(Bloomberg) — German banks are beginning to feel the effects of the stagnant economy.

Most read from Bloomberg

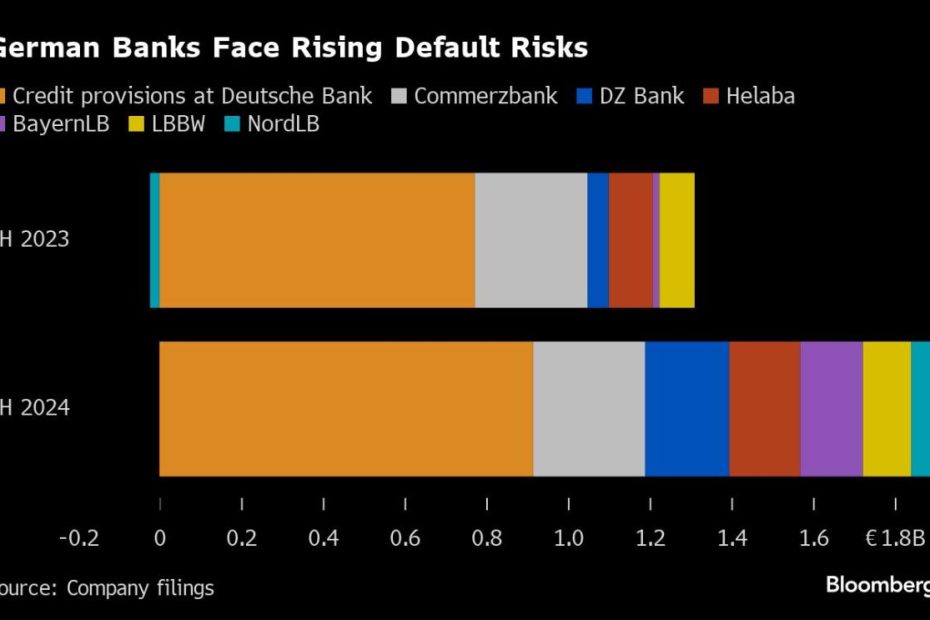

Provisions by the nation's largest lenders rose nearly 50% in the first half of the year, with many banks saying loans to struggling businesses and consumers were a big part of the reason. Several said things could get worse before they get better.

“Geopolitical uncertainties will continue to affect the economy as a whole in the remaining months of the year,” DZ Bank AG said when presenting its results on Thursday. The lender — Germany's second-largest by assets — increased risk provisions four times compared with the same period a year earlier. Most other banks also set aside more money.

The German economy has been struggling since Russia’s invasion of Ukraine abruptly ended an era of low energy prices. Rising borrowing costs have added to the burden, plunging the country into prolonged stagnation and dashing hopes of a quick recovery recently.

Germany is “falling into crisis,” Ifo Institute President Clemens Fuest warned earlier this week.

According to credit rating agency Creditreform, the number of corporate bankruptcies in Germany rose by almost 30% in the six months to June compared to a year earlier, reaching the highest level in a decade.

The companies facing financial problems include chemical makers OQ Chemicals GmbH and Heubach GmbH, commodities trader BayWa AG and battery maker Varta AG. Lenders to the companies include BayernLB, Commerzbank AG, Deutsche Bank AG, LBBW and NordLB, according to data compiled by Bloomberg.

Corporate bankruptcies could increase “in the coming months” amid challenges such as higher borrowing costs, Commerzbank said in its second-quarter report published earlier this month. The lender increased loan loss provisions in its corporate client segment by 52% in the first half of the year.

–With assistance from Stephan Kahl.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP