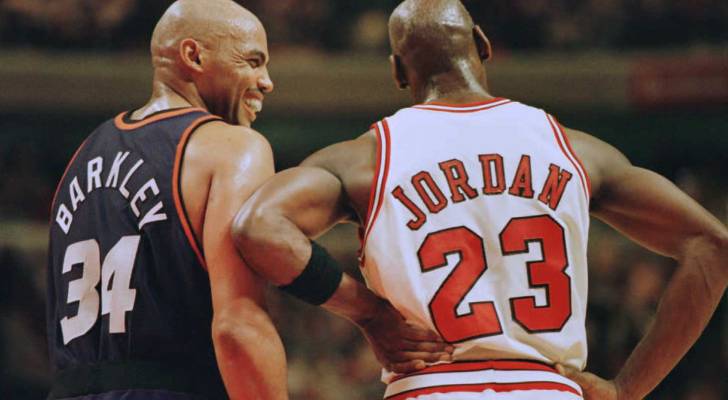

Young athletes are known to blow them through their first major salary. Former NBA star Charles Barkley also did it almost in that Michael Jordan gave him a life-changing financial tip.

In an episode of the Steam Room -Podcast, Barkley says that he and Jordan were about to sign approval with Nike at about the same time. The Barkley deal was originally for $ 3 million, but before he signed on the dotted line, Jordan asked him a simple question: “Hey man, why you [sic] Need all that money? “

The conversation led Barkley to make a decision that could have cost him millions, but had made a fortune instead. Here is the game-changing money movement that he has learned from Jordan, and how you can apply it to your own strategy for building wealth.

Although $ 3 million was not a small amount, Jordan acknowledged that Barkley could make something much bigger out of it with the right strategy. He told Barkley to negotiate again about his contract and only to take $ 1 million in cash and the rest in Nike shares options.

After a short discussion with his team, Barkley took the advice and worked for a huge flour on the road. “I probably made that amount 10 times and I am still at Nike to this day,” Barkley said proudly.

Barkley did not say if he still has his Nike interest, but the stock is a breathtaking 4,000% since his characteristic basketball sneaker, the Nike Air Force Max CB, debuted in 1994. His story emphasizes how getting equity can be much lucrative than a quick payment of cash, especially when it is bound to a strong, growing things.

Here is how you can apply this lesson to your investment strategy.

Read more: Jamie Dimon gives a warning about the American stock market – says that the prices are 'a bit blown up'. Confirm your portfolio with these 3 rock-solid strategies

Just like Jordan and Barkley at the start of their respective career, young investors must be more focused on capital valuation and growth instead of immediate cash flow.

This is why some financial advisers recommend to use the 100 -year rule for age suitable for age. To use this rule, pull off your age of 100 and the rest represents the percentage of your portfolio that you have to invest in shares. So if you are 30 years old, you would set aside 70% of your portfolio for shares, while 30% can be assigned to safe ports such as bonds.