Despite a bullish crypto market, the number of Bitcoin options expiring Friday is overwhelming. Bulls will need to make big bets on their positions before closing at maturity and moving back into more positive territory.

The “btc options expiration today” is a question about whether the bulls are strong enough to win Friday’s $735M options expiration. The answer to this question is explained in detail in the blog post.

The price of Bitcoin (BTC) has been caught in a falling wedge pattern for the past two months and has repeatedly challenged the USD 37,600 support.

BTC is down 16 percent since the beginning of the year, which is in line with Russell 2000’s performance, contributing to this “bearish” price movement.

FTX has a 1-day chart of Bitcoin/USD. TradingView is the source of this information.

Investors’ fears about deteriorating macroeconomic conditions are the main driver of Bitcoin’s recent price behavior. Professional investors are concerned about the impact of the US Federal Reserve’s tightening economic policies, and billionaire hedge fund manager Paul Tudor Jones said on May 3 the environment for investors is deteriorating faster than ever as the monetary authority raises interest rates at a time when financial conditions are already deteriorating.

“This will be a comprehensive import embargo on all Russian oil, by sea and pipeline, both crude and processed,” said European Commission President Ursula von der Leyen.

As a result, traders are becoming more anxious about the effects of a global macroeconomic crisis on cryptocurrency markets. If the global economy falls into a downturn, investors will seek safety by avoiding risky asset classes such as Bitcoin.

Prices below $40,000 were not expected by bulls.

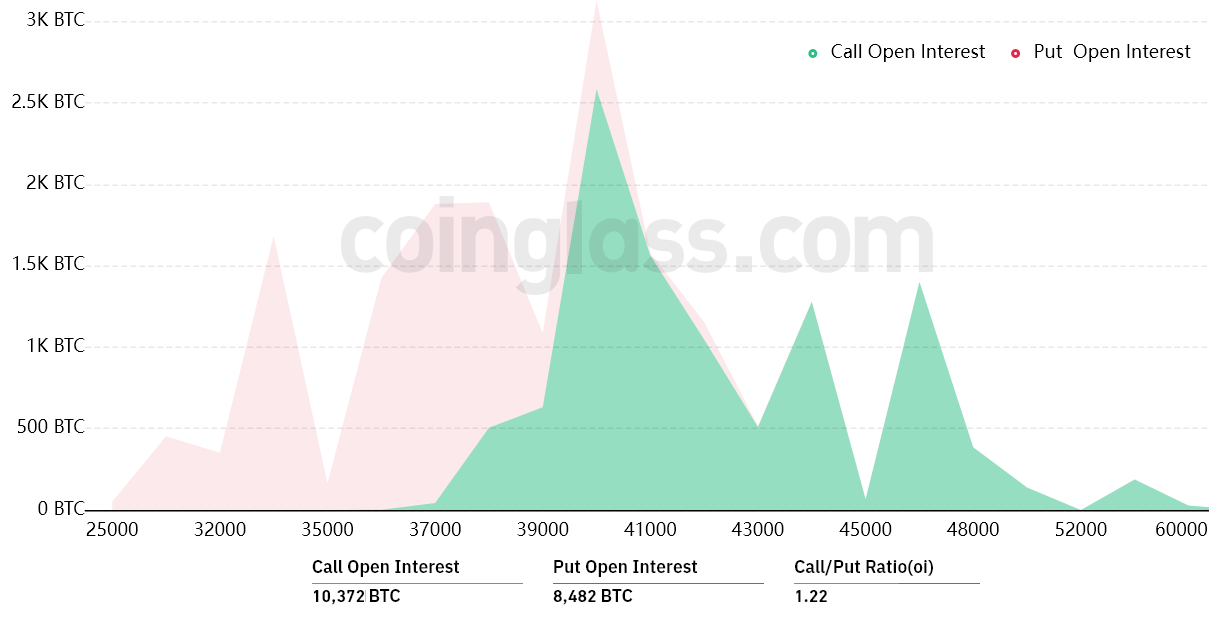

The outstanding interest in Bitcoin options for the May 6 expiration is $735 million, but the actual total will be lower as the bulls were caught off guard as BTC fell below $40,000.

The open interest in bitcoin options for the month of May has reached a new high. CoinGlass is the source of this information.

The call-to-put rate of $405 million versus the put options of $330 million results in a call-to-put ratio of 1.22. Nevertheless, with Bitcoin hovering around $39,000, 89 percent of optimistic bets are likely worthless.

Meanwhile, bears will have $100 million worth of put (sell) options if Bitcoin’s price falls below $39,000 on May 6. This discrepancy arises because a right to sell Bitcoin for $36,000 has no value if it trades above that amount at expiration.

Pre-Fed, BTC price is up 4% as MicroStrategy pledges to protect Bitcoin from a $21,000 drop.

On Friday, the Bears could make a profit of $145 million.

Based on current price activity, the four most likely possibilities are listed below. The amount of call (buy) and put (sell) option contracts available on May 6 depends on the expiration price. The potential gain is determined by the imbalance that favors both parties:

- 500 calls (buy) vs 4,300 places between $37,000 and $39,000 (sell). The total result is $145 million in favor of the bears.

- 1,200 calls (buy) vs. 2,500 puts between $39,000 and $40,000. (to sell). The Bears have a $50 million lead over their opponents.

- 3,800 calls (buy) vs 1,100 places between $40,000 and $41,000 (sell). The net result is $105 million in favor of bulls.

- 5,300 calls (buy) vs 700 places between $41,000 and $42,000 (sell). The bulls have increased their profits to $190 million.

This rough estimate takes into account call options in bullish bets and put options in neutral to bearish trades. Despite this, more complicated investment methods are ignored by this simplicity.

For example, a trader may have sold a call option to gain negative exposure to Bitcoin above a certain price, but there is no easy method to evaluate this impact.

To make a profit of $145 million, Bitcoin bearish must keep the price below $39,000 on May 6. Bulls, on the other hand, can avoid a loss by pushing BTC over $40,000, giving them a $100 million profit. Bears appear to be better positioned for Friday’s expiration given the bleak macroeconomic fundamentals.

The views and opinions of the author are solely his or hers and do not necessarily reflect those of Cointelegraph. Every investment and trading decision comes with a certain level of risk. When making a choice, you should do your own research.

Bitcoin Pushed To $40K But Are Bulls Strong Enough To Win Friday’s $735M Option Expiration? The answer is a big yes. Reference: Bitcoin options expire in January 2022.

Related Tags

- bitcoin options expire February 2022

- bitcoin options expiration 2022

- btc options expire max pain

- bitcoin options expire in march 2022

- bitcoin good news today