The Canadian Bitcoin Exchange-Traded Fund (ETF) has seen a significant surge in interest as investors look to speculate in the cryptocurrency market. With daily volume of over 6,900 BTC and an increase of nearly 300% since October, GBTC could soon be trading at a historically low discount.

The “gbtc discount table” is a cryptocurrency-related term that refers to the price of Bitcoin Investment Trust shares. The GBTC discount hit a record low this week, dropping 6.9K BTC in a single day.

Bitcoin’s (BTC) drop to $24,000 has cost its largest institutional investor more than the common hodler.

Grayscale Bitcoin Trust (GBTC) is currently being sold at a discount of about 31%, according to data from on-chain monitoring site Coinglass on May 13.

Investors are “waiting for things to settle down,” said Grayscale’s CEO.

GBTC’s embryonic comeback has – for now – turned on its head amid ongoing market instability.

The so-called GBTC premium, which has been negative for a long time and thus effectively represents a discount, has now fallen to its lowest level ever.

The discount was 30.6 percent on May 13, suggesting that GBTC shares were more than a third cheaper than the Bitcoin spot price (referred to as NAV).

The statistics mean a sharp turnaround for the premium, which had risen to a 21 percent discount in mid-April.

GBTC, on the other hand, has long been traded at a discount as Grayscale aims to convert it into an exchange-traded fund (ETF).

“Setting up GBTC required clarity and conviction, and Grayscale shows courage and dedication in their pursuit of turning GBTC into a Spot Bitcoin ETF.” MicroStrategy CEO Michael Saylor said this week that the initiatives “deserve your support,” and encouraged Twitter followers to urge US authorities to approve the plans.

Such a move would be unique in the United States, where the Securities and Exchange Commission (SEC) has been slow to approve a Bitcoin-based ETF, behind other countries’ regulators.

Meanwhile, Grayscale CEO Michael Sonnenshein remained optimistic about GBTC and institutional demand for Bitcoin exposure despite the turmoil.

In an interview with CNBC on May 12, he said, “I believe some investors are definitely waiting for things to settle down.”

“I really think that when things settle down and crypto gains a foothold, you’re going to see some of those more institutional buyers start to step in and some have already indicated that they’re actually starting to take purchases at these levels .”

GBTC premium vs asset ownership vs BTC/USD chart. Source: Coinglass

The aim of Bitcoin ETF is to see daily record purchases.

The world’s first Bitcoin spot ETF, based in Canada, has benefited from the week’s trading conditions.

Why does the world need a place? The CEO of 21Shares describes the Bitcoin ETF in the United States.

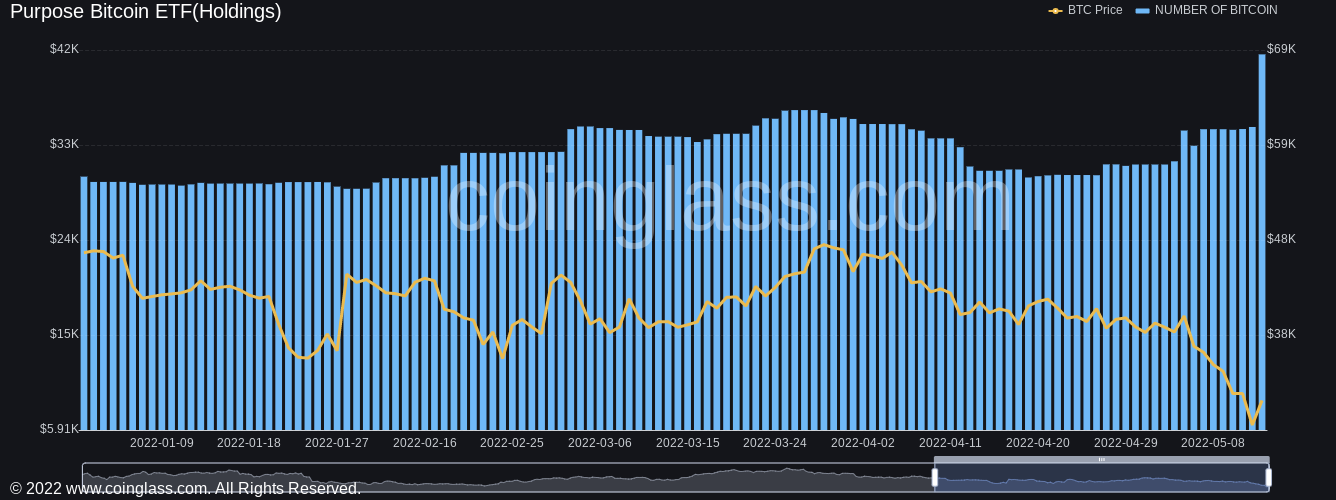

On May 13, the Purpose Bitcoin ETF added 6,903 BTC in a single day, the most one-day buy-in in the fund’s history.

Purpose currently manages 41,620 BTC, surpassing the previous record of 36,322 BTC set in March of this year.

BTC holdings of the Bitcoin ETF vs. BTC/USD chart. Credit: Coinglass

The surge came when Australia’s first spot ETFs were launched, one of which, the Cosmos-Purpose Bitcoin Access ETF (CBTC), bought shares in the Canadian Purpose offering.

Important to note: Two Bitcoin ETFs launched in Australia yesterday. The Cosmos-Purpose Bitcoin Access ETF ($CBTC) buys shares of the Canadian #Bitcoin Purpose spot ETF to gain exposure to BTC. As a result, the latter now reflects two ETFs.

May 13, 2022 — Jan Wustenfeld (@JanWues)

The thoughts and opinions of the author are entirely his or her own and do not necessarily reflect those of Cointelegraph.com. Every investment and trading choice has risks, so do your homework before making a decision.

The “gbtc discount explained” is the lowest price for GBTC since inception. The price of GBTC is up 6.9K BTC in one day.

Related Tags

- gbtc discount calculator

- how to take advantage of gbtc discount?

- is grayscale bitcoin trust a good investment?

- gbtc discount to nav

- gbtc discount or premium to nav