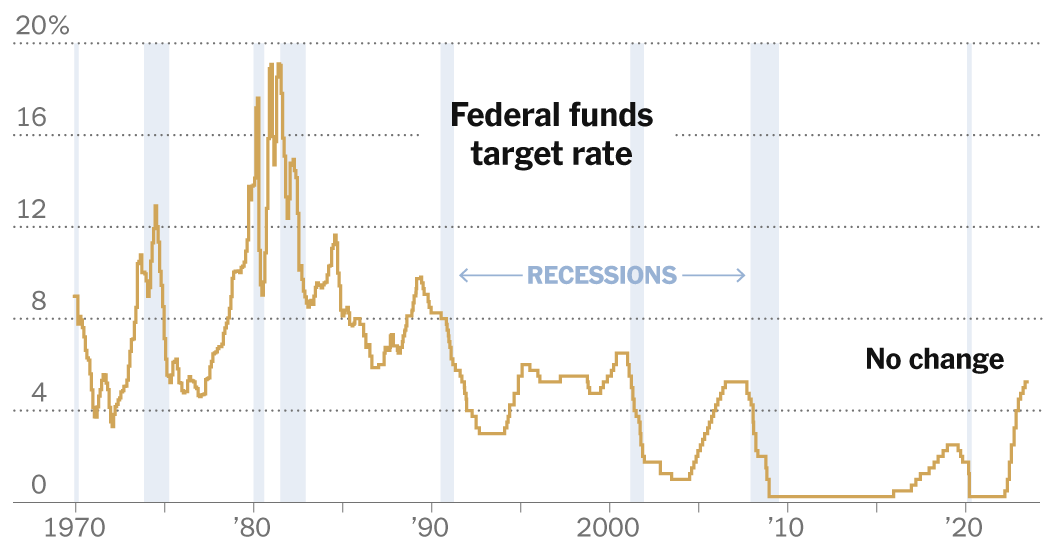

Federal Reserve officials left interest rates unchanged on Wednesday, skipping a hike after raising rates 10 times in a row since March 2022. Still, policymakers predicted they may have to raise rates twice more this year as inflation, while subdued, remains stubborn.

Fed officials said in their policy statement that they were giving themselves time to assess how the economy reacted to what was a quick campaign to slow demand and bring rapid inflation under control. The central bank had already raised interest rates in just over a year to a range of 5 to 5.25 percent.

But policymakers also predicted in their economic forecasts that they could raise rates even further — to 5.6 percent by the end of 2023. That would amount to two more quarter-point increases over the course of the Fed’s four remaining meetings this year . The projections sent a clear signal that Fed officials are increasingly concerned about continued inflation and will need to do more to cool growth and contain price increases.

“The process of reducing inflation will be gradual — it will take time,” Fed Chairman Jerome H. Powell said at a news conference following the decision. But given how much rates have already risen, he also added that “stretching at a more moderate pace is appropriate.”

Fed officials are entering a new and more patient phase of their war on inflation, which began to accelerate in 2021. But mr. Powell made it clear on Wednesday that the decision to skip a hike this month did not mean the Fed was giving up. are pushing to tame price increases.

The interest rate moves already made by the Fed are still trickling down and weighing on the economy. And the prospect of even higher borrowing costs could keep lenders and consumers cautious, which could slow economic growth.

“The Fed is trying to have their cake and eat it too,” said Gennadiy Goldberg, an interest rate strategist at TD Securities, explaining that pausing gives officials a chance to proceed more cautiously, even though their forecasts indicate they will eventually can be more aggressive. . “The problem is, can they convince markets?”

Stocks fell sharply after the Fed’s policy statement and economic projections were released, but rallied during Mr. Powell, where he emphasized that the forecasts are estimates and not a promise of future interest rate changes.

Investors expect another rate hike this year, most likely when the Fed meets again on July 25-26, but less than what Fed policymakers predict.

When Fed officials raise interest rates, mortgages and business loans become more expensive. That causes consumers and businesses to pull out and should, in theory, force companies to stop raising prices so much.

But 15 months after the Fed’s attempt to curb growth and inflation, the economy is proving surprisingly resilient. Consumer spending has slowed, but not declined. Wage gains are a little more subdued, but companies are still hiring.

And while the economy picks up, inflation lingers. Overall price increases have slowed, in particular as fuel costs have fallen and food price increases have moderated. But inflation remains very fast after removing those two volatile products. Downshifting in that “core” measure has stalled much more.

“You just don’t see much progress,” said Mr. Powell Wednesday. “We want it to go down decisively.”

The Fed’s economic projections come out every three months, the first since March, and they reflected rising inflation concerns. The new projections suggested that 2023 could end with inflation at 3.9 percent after scrapping food and fuel prices. That forecast was much higher than the 3.6 percent that officials had predicted in March.

The inflation measure was 4.4 percent in April. A related and more timely inflation gauge – the consumer price index – confirmed this week that while headline inflation fell, the core measure remained very sticky.

Consumer price increases fell back to 4 percent after rising to about 9 percent last summer, but on a core basis they remained much faster at 5.3 percent.

Still, the Fed is trying to strike a delicate balance.

Officials firmly believe that they must bring hot inflation under control in a timely manner, even at the expense of the labor market. The economy as a whole can only become stable if inflation falls, Mr. Powell Wednesday.

And doing too little can have real costs. If policymakers fail to bring inflation under control in a timely manner, consumers and businesses may begin to expect increasingly higher prices and adjust their behavior accordingly: workers could demand larger annual wage increases, companies could push prices up more regularly, and in general could become more difficult to eradicate price increases.

But central bankers also want to avoid raising interest rates too much and plunging the economy into an unnecessarily strong slowdown. This would cost Americans their jobs and undermine financial security for families across the economy.

That is why central bankers are slowing down. Raising rates cautiously would give officials a chance to consider more data before making decisions.

“We have covered a lot of ground and the full effects of our tightening have yet to be felt,” said Mr. Powell. He said no decisions had been made on the timing of future rate increases, but added that July would be a “live” meeting – meaning officials could very well raise rates.

The question is whether the economy can avoid a recession with interest rates this high and poised to rise further. Fed officials still think there is a path to lower inflation without a painful recession that costs many workers their jobs, even if it is narrow.

“It’s possible – in a sense, a strong labor market that is gradually cooling helps with that,” said Mr. Powell. But he also stressed that the primary focus is now on bringing inflation back under control.

“We understand that we cannot allow inflation to become entrenched in the US economy,” said Mr. Powell, adding that the inflation outcome will matter to “generations” of Americans and is the Fed’s “top priority.” ”

Joe Rennison contributed reporting.