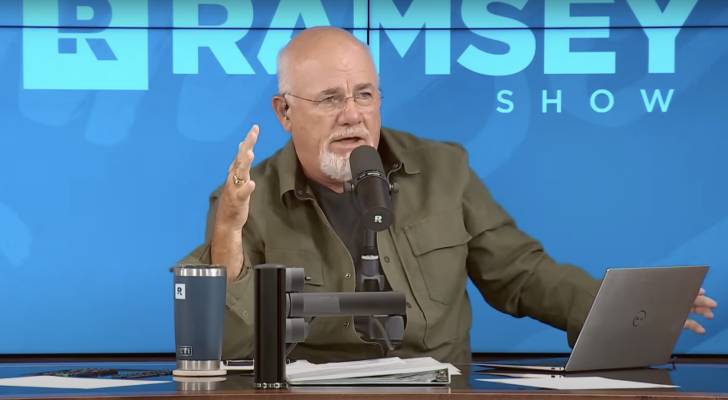

Dave Ramsey, the well-known financial advisor and radio host, has built a reputation as an advocate for simple and straightforward investment strategies.

His philosophy is based on the belief that investors do not need complicated maneuvers and sophisticated assets to perform well.

“I don’t play individual stocks, I don’t mess with gold, I don’t mess with Bitcoin, and I don’t need stock tips from your broke golf buddy with an opinion,” he said in a loose rant during an episode of The Ramsey Show.

Do not miss it

-

Commercial real estate has been beating the stock market for 25 years — but only the super-rich could get in. This is how even ordinary investors can become landlords for Walmart, Whole Foods or Kroger

-

Auto insurance premiums in America are sky high — and only getting worse. But in 5 minutes, you could be paying as little as $29/month

-

These 5 Magical Money Moves Will Boost Your Net Worth in 2024 — and You Can Complete Each Step in Minutes. Here's How

To those who insist he “missed out” on better opportunities, Ramsey had a clear message: “I didn't miss out! I'll put my net worth next to yours while you talk!”

Rather than chasing “cool” asset classes, the financial guru says his net worth, estimated at $200 million, is concentrated in just three investments. Here’s a closer look at his streamlined portfolio.

His business

Like many ultra-wealthy individuals, Ramsey’s business ventures are a major contributor to his immense net worth. By 2024, he estimates that the company will generate around $300 million in revenue. Because it is a privately held company, it is difficult to confirm its valuation and how much Ramsey’s personal stake in the company is worth.

Business interests account for 41% of the total wealth of the top 1%, according to the Federal Reserve's Survey of Consumer Finances. In other words, starting or buying a successful business can be a great way to build a fortune.

Fortunately, Americans are very entrepreneurial. According to the U.S. Chamber of Commerce, 5.5 million new businesses will be registered in 2023 alone. Meanwhile, 93% of working Americans have a part-time job, and 44% rely on income from their part-time job to pay bills and make ends meet, according to a recent survey by Insuranks.com.

Joining this entrepreneurial wave can be beneficial for your personal finances.

Debt-free real estate

Ramsey is more passionate about real estate than any other asset class. He earned his broker’s license at 18 and was a millionaire by 26. But a brush with bankruptcy left him permanently wary of leverage.

Ramsey now claims he owns his vast real estate portfolio outright, with no mortgages on it.

Ramsey’s approach is unusual, but his fascination with real estate is understandable. According to Zillow, the U.S. residential real estate market is worth $52 trillion in total. That makes it a larger asset class than stocks, since the combined value of all publicly traded companies is about $50 trillion.

For most average American families, their primary home is their largest asset, according to an analysis by the Pew Research Center. Like Ramsey, a whopping 39.3 percent of homeowners own their homes without a mortgage, according to U.S. Census data.

However, with rising interest rates and home prices, it has become increasingly difficult for first-time homebuyers to purchase real estate without taking on a large, expensive mortgage. If you’re looking for exposure to this asset class without buying physical real estate, consider a real estate investment trust like Equity Residential Properties Trust (EQR), which owns 299 properties consisting of 79,688 apartments in America’s largest cities.

Read more: Auto insurance rates have risen to a staggering $2,150/year in the US — but you can be smarter than that. Here's how you can save up to $820 annually in just a few minutes (it's 100% free)

Investment funds

Ramsey has often expressed his preference for mutual funds that track the broader stock market. Instead of picking stocks, he believes a passive investment approach is better.

This theory has become increasingly popular. Passive investment strategies now have more assets under management than actively invested funds, according to Morningstar. The Vanguard S&P 500 ETF, a low-cost fund that simply tracks the S&P 500 index, has delivered a compound annual growth rate of 14.51% since 2010.

By gaining more exposure to the stock market through index funds, you may be able to accelerate your wealth accumulation.

What you should read next

This article provides information only and should not be taken as advice. It is provided without warranty of any kind.