, Ether (ETH) is at $2,689 and XRP is at At the end of the week, Bitcoin (BTC) is at $35,983, Ether (ETH) at $2,689 and XRP at $0.59. Its total market cap is $1.65 trillion, according to CoinMarketCap..59 at the end of the week. According to CoinMarketCap, the total market cap is $1.65 trillion.

TRON (TRX), Anchor Protocol (ANC) and Algorand (ALGO) are the top three altcoin winners this week, with 27.92 percent, 17.18 percent and 10.21 percent in the top 100 cryptocurrencies, respectively.

ApeCoin (APE), STEPN (GMT) and Kava (KAVA) are the top three cryptocurrency losses this week, at -39.48 percent, -34.06 percent and -27.18 percent, respectively.

Read Cointelegraph’s market analysis to learn more about crypto prices.

The most memorable quotes

“When I think of Bitcoin, I think of the early Internet.” [The government] was caught off guard, and now it’s a legitimate kind of cash that can be used to buy things.

Podcaster Joe Rogan

“Now if you just overlay the Nasdaq and cryptocurrency markets, they are insanely interconnected, so I believe that causes a lot of churn and misery in the markets.” During this time, billions of dollars are being invested in Web3.”

SkyBridge Capital founder and managing partner Anthony Scaramucci

“I wouldn’t accept it if you told me you had all the Bitcoin in the world and gave it to me for $25 because what would I do with it?”

Berkshire Hathaway CEO Warren Buffett

“What makes a work of art worth ten million dollars?” It is an oil painting on canvas. As a result, the value is determined by the viewer.”

Citadel Securities’ founder and CEO, Ken Griffin

“Why are you going to put so much work into setting up a […] stablecoin payment system if the Fed is just going to wipe you out?”

Former Vice Chairman of the Federal Reserve’s Oversight Committee, Randal Quarles

“The NFT market is in free fall.”

The Wall Street Journal reporter Paul Vigna

The forecast of the week

Bitcoin is down 1,000 points to $35.5K. The Dow experienced its worst trading day since 2020.

The price of Bitcoin has fallen in the past week. Bitcoin’s price dropped below $36,000 on Thursday, impacting both crypto and traditional financial markets.

In terms of optimistic versus bearish storylines, some technical analysts believe the $37,500 level is the dividing line. Bitcoin’s drop below that level indicates that the short-term outlook has shifted to negative.

The FUD of the week

Warning: Smartphone SMS Prediction predicts the seed phrase of a crypto hodler.

Andre, aka u/Divinux, recently issued a warning on Reddit, noting that if the owner’s crypto-seed phrase is typed onto the device, the phone’s predictive text may be able to guess the phrase. Andre replicated his findings on several devices, with similar results. This can put the mobile phone owner at risk from crypto theft.

To date, DeFi has raised more than $1.6 billion in 2022.

According to statistics from blockchain security firm CertiK, crypto-related theft from hacks and other criminal behavior has already surpassed the previous two years combined in 2022. In total, nearly $1.6 billion in crypto assets had been appropriated by 2022.

That said, context is crucial. According to DeFi Llama, the decentralized financial sector has grown in value over the past two years and now stands at over $200 billion in total value.

Argentina’s central bank steps in to prevent banks from launching new cryptocurrency offerings.

Under a regulation of the Argentine Central Bank, or BCRA, financial institutions are prohibited from offering crypto trading to consumers. The central bank justified its decision by citing known issues about cryptocurrency, such as a lack of effective regulation.

A few prominent Argentine banks earlier this week, just before the BCRA’s move, announced plans to sell some crypto assets to consumers.

CoinTelegraph’s Best Features

Here’s how blockchain games can succeed in the mainstream.

According to one notable investor, most P2E games are “crap”. But they have the potential to be so much more.

Blockchain technology is gradually making its way into everyday life.

Blockchain technology is making its influence known in households, from green seafood to Bored Apes.

The Metaverse’s creative economy will grow, but not under the control of Big Tech.

Decentralization should allow independent innovators and artists to resist the limitations of Big Tech, especially in the Metaverse.

The “US Fed Raises Interest Rates, Bitcoin Dips Below $36K, and Argentina’s Central Bank Says No to Financial Institutions Offering Crypto: Hodler’s Digest, May 1-7” is a blog post written by Hodler. The article discusses the US Fed raising interest rates, Bitcoin crashing to $36K and Argentina’s Central Bank refusing to allow financial institutions to offer cryptocurrencies. Reference: crypto with interest rates.

Related Tags

- squeeze btc

- bitcoin news

- crypto taking a hit

- bitcoin crash ahead

- coin telegraph price analysis