The Fed issued a stronger-than-expected statement on the economy and expressed optimism about recent economic data. Bitcoin is trading in a popular bear channel, traders are looking at $28K as the next support level for BTC/USD.

The “bitcoin fomc” is a term that refers to the Federal Open Market Committee’s comments on bitcoin. This could be a chance for bitcoin to drop to $28,000.

The bleak trend in crypto and stock markets has continued into May and there is currently no evidence of any short-term variables that could reverse the bearish trend.

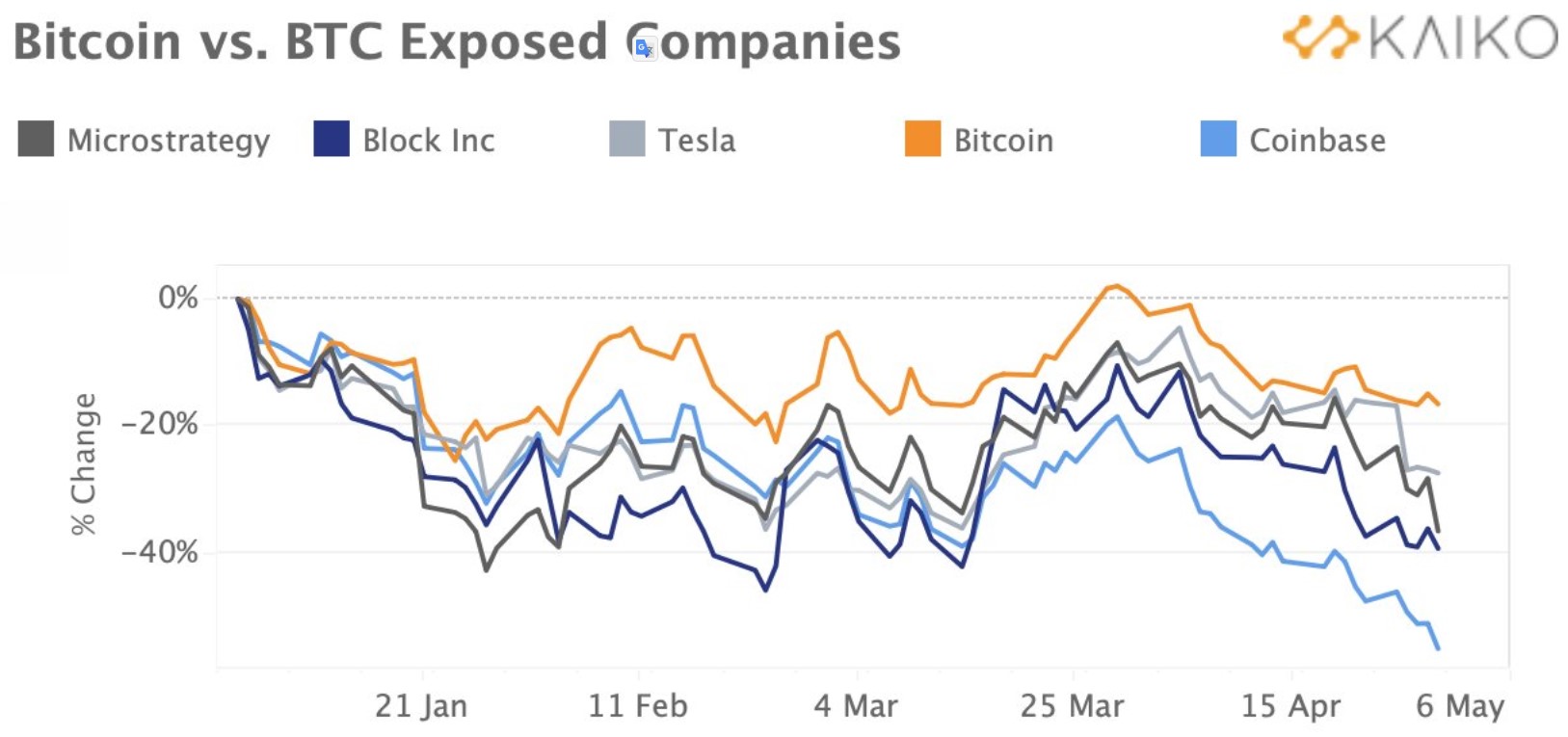

The stock market is also falling, and according to researcher Clara Medalie, the price of shares of companies with exposure to Bitcoin (BTC) has also fallen significantly.

Companies exposed to Bitcoin vs BTC. Twitter is the source of this information.

Medal explained:

“Block, Tesla, Microstrategy and Coinbase are all down between 20% and 50%.”

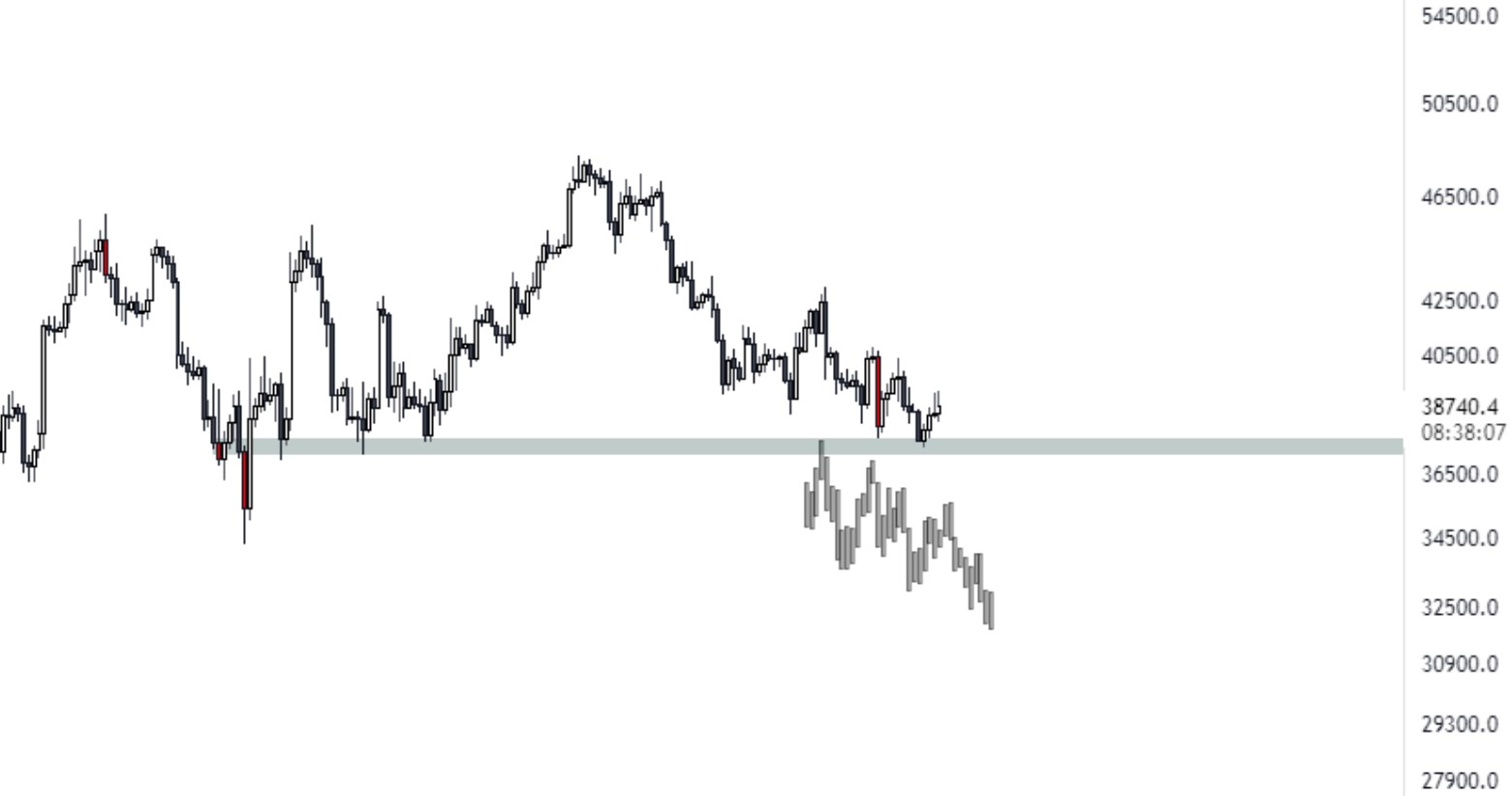

Bitcoin (BTC) bulls’ early morning attempt to climb more than $39,000 was easily defended by bears, resulting in a drop to $38,200, according to data from Cointelegraph Markets Pro and TradingView.

1-day chart of BTC/USDT. TradingView is the source of this information.

Here’s what a few experts have to say about the current price movement, as well as what lower levels to watch for in case of further collapse.

There will be a further decline until the 200 EMA turns into support.

Observing a close above the 200-day exponential moving average (EMA), according to independent market analyst Rekt Capital, is a simple method of analyzing Bitcoin’s current weakness. The score is an “indicator of investors’ long-term attitude toward Bitcoin,” the expert said.

1-day chart of BTC/USD. Twitter is the source of this information.

According to Rekt Capital,

“BTC has not been above the black 200-day EMA for long since mid-2021. Each time BTC broke above the EMA, it quickly moved back down after losing it as support.

The macro bottom could be $28,000.

Crypto trader and pseudonymous Twitter user “Cantering Clark” provided insight into what might happen next for BTC price, posting the following chart highlighting the parallels between current price behavior and BTC’s price action in July 2021.

1-day chart of BTC/USD. Twitter is the source of this information.

Clark, galloping, commented:

“We saw a similar pattern of violent sell-offs, followed by weak attempts to move higher in July 2021, again after a longer-term sideways margin formed and lows began to favor. “A possible set-up for a trap.”

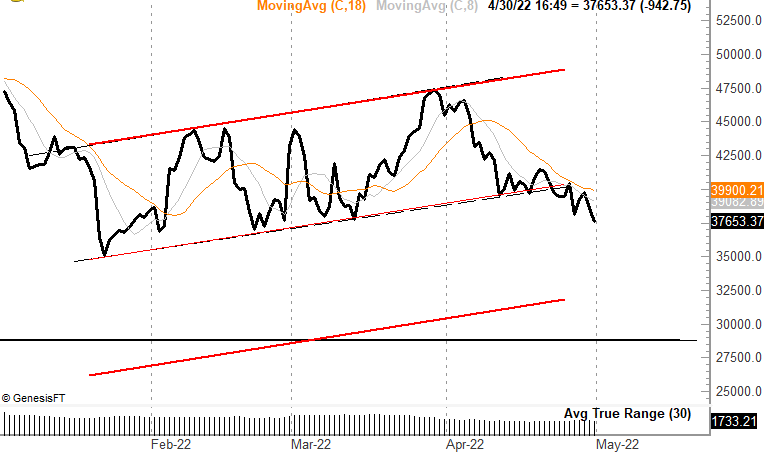

Veteran trader Peter Brandt had a similar perspective, stating that if the current “bear channel” holds out, Bitcoin price could plummet to new lows.

1-day chart of BTC/USDT. Twitter is the source of this information.

According to Brandt:

“The completion of a bear channel usually results in a decrease equal to the width of the channel, or in this case a hard test of $32,000 or so — my forecast is $28,000.”

Bitcoin’s ‘bad market’, according to a trader with shares to surrender, could push the price up to $25,000.

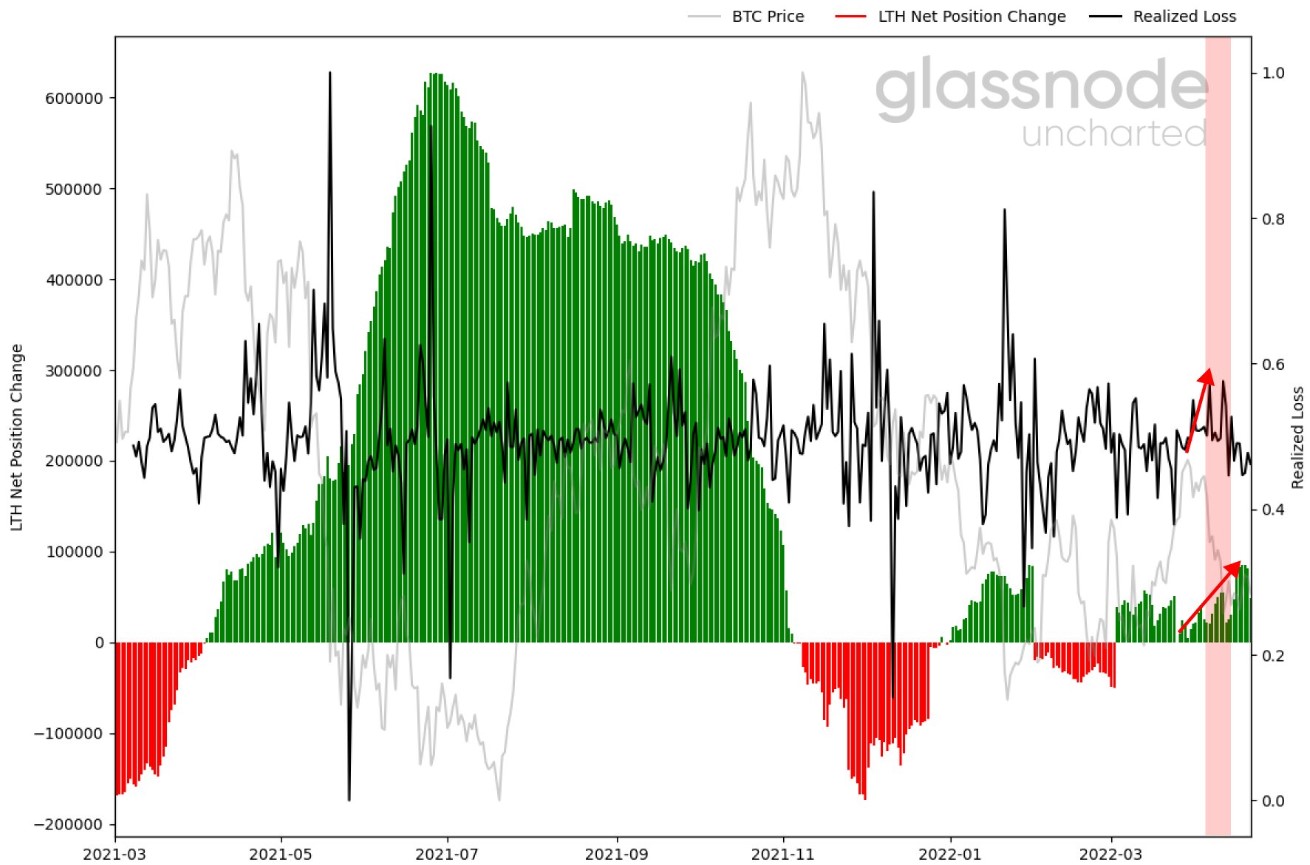

The long-term build-up continues.

Despite the current slump, data from glassnode shows that BTC accumulation is on the rise, as Twitter user Negentropic has pointed out.

Long-term change in the net position of Bitcoin holders. Twitter is the source of this information.

According to the experts

Panicked short-term investors suffered losses, while long-term investors saw their net positions grow.

The total cryptocurrency market cap is currently $1.72 trillion, with Bitcoin taking 42.5 percent of the market.

The thoughts and opinions of the author are entirely his or her own and do not necessarily reflect those of Cointelegraph.com. Every investment and trading choice has risks, so do your homework before making a decision.

The “fomc meeting time” is a comment from the Fed that is seen as negative for Bitcoin. This can kick off the “bear channel” and lead to a price drop.

Related Tags

- bitcoin price

- cryptocurrency bear market 2022

- why the crypto market is bearish today

- has bitcoin hit bottom

- Federal Reserve