Warren E. Buffett, the famous investor who is known for his enthusiasm for undervalued shares and companies, now feels Bullish about a traditional fixed investment: Treasury Bills.

The money supply of Berkshire Hathaway, are vast multinational conglomerate, rose by $ 334 billion at the end of last year, including $ 286 billion in short -term treasuries. The conglomerate doubled his Treasury Holdings more than a year earlier, thanks in part to the money generated by selling a large part of his interest in Apple.

In his annual report and letter to the shareholders, released on Saturday, Mr Buffett defended Berkshire's treasure, of which he said he was happy to continue to build unless or until a potentially lucrative investment chance arose.

“Berkshire will never prefer the ownership of cash equivalent assets over the ownership of good companies,” Mr Buffett wrote.

But the steady interest rates offered by Treasury Bills helped to stabilize Mr Buffett's kingdom for a year in which more than half of the nearly 200 companies operating it saw their income fall. Berkshire Hathaway had net income of $ 90 billion last year, a decrease from the more than $ 96 billion that it generated a year earlier.

The operational income of the company – the metric that Mr Buffett prefers because the paper losses and profit excludes investments that were not sold – were $ 47 billion in 2024, an increase of $ 37 billion in 2023.

The core line of Berkshire, insurance, showed a significant profit in his investment and insurance technical income. The lack of a “monster” event in 2024 was an important blessing, Mr Buffett wrote, although he acknowledged that the industry “has to take our nodules without emotionally” when that happiness turns.

“One day, every day, a really amazing insurance loss will occur,” he wrote. “Think of forest fires,” he later added in a hooks, referring to the fires that Los Angeles destroyed.

Geico, Berkshire's car insurance activities, moved from a loss of almost $ 2 billion at his insurance company in 2022 to the win of almost $ 8 billion in 2024.

The company was “a long jewel that needed great repolishing”, Mr Buffett wrote, referring to the work that Todd Combs did to revise the company. Mr. Combs is an investment manager from Berkshire who became the Chief Executive of Geico in 2020.

Last year Berkshire completed his handle on Pilot Travel Centers, a gas and truck stop chain in which the conglomerate began to invest in 2017. It now owns the company.

But the pilot's income fell last year and fell to $ 614 million – almost 37 percent compared to a year earlier – as part of a broader decrease in profit at Berkshire's retail and service companies, including Dairy Queen, the furniture rentalcort Cort and the private jet company Netjets. Lower average fuel prices took a toll on pilot, Berkshire said, and a growing consumer preference for eating at home dragged the results of Dairy Queen.

Last year Berkshire sold almost 70 percent of his Apple shares and gave distance from more than 600 million shares, although Apple Berkshire's greatest equity remains. The profit on that turnover contributed to a milestone that Mr Buffett noted in his letter: a tax assessment of $ 26.8 billion, of which he mentioned an American record and said it was equal to “about 5 percent of what the whole company America paid. “

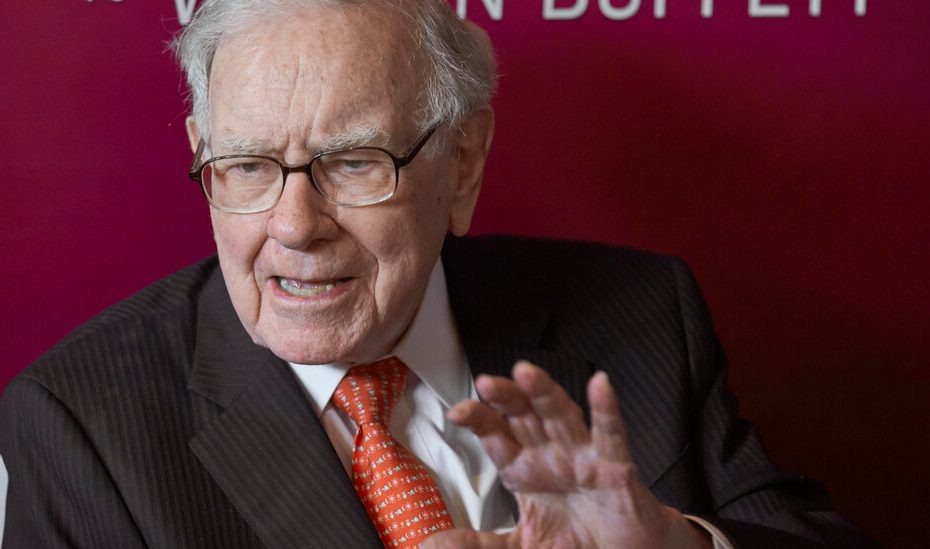

Mr. Buffett, who is 94, has been running Berkshire from his birthplace, Omaha, and is transforming the namesake of textile production company into a vast multinational conglomerate whose participations a railway, jewelry shop, a candy maker and investments in blue-chip companies such as american, such as american and Coca-Cola. Last year the market rating of the company $ 1 trillion surpassed.

He shouted the Berkshire railway and utilities, the two largest business areas outside insurance, like those who remained stable in 2024 but “a lot of left”. BNSF Railway had an operational profit of $ 5 billion, a small decrease from a year earlier, while Berkshire Hathaway Energy earned $ 3.7 billion, an increase of 60 percent compared to the previous year. Higher income from natural gas pipelines helped the business line of the utility companies, just like lower estimated natural burn losses in 2024, compared to 2023.

A place where Mr. Buffett sees the chance, is Japan. Six years ago, Berkshire started to gather an interest in five diversified Japanese companies, and it quickly paid off: the company paid almost $ 14 billion for shares that ended the year with a market value of more than $ 23 billion. Mr Buffett said that he expects Berkshire to keep his Japanese companies for decades.

Mr Buffett said that this year he is planning to be on stage again in May for the annual shareholders' meeting of Berkshire, a Folksy Extravaganza called the 'Woodstock of Capitalism'. In a nod to his progressive age, he wrote that “it will not be long” before Greg Abel, the leader of Berkshire Hathaway Energy and his designated successor, replaces him as Chief Executive of Berkshire.

But Mr Buffett, who has not shown eagerness to resign, recorded a long anecdote in his newsletter about Pete Lieggl, the founder of Forest River, a company that Berkshire bought in 2005. Forest River grew to be the largest manufacturer of outdoor recreational vehicles such as freight trucks, pontoon boats, buses and vans, and it wore “many billions,” Mr Buffett said to the wealth of Berkshire shareholders

“Pete died in November and still worked at 80,” Mr Buffett wrote approvingly.