Bitcoin and Ethereum had a rough week, but derivatives data reveals a silver lining. This is due to the rise of stablecoins: coins that are 1:1 pegged to government-backed assets such as gold or fiat currencies. Stablecoins may be the future of cryptocurrency trading as they offer more protection against market volatility than regular cryptocurrencies

Bitcoin and Ethereum had a rough week, but derivatives data reveals a silver lining. The two cryptocurrencies are down about 25% this week, which isn’t bad considering they’re up more than 1,500% this year. Read more in detail here: btc has moved to exchanges.

The crypto market has seen a significant drop in value this week after Coinbase, the largest US exchange, reported a net loss of $430 million per quarter and South Korea announced its intention to impose a 20% tax on cryptocurrency profits.

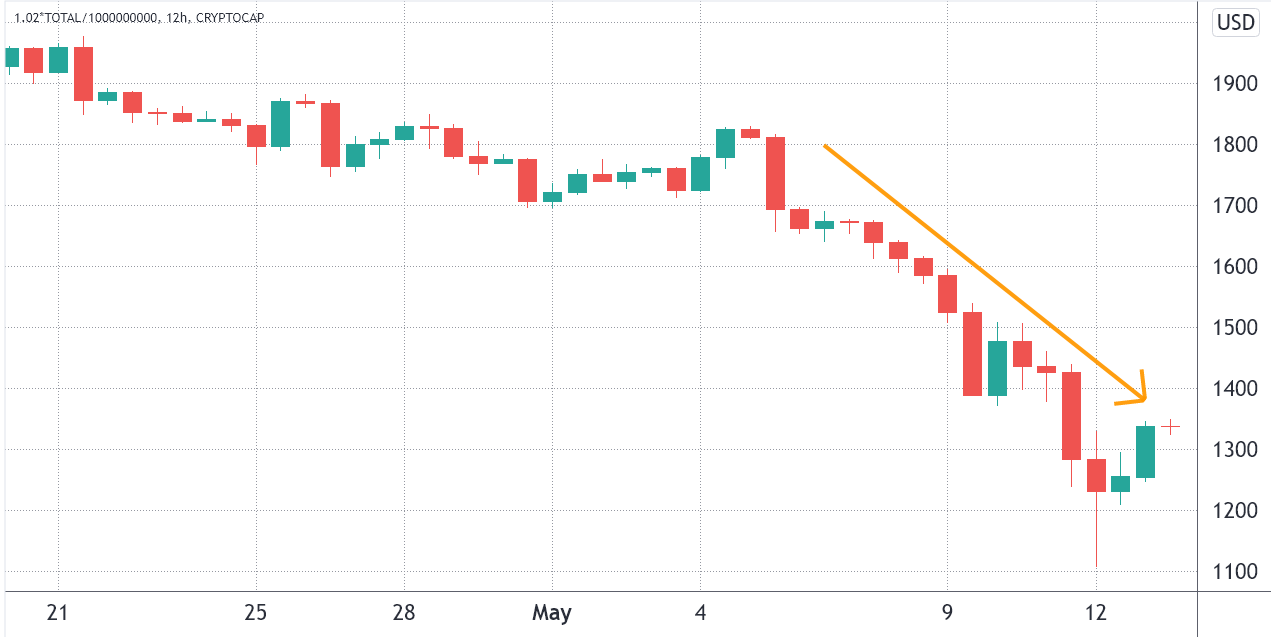

Even for a volatile asset class, the total global crypto market capitalization fell 39 percent in seven days, from $1.81 trillion to $1.10 trillion. A similar fall in value occurred in February 2021, resulting in bargains for risk takers.

USD billion in total crypto market capitalization. TradingView (source)

Despite this week’s volatility, there have been a few ups and downs, with Bitcoin (BTC) rising 18 percent from a low of $25,400 to its current level of $30,000, and Ether (ETH) surging to $2,100 from a near low. from $1,700 in nearly a year.

According to statistics from the Purpose Bitcoin ETF, institutional investors bought the drop. The exchange-traded instrument is based in Canada and on May 12 it added 6,903 BTC, the largest single-day buy-in ever.

Treasury Secretary Janet Yellen noted on May 12 that the stablecoin market poses no threat to the country’s financial stability. Yellen added during a hearing before the House Financial Services Committee:

“They pose the same kinds of threats that have been associated with bank runs for decades.”

In just seven days, the total cryptocurrency market cap has fallen by 19.8%.

In the past seven days, the total market cap of all cryptocurrencies has fallen 19.8% to $1.4 trillion. However, other medium-capitalization cryptocurrencies were crushed, falling more than 45 percent in a week.

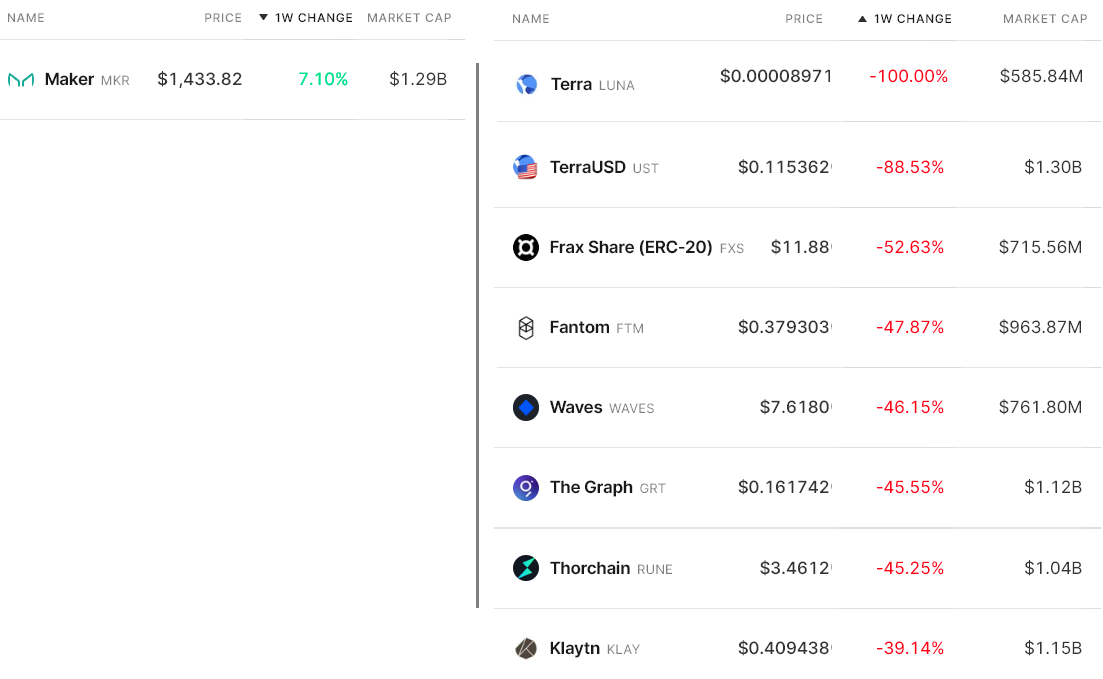

The biggest winners and losers in the top 80 cryptocurrencies by market capitalization are shown below.

The top 80 coins have weekly winners and losers. Nomics is the source of this information.

The death of a rival algorithmic stablecoin helped Maker (MKR). DAI remained fully operational, but TerraUSD (UST) succumbed to the market slump, shattering its peg well below $1.

Terra (LUNA) saw a huge 100 percent drop when the foundation in charge of the ecosystem reserve was forced to liquidate its Bitcoin holding at a loss and spend billions of LUNA tokens to devalue the stablecoin below $1. to compensate.

The total value locked in, or the number of FTM coins placed on the ecosystem’s smart contracts, fell 15.3 percent in one day. Fantom has been suffering since Andre Cronje and Anton Nell, senior team members of the Fantom Foundation, left the project.

Retailers show interest in Tether premium.

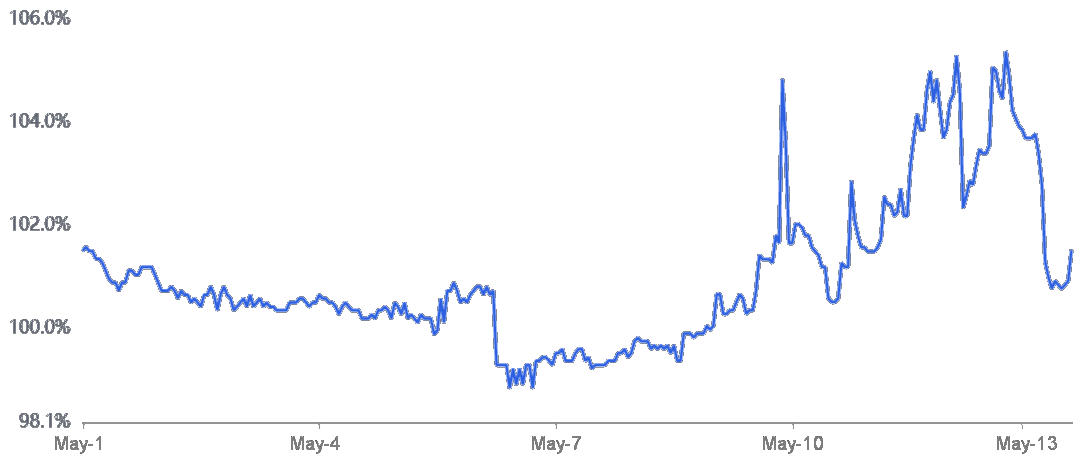

The OKX Tether (USDT) premium is a proxy for Chinese retail demand for cryptocurrencies. It calculates the difference between peer-to-peer USDT trading in China and the official US dollar.

The indication is above the fair value, which is 100 percent, due to excessive purchasing demand. Tether’s market supply, on the other hand, is flooded during weak markets, resulting in a discount of 2 percent or more.

Peer-to-Peer Tether (USDT) vs. USD/CNY Author: OKX

Tether’s premium is 101.3 percent, which is slightly favourable. There has been no panic in the past two weeks. Such figures suggest Asian retail demand is not declining, which is encouraging given that the total cryptocurrency market value has fallen 19.8% in the past seven days.

What exactly happened? The Terra fiasco reveals vulnerabilities in the cryptocurrency business.

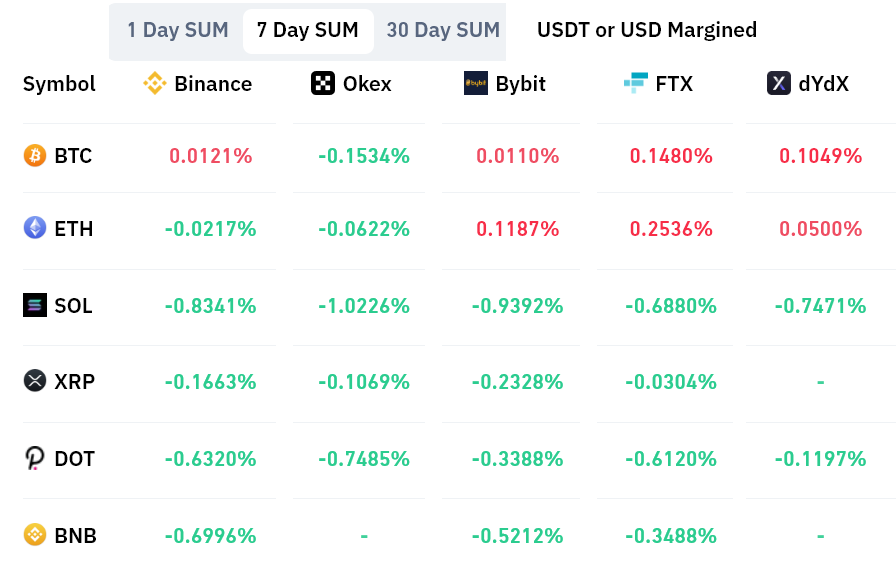

Financing rates for altcoins have also fallen to alarmingly low levels. The embedded rate on perpetual contracts (inverse swaps) is normally charged every eight hours. These are the preferred derivatives of retailers as their prices closely match normal spot markets.

These charges are used by exchanges to minimize imbalances in exchange rate risk. Longs (buyers) seek additional leverage when the funding rate is positive. When shorts (sellers) need more leverage, the funding rate drops below zero.

Perpetual futures funding percentage accrued over seven days. Credit: Coinglass

The cumulative seven-day funding rate is generally negative, as you can see. This information suggests that sellers have more power (shorts). For example, Solana’s (SOL) negative weekly rate of 0.90 percent is 3.7 percent per month, which is a significant hardship for futures traders.

However, as shown by the cumulative funding rate, the two major cryptocurrencies did not experience the same leveraged selling pressure. When there is an imbalance caused by extreme pessimism, that percentage can quickly drop to below -3 percent per month.

The lack of leverage shorts (sellers) in Bitcoin and Ethereum futures markets, as well as slight bullishness from Asian retailers, can be seen as incredibly positive, especially after a weekly performance of -19.8%.

The thoughts and opinions of the author are purely his or hers and do not necessarily reflect those of Cointelegraph. Every investment and trading decision is fraught with danger. When making a choice, you should do your own research.

The “ether price drop” is a result of the ongoing “crypto winter”. The “crypto winter” has caused Bitcoin and Ethereum to lose about $30 billion in market cap. However, derived data shows that this cloud has a silver lining.

Related Tags

- derived meaning

- data on bitcoin derivatives

- top 5 cryptocurrencies to watch this week

- bitcoin consolidation

- bitcoin $53k