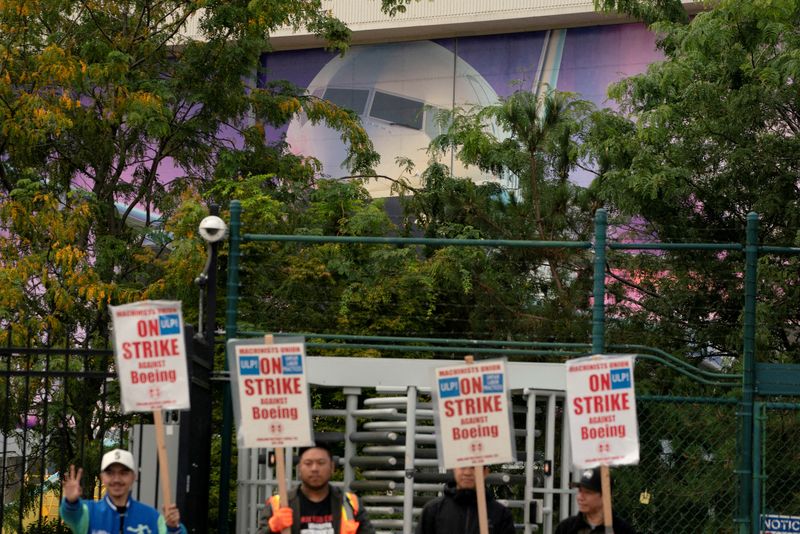

(Reuters) – Boeing faces a crucial test with employees, customers and investors after announcing 10% job cuts and a $5 billion lawsuit as a crippling machinists' strike enters a fifth week.

The aircraft maker is planning a series of internal meetings this week to craft the jobs plan, which could rely at least partly on involuntary cuts whose costs and impact on retaining coveted skills are easier to manage, industry sources said.

Boeing declined to comment. The stock fell 1.7% in pre-market trading.

In a surprise move late Friday, Boeing announced 17,000 job cuts and pre-announced quarterly profits with $5 billion in costs, led by another delay of the 777X and ending civilian production of the 767. No timetable for the job cuts was given.

The one-year delay in 777X deliveries to 2026 follows a widely anticipated industry delay following certification and testing delays, and means the planned successor to the 777 mini-jumbo is six years late would come.

Emirates Airlines president Tim Clark, whose initial order for 150 jets more than a decade ago helped launch the world's largest twin-engine jetliner, hit back Monday.

“Emirates has had to make significant and very expensive changes to our fleet programs as a result of Boeing's multiple contractual failures and we will be in serious discussions with them in the coming months,” he said in a rare written statement about the US fleet. issue of delivery delays.

He also questioned Boeing's new schedule. Citing the suspension of a milestone testing certifications and the ongoing four-week strike, he said: “I don't see how Boeing can make meaningful predictions about delivery dates.”

Emirates is the biggest user of the 777 jet family, a long-haul bestseller whose initial success was clouded by delays to its successor and the crisis that engulfed Boeing's smaller 737 cash cow over safety and quality issues.

The latest crisis comes as Boeing's markets are growing and many of its rivals are drawing scarce labor to meet demand and ease pressure on aerospace supply chains.

“The trick is not to lose the 10% of people you want to keep, which is even more important than normal in the post-pandemic crisis,” said Agency Partners analyst Nick Cunningham.

Analysts said preliminary results, including just over $10 billion in gross cash, would ease pressure in the near term, but noted that Boeing would still need to raise money by the end of the year.

JP Morgan said it would also give Boeing management some more dry powder in its battle with the machinists' union.

Reaching a deal to end the strike is crucial for Boeing, which relies on 737 production for much of its money.

Credit rating agency S&P has warned that Boeing is at risk of losing its prized investment-grade credit rating.

The union representing striking workers said Friday the decision to suspend the 767 freighter was troubling and dismissed Boeing's claims about the conduct of labor talks as baseless.

(Reporting by Abhijith Ganapavaram, Tim Hepher, Joe Brock; Editing by Christina Fincher)