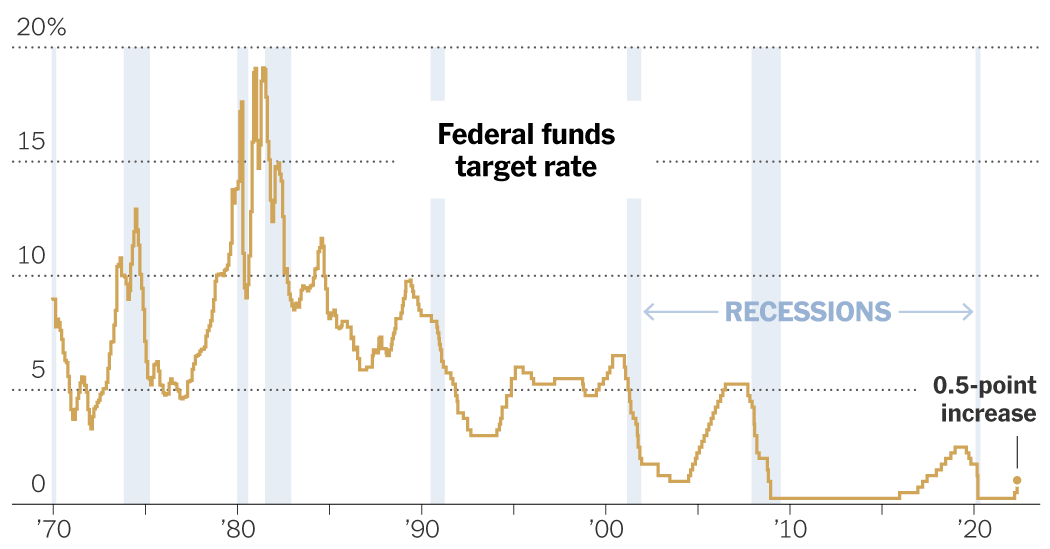

Deciding how quickly to remove policy support is a difficult exercise. Central bankers hope to act decisively enough to halt price increases without curbing growth so aggressively as to plunge the economy into a deep slump.

Frequently asked questions about inflation

What is inflation? Inflation is a loss of purchasing power over time, meaning your dollar won’t go as far tomorrow as it did today. It is usually expressed as the annual price change for everyday goods and services such as food, furniture, clothing, transportation, and toys.

Mr Powell nodded at that balancing act, saying, “I expect this will be quite a challenge — it won’t be easy.” But he said the economy had a good chance of “making a soft landing.”

He later explained that it might be possible to “restore price stability without a recession, without a severe downturn and without significantly higher unemployment.”

The Fed’s balance sheet plan released on Wednesday matched analysts’ expectations, which also likely contributed to the market’s sense of calm. The Fed will begin shrinking its nearly $9 trillion in assets in June by maturing government bonds and mortgage-backed debt without reinvestment. It will eventually mature up to $60 billion in government debt each month, along with $35 billion in mortgage-backed debt, and the plan will be fully implemented by September.

By reducing its bond holdings, the Fed is likely to draw steam from the financial markets – bond prices will fall, pushing yields up, and riskier assets like stocks will become less attractive. It could also help cool the housing market by driving up longer-term borrowing costs that track bond yields, amplifying the effect of the central bank’s rate hikes.

In fact, mortgage rates have already started rising and are up nearly two percentage points since the start of the year. The rate on a 30-year mortgage averaged 5.1 percent for the week ended Thursday, according to Freddie Mac, reaching the highest level in more than a decade.

The Fed’s measures “will soon make it more difficult to fund large purchases.” Jonathan Smoke, chief economist at Cox Automotive, wrote in a research note after the meeting. “This is exactly what the Fed wants to see. As demand for homes, cars and other durable goods declines in response to declining affordability, the pace of price increases should also slow down.”