The lesson of bimetallism is that the value of a currency is proportional to its relative purchasing power. As one metal becomes rarer, it becomes more valuable than the other and vice versa. This dynamic is changing how we look at an economy and how we think about including new coins in our wallets, especially if they are also privacy coins.

The “will privacy coins be banned” is a question on the minds of many cryptocurrency enthusiasts. If a lesson in bimetallism can help Bitcoin and other cryptocurrencies, then it should help with privacy coins as well.

Since the end of 2021, the crypto market has been in a downward trend. It culminated in a decline in early May 2022, which shook conventional markets almost as hard. The latest market crash unleashed some of the speculation in the market. However, this time is different from the past. The Bitcoin network still has a much higher number of active users than in previous cycles. Many more sincere believers and keepers reached the other side. However, if this trend continues, one of the concerns some people have about Bitcoin (BTC) is that it will impact its adoption. As a solution, privacy coins can be an economic incentive, not just a benefit.

Privacy currencies such as Monero (XMR), Dash (DASH) and Zcash (ZEC) have performed very well against other altcoins in various periods in the first half of 2022, both in crypto market rallies and large dumps. Is this an indication that there is a fundamental desire for crypto privacy?

The Bitcoin Standard Has Arrived (Well, Not Yet)

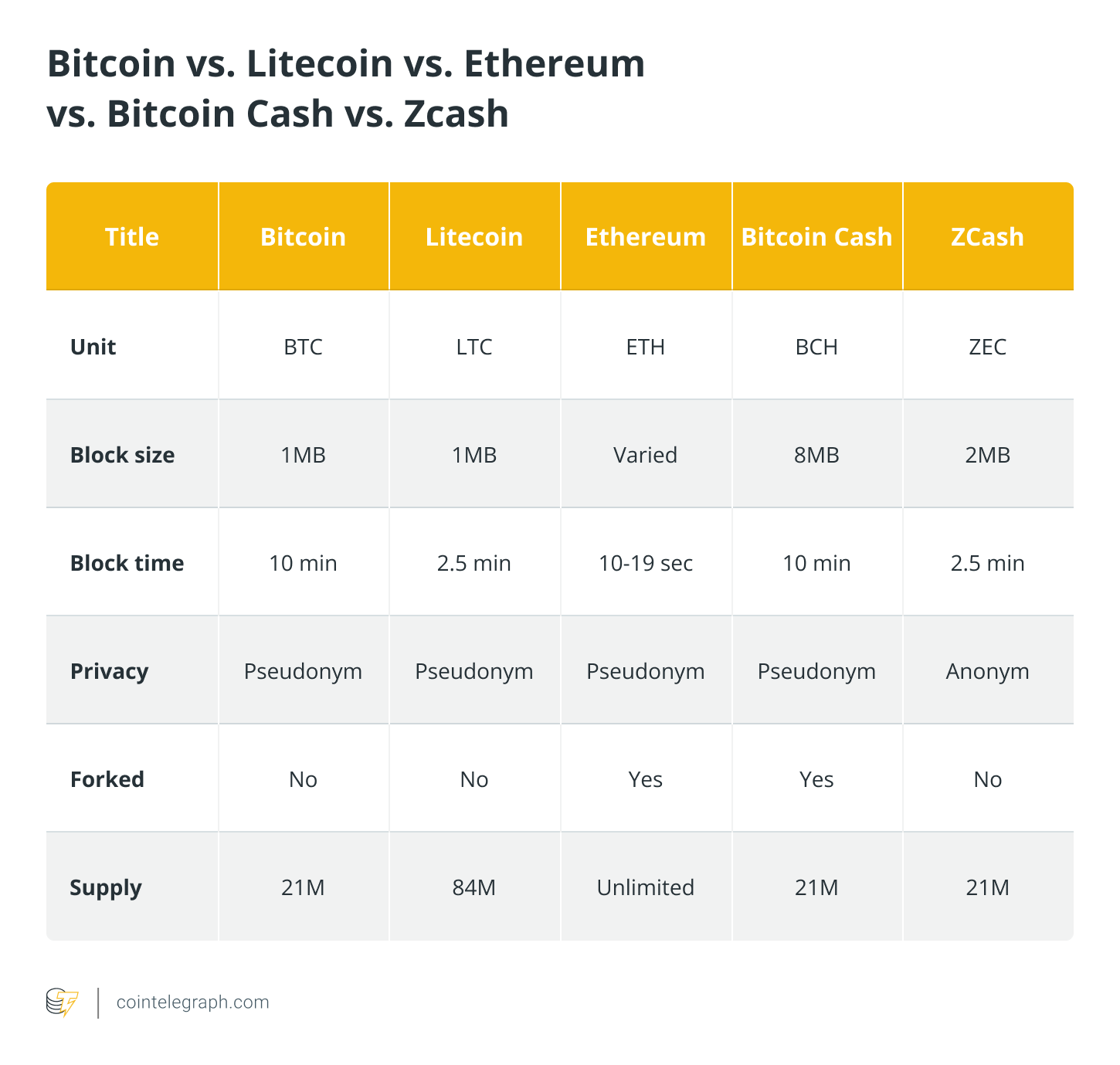

Let’s assume Bitcoin makes it out for the sake of this debate. Bitcoin is currently the most used money in the world. However, due to the pseudo-anonymous structure of the Bitcoin blockchain, anyone can view all transactions for any wallet. And for every cup of coffee purchased, the buyer’s buying habits, location where the spending was made, and all the other dystopian trappings of a 1984-inspired nightmare are a reality. This nightmare has inspired the invention of cryptocurrencies such as Monero, Zcash, Dash, Decred (DCR), Secret (SCRT), and Horizen (ZEN), just to name a few. Some of them have features similar to Bitcoin. Zcash is based on the same principles as Bitcoin, with a hard limit of 21 million coins and a proof-of-work algorithm.

Is it possible that one or more of these blockchain protocols will be accepted as an “everyday” transaction currency in addition to the Bitcoin standard? For example, Monero and Zcash have low inflation or limited amount. They trade with their tokenomics and offer to be nothing more than a commodity and store of value, except to protect the user’s privacy.

Related: Why We Have To Fight For A Decentralized Future Over The Loss Of Privacy

What is bimetallism and why is it important?

Bimetallism is a concept that predates the invention of cryptocurrencies. The goal behind bimetallism, as the name implies, is to use multiple types of precious metals to counteract price inflation relative to each other. In the past, gold and silver were used to balance each other if one had too much purchasing power. For example, a horse is worth one gold coin or ten silver coins (gold and silver are rare to varying degrees, but still have different intrinsic properties for usefulness). If the horse is currently worth two gold coins a year, it may only be worth 12 silver coins, making the exchange more attractive to silver holders and putting downward pressure on gold inflation. With two comparable trading commodities, such as precious metals, this bimetallic arrangement works in principle. Grisham’s law sprang into action when the state put fiat money into the equation.

According to Grisham’s law, bad money drives out good. If a holder has both currency and Bitcoin, there is a good chance that they will value the item/service less than BTC and sell the fiat, which has an almost unlimited supply. This means that Bitcoin will remain unused in people’s wallets for the rest of their lives, eliminating some of the value proposition of sound decentralized money to the rest of the world. The rules of the economy will not change if we believe the world is moving to digital commerce media.

Things like tradable assets will continue to experience price swings. Other means may be needed as an alternative to control these different media. If we don’t want Grisham’s law to repeat itself, there must be assets that are similar to Bitcoin but offer a clear value proposition. Then there are privacy coins.

How can investors protect themselves against inflation with gold, bitcoin or DeFi?

Privacy matters.

Bitcoin has the potential to be a unit of account, a medium of exchange, a store of value and other attributes that align with the gold 2.0 story. Furthermore, the traceability of Bitcoin is a useful aspect. As we can see with Bitcoin-backed loans, the openness of the chain to guarantee creditors that money exists is a huge advantage. But do you want the coffee barista to know that you go to the antique store every Wednesday? Do you want your employer to know about your personal finances? Or to someone interested in your payment history?

This is where bimetallism, or “bicryptoism,” comes in handy to help overcome these problems. When Bitcoin is combined with one or two more rare and limited mediums of exchange (a privacy currency), the purchasing power of goods and services can be kept in constant “stable fluctuation” relative to each other. This is of course in the future when Bitcoin is the world’s leading currency.

These multiple protocols can serve different tasks in users’ lives as they have different qualities (just like gold and silver). Users can take advantage of the privacy that a privacy coin can provide, while still leveraging the benefits of a decentralized ledger and blockchain technology for day-to-day transactions. Users can choose to keep their money in Bitcoin if they want to move it to wallets with a publicly visible address. This can be even easier than a decentralized or centralized exchange due to on-chain capabilities such as atomic swaps.

“For greater anonymity, it is recommended that you only use Bitcoin addresses once,” said Satoshi Nakamoto, the enigmatic creator(s) of Bitcoin. For the crypto user in 2022, a new BTC address for every user would be unfeasible, much only in a world where Bitcoin is the main medium of exchange. Users must either submit a Bitcoin improvement proposal (BIP) to change Bitcoin to include privacy-enhancing features, or coexist in a “bicryptoism” configuration with one or more privacy currencies. The latter has the added economic benefit of reducing price inflationary pressures over time.

These are just some ideas for the future, and the crypto community as a whole should consider these challenges as we move forward. Economics was essential in the creation of Bitcoin and the cryptocurrency revolution, and it should remain so in the future.

There is no financial advice or suggestion in this article. Every investment and trading choice has risks and readers should do their own due diligence before making a decision.

The author’s views, ideas and opinions are his or her own and do not necessarily reflect or represent those of Cointelegraph.

Michael Tabone is an economist at CoinTelegraph Research. He also provides strategic advice to organizations focused on DeFi and blockchain. He is a Ph.D. candidate, engineer, economist and business strategist. Michael is the co-author of many studies for Cointelegraph Research and contributes to the quarterly venture capitalist report of the Cointelegraph Research Terminal. DAOs and their practical applications in business are the subject of his Ph.D. thesis.

Bitcoin and privacycoins have been in the news a lot lately. Not surprisingly, they are some of the most popular cryptocurrencies on the market. However, many people don’t know how bimetallism can help with their long-term stability and privacy. Reference: coindesk privacy.

Related Tags

- privacy coins future

- coin market capitalization

- new privacy coins

- coinecko

- coindesk privacy week