The cryptocurrency world was turned upside down on Tuesday when one of the largest digital currency exchanges, which appeared to be on the brink of collapse, was rescued by a major rival in a deal that highlighted the dangers of the industry’s volatility.

Binance, the world’s largest cryptocurrency exchange, said it had reached an agreement to buy its competitor FTX, which has struggled to meet a wave of withdrawal requests in recent days as the crypto market teetered on the brink of another collapse. The size of the acquisition could not be immediately determined, but the privately owned FTX was once valued at $32 billion.

The closing of an emergency deal highlighted the ongoing instability of the crypto industry, which was ravaged this spring by a $2 trillion crash that drained the savings of many amateur investors. That downturn destabilized some of the largest crypto firms, though FTX was by far the biggest casualty. It was widely regarded as one of the most agile and best managed companies until recently its finances began to unravel.

Many of the major crypto firms “are inherently vulnerable, prone to a Lehman-esque collapse at any moment,” said Cory Klippsten, a Bitcoin entrepreneur who is critical of the rest of the crypto industry. “The only hope once under pressure is that another player will save them.”

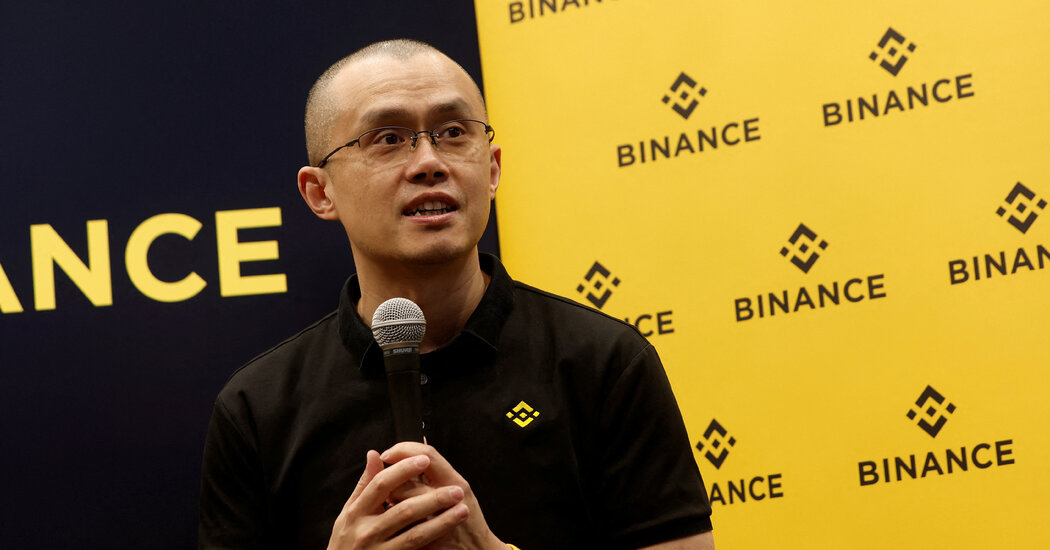

If the deal goes through, it will unite two of the largest crypto firms and cement the status of Binance founder, Changpeng Zhao, as one of the most powerful figures shaping the future of loosely regulated technology.

The deal was announced as crypto markets, which have suffered devastating losses this year, were on the brink of more panic. There were reports that FTX was resting on shaky financial foundations. Many of his clients, who use FTX to buy and store their digital currencies, rushed to withdraw their funds. On Monday evening, the crypto research firm Nansen reported that more than half a billion dollars had flown from the platform in the past 24 hours.

At some point on Tuesday, FTX stopped processing withdrawals altogether, according to crypto research firm The Block. The exchange appeared to have entered a “liquidity crisis”, meaning it lacked the funds to meet the demand for withdrawals.

“This afternoon, FTX asked for our help,” said Mr. Zhao said on Twitter, describing how Binance closed the deal to buy FTX. He said his company planned to “completely acquire FTX.com” to ease pressure on the stock market, but added that the agreement was “non-binding”.

Sam Bankman-Fried, Director of FTX, said on Twitter that the deal would “benefit the entire industry” and allow FTX to meet the wave of withdrawal requests.

mr. Bankman-Fried, who leads FTX from its headquarters in the Bahamas, added that the deal would not affect the company’s smaller, US-based arm.

An FTX spokesperson said the company had no comment beyond the Twitter posts. A Binance spokeswoman did not immediately respond to a request for comment.

The deal was a humble turning point for Mr. Bankman-Fried, who had emerged as one of the most powerful figures in the crypto industry over the past two years. He launched a lobby to shape crypto regulation in Washington and bought the naming rights to the Miami Heat’s arena as part of an aggressive marketing campaign. He has also been a major political donor, contributing $5.6 million to support Joseph R. Biden’s 2020 election efforts.

When the crypto market collapsed in the spring, Mr. Bankman-Fried struck deals to shut down struggling companies. He launched a bid to acquire Voyager Digital, a publicly traded cryptocurrency lender that has filed for bankruptcy.

But cracks began to emerge last week when crypto publication CoinDesk reported on a leaked balance sheet that appeared to show that FTX’s sister company, Alameda Research, was on shaky footing. Alameda is a hedge fund that Mr. Bankman-Fried founded before starting FTX. The two companies have close financial ties.

The report revealed that much of Alameda’s assets were a cryptocurrency called FTT, which FTX invented for traders to use on its platform. The revelation fueled fears that a sudden drop in the price of FTT could spark a crisis for Alameda and FTX.

Mr. Zhao was an early investor in FTX, which earned him a stake in the company. Mr. Bankman-Fried later repurchased that interest and partially paid it in FTT. Over the weekend, Mr. Zhao announced that Binance would sell its FTT shares, citing “recent disclosures”.

The announcement sparked a public quarrel between Mr. Zhao and Mr. Bankman-Fried. “A competitor is going after us with false rumours,” Mr Bankman-Fried said on Twitter on Monday. “FTX is fine. Assets are fine.”

But Binance’s moves also caused the price of FTT to rise. On Tuesday, it was down about 63 percent in the past 24 hours. The rest of the crypto market took a hit, with the prices of Bitcoin and Ether also falling.

Traders rushed to remove their cryptocurrencies from the FTX platform as fears grew that the company could be the next in a string of high-profile crypto companies to collapse. More than $1.2 billion was withdrawn from FTX on Monday, crypto tracking firm Nansen said. reported that night.

“There is a crisis of confidence here,” said Ed Moya, a crypto analyst at OANDA, a trading firm. “When you have the instability of a key token or coin pegged to one of the key crypto ciphers, there is always concern that you could see contagion, and a much more important moment of crisis.”

This is a news item in development. Stay tuned for updates.