The massive bear market that has hit Bitcoin this year is finally coming to an end. There are some huge milestones on the horizon, with the expiration of a $640 million BTC option in September being a key date for investors to keep their eyes peeled for.

The “price target for bitcoin” is a prediction of the price Bitcoin will have by the end of Friday. The “This is why bears are aiming to keep Bitcoin below $29K ahead of Friday’s $640 million BTC options expiration.”

The daily closing price of Bitcoin (BTC) has fluctuated in a narrow range between $28,700 and $31,300 for the past nine days. The May 12 fall of TerraUSD (UST), the third-largest stablecoin by market value, has hurt investor confidence, and the path for Bitcoin’s price recovery seems hazy after the Nasdaq Composite Stock Market Index fell by 4 on May 18. 7 percent fell.

Disappointing quarterly results from top retailers in the United States bolster fears of a recession, and on May 18, Target (TG) shares fell 25%, while Walmart (WMT) shares fell 17% in two days. The prospect of an economic slowdown pushed the S&P 500 index to the brink of bear market territory, contracting 20% from its all-time high.

Additionally, leveraged buyers were hit hard by the latest bitcoin price drop (longs). According to Coinglass, total liquidations on derivatives exchanges between May 15 and 18 were $457 million.

Bulls place bets of $32,000 or more.

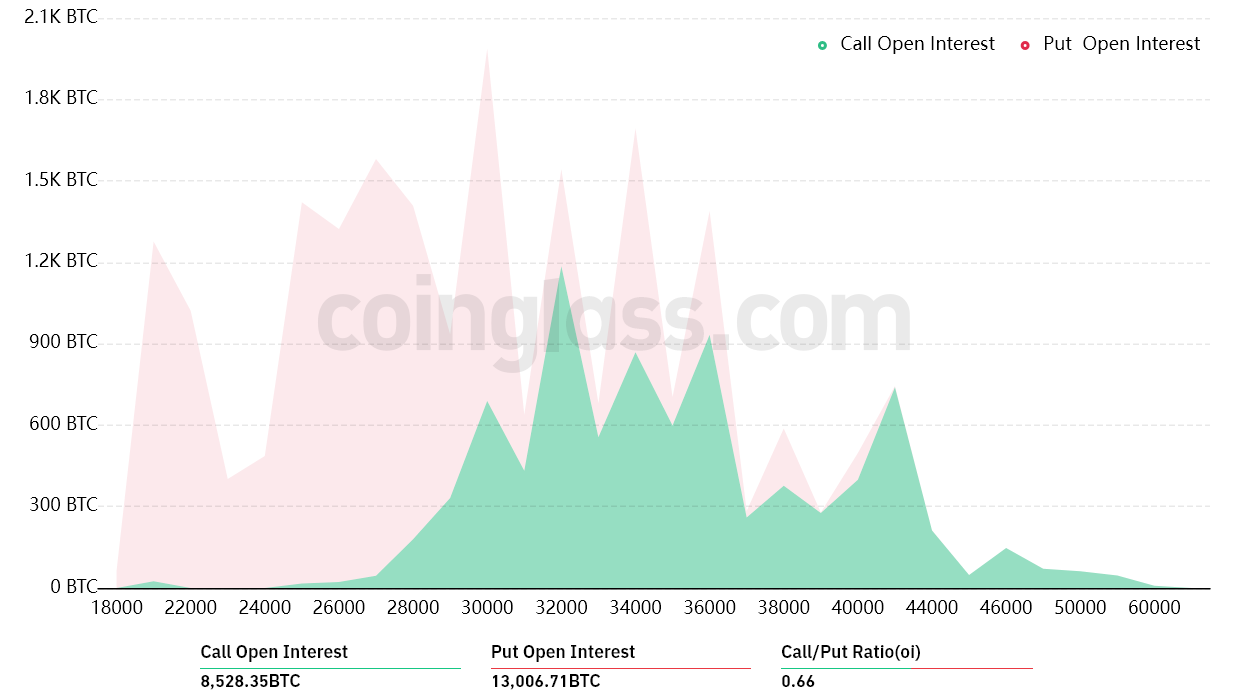

The open interest for options expiring on May 20 is $640 million, but because bulls were overly optimistic, the real total will be significantly lower. Bitcoin’s latest drop below $32,000 caught buyers off guard, and only 20% of May 20’s call (buy) options were pushed below that price level.

Open interest in bitcoin options before May 20. Credit: CoinGlass

The $385 million put (sell) open rate exceeds the $255 million call (buy) options, resulting in a 0.66 call-to-put ratio. However, with Bitcoin approaching $30,000, most put (sell) bets are expected to lose value, narrowing the bears’ lead.

There are only $160 million worth of put (sell) options available if Bitcoin’s price remains above $29,000 on May 20 at 8:00 AM UTC. This is due to the fact that a right to sell Bitcoin for $30,000 is useless if BTC trades further level at expiration.

Bears would benefit from BTC below USD 29,000.

Based on current price activity, the three most likely possibilities are listed below. The number of call (bull) and put (bear) option contracts available on May 20 depends on the expiration price. The potential gain is determined by the imbalance that favors both parties:

- 300 calls vs 7,100 places between $28,000 and $29,000. The total result is $190 million in favor of the put (bear) instruments.

- 600 calls versus 5,550 places between $29,000 and $30,000. At $140 million, the outcome is in favor of the bears.

- 1,750 calls vs 3,700 places between $30,000 and $32,000. The total result is a $60 million benefit for the put instruments (bear).

This rough estimate takes into account put options in bearish bets and call options in neutral to bullish trades. Despite this, more nuanced investment methods are ignored by this simplicity.

For example, a trader may have sold a put option to gain positive exposure to Bitcoin above a certain price, but there is no easy method to evaluate this impact.

In the medium term, the bulls have nothing to gain.

To make a profit of $190 million, Bitcoin must bearishly push the price below $29,000 on May 20. The bulls’ best-case scenario, on the other hand, requires an increase of more than $30,000 to mitigate damage.

Since Bitcoin bulls liquidated $457 million in leveraged long positions between May 15 and 18, they should be able to push the price higher with less margin. As a result, bears will attempt to keep BTC below $29,000 prior to options expiration on May 20, reducing the chances of a near-term price recovery.

The thoughts and opinions of the author are purely his or hers and do not necessarily reflect those of Cointelegraph. Every investment and trading decision is fraught with danger. When making a choice, you should do your own research.

The “btc puts” is a derivative that allows traders to speculate on the price of Bitcoin. Traders can buy or sell options contracts for Bitcoin at specific prices and dates. The expiration date of these contracts is Friday, December 21, 2018. Interestingly, this option will expire worthless if the price of Bitcoin drops below $29K.

Related Tags

- warning for bitcoin fed

- bitcoin november options expired

- ethereal regulation

- btc bears

- bitcoin friday