Most traders are long, meaning they bet that Bitcoin will rise. This pressure is causing many crypto whales and exchanges to do what they can to pump the price higher. But it appears that these efforts have been successful in creating a short squeeze – something that could be dangerous for investors with leveraged positions such as futures or options trading.

The “crypto leverage chart” is a tool that can be used to find the best time to enter or exit a trade. The chart shows how much profit you make when you are long or short on Bitcoin.

The symmetrical triangular formation that has limited the price for nearly 20 days is breaking upwards, according to this week’s Bitcoin (BTC) chart. Professional traders, on the other hand, are averse to increasing their leveraged positions and are charging too much for downside protection, as evidenced by derivatives measures.

Kraken’s 12 Hour BTC-USD Prices. TradingView is the source of this information.

Will BTC Change Direction Despite Deteriorating Macroeconomic Conditions?

The performance of global markets will impact whether BTC can move from the $30,000 to $31,000 level in support.

The last time stock markets in the United States saw a seven-week decline was more than a decade ago. New home sales in the United States have fallen for the fourth straight month, the longest slip since October 2010.

China’s on-demand services are down as much as 20% year over year, the biggest drop ever. According to government figures released on May 30, consumer spending on Internet services between January and April was $17.7 billion.

Rising interest rates, inflation and macroeconomic uncertainty drove investors to seek shelter in cash, causing the value of equity offerings in Europe to plummet to its lowest level in 19 years. The IPOs and follow-up deals yielded just $30 billion in 2022, according to Bloomberg.

All of this helps explain the difference between Bitcoin’s recent recovery to $32,300 and lackluster derivatives data, as investors estimate a higher probability of a crash, mainly due to deteriorating global macroeconomic conditions.

Metrics for derivatives are neutral to negative.

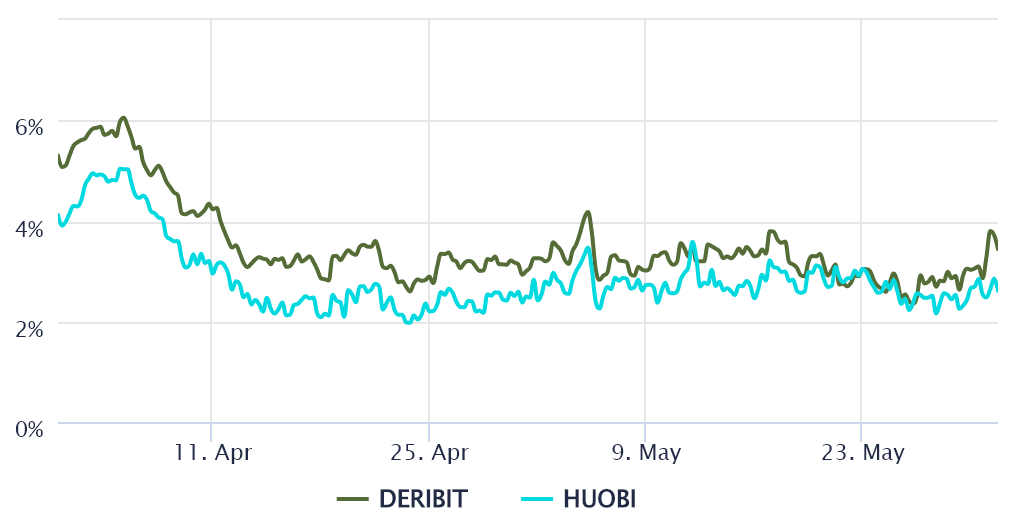

Because of the price difference between quarterly futures and spot markets, retail traders normally avoid them, while professional traders prefer them because they avoid the variable funding rate of the perpetual contracts.

Because investors want more money to keep with the settlement, these fixed-month contracts normally trade at a small premium to spot markets. This is not just a problem with crypto markets. As a result, futures in healthy markets should trade at an annual premium of 5 to 12 percent.

The annualized premium for Bitcoin 3-month futures. Laevitas is the source of this information.

According to Laevitas statistics, Bitcoin futures premium has remained below 4% since April 12. This number is indicative of bearish markets, and the fact that the indicator failed to break the 5% neutral barrier as the price approached $32,000 is worrying.

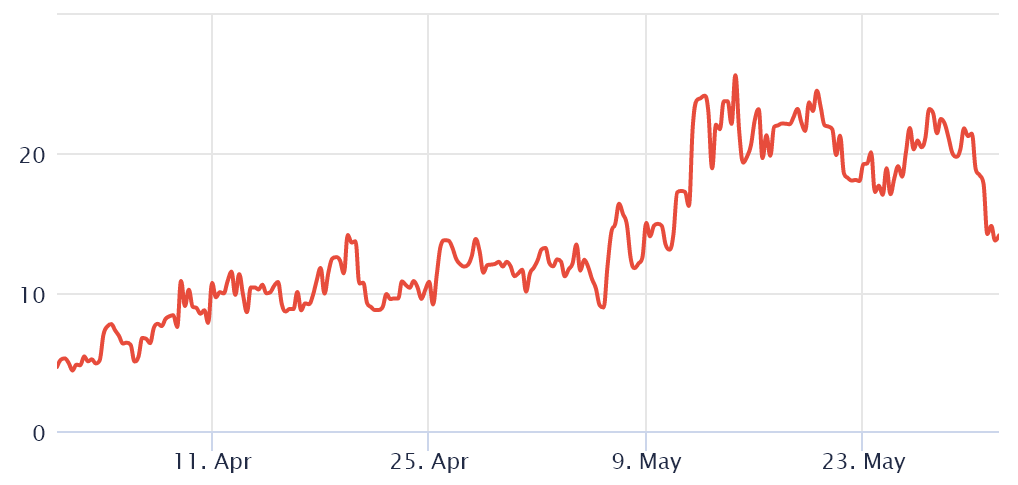

Traders should also examine the Bitcoin options markets to rule out externalities specific to the futures instrument. When Bitcoin market makers and arbitrage bureaus overcharge for upside or downside protection, the 25 percent delta skew is ideal.

Options investors assign greater chances of a price decline in unfavorable markets, pushing the skew indicator by more than 12 percent. The overall excitement of a bull market, on the other hand, causes a negative skew of 12 percent or lower.

30-day Bitcoin picks a 25% delta skew: Laevitas is the source of this information.

On May 14, the 30-day delta skew hit a new high of 25.4 percent, which is a sign of severely negative markets. However, on May 30 and May 31, the situation improved as the indicator remained stable at 14%, although this still carries a higher risk of price decline. Nevertheless, it shows a slight increase in the attitude of derivatives traders.

The risks of a global economic slowdown are probably the main reason why Bitcoin options markets are under pressure and why the futures premium is still low. The 30-day correlation of BTC versus the S&P 500 index is 89%, meaning traders have less incentive to place bullish bets on cryptocurrencies.

Some indicators suggest that the stock market bottomed out last week, especially considering it’s now trading 8.5 percent above its May 20 intraday low, but dismal economic data is dragging on investor morale. This contributes to the risk-averse trend, which is negatively impacting cryptocurrency markets.

Bitcoin traders should avoid building leveraged long positions and adopt a negative stance until a clearer definition for conventional finance and the world’s largest economies emerges, a trait now reflected in options markets.

The thoughts and opinions of the author are purely his or hers and do not necessarily reflect those of Cointelegraph. Every investment and trading decision comes with a certain level of risk. When making a choice, you should do your own research.

The “best crypto leveraged trading platform” is a question many people ask. Bitcoin’s price broke upwards, but where are all the leveraged long traders?

Related Tags

- how much leverage is in crypto

- leverage trading crypto example

- high leverage bitcoin trading

- bitcoin price analysis