ZkLend is a two-solution money market protocol for institutions and retail. It also provides lenders with the means to select credit products that are compliant, secure and transparent. The platform improves liquidity in the financial sector by offering low-cost assets on the one hand, while protecting investors from losing their capital due to insolvency or bankruptcy risks on the other side of the zkLend ecosystem.,

:%20php_network_getaddresses:%20getaddrinfo%20failed:%20Temporary%20failure%20in%20name%20resolution%20in%20/home/runcloud/webapps/autoblogging/vaibhav/index.php%20on%20line%2043%0A%0AWarning:%20%20file_get_contents(https://img.nxwv.io/preview/61768062b3bd650ebf862c64?data=%7B%22BG%22%3A%22https://app.autoblogging.ai/vaibhav/general/pexels-photo-1631677.jpeg%22%2C%22SITENAME%22%3A%22darknotetalk.org%22%2C%22ARTICLETITLE%22%3A%22Behind%20zkLend,%20a%20dual%20solution%20money%20market%20protocol%20for%20institutions%20and%20retail%20%7C%22%7D):%20failed%20to%20open%20stream:%20php_network_getaddresses:%20getaddrinfo%20failed:%20Temporary%20failure%20in%20name%20resolution%20in%20/home/runcloud/webapps/autoblogging/vaibhav/index.php%20on%20line%2043%0A%0ANotice:%20%20Trying%20to%20access%20array%20offset%20on%20value%20of%20type%20null%20in%20/home/runcloud/webapps/autoblogging/vaibhav/index.php%20on%20line%2081%0A%0ANotice:%20%20Trying%20to%20access%20array%20offset%20on%20value%20of%20type%20null%20in%20/home/runcloud/webapps/autoblogging/vaibhav/index.php%20on%20line%2081%0A%0ANotice:%20%20Trying%20to%20access%20array%20offset%20on%20value%20of%20type%20null%20in%20/home/runcloud/webapps/autoblogging/vaibhav/index.php%20on%20line%2081%0A)

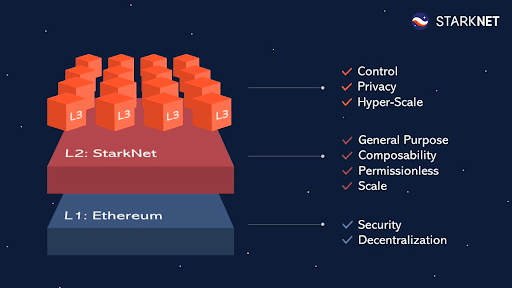

zkLend is a StarkNet-based L2 money market protocol that combines the best of zk rollups with Ethereum to expand the DeFi market.

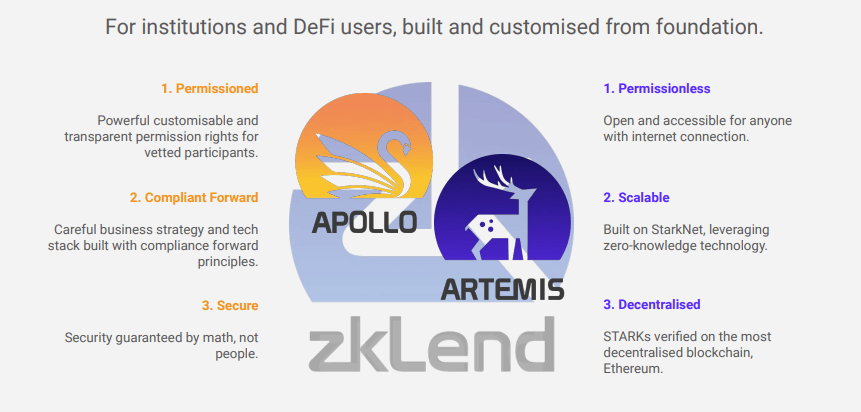

To differentiate itself from the growing competition, zkLend offers a unique dual solution to the DeFi problems: an authorized and compliance-focused solution for institutional customers and a permissionless service for DeFi consumers. All this while preserving decentralization.

zkLend = Zk Rollups + StarkNet + Ethereum

zkLend was developed to accelerate the adoption of DeFi by making blockchain-based financial primitives available to retail and an increasing number of institutional customers. While this may seem like a simple idea, the protocol faced a number of complicated issues that needed to be addressed, the first of which was security.

When rumors of Layer-2 solutions surfaced around 2021, the team behind zkLend started toying with the idea of creating a protocol. While Ethereum was and still is one of the best blockchain platforms to launch in terms of overall security and network impact, the team was forced to start with an L2 due to the congestion and high costs it encountered at the time.

The team’s belief that zk rollups were the ideal L2 option for zkLend was reinforced when Vitalik Buterin’s guide to rollups was released in early May last year. zk rollups enabled scalability without sacrificing security by performing computations outside the main blockchain while proving the results and recording the changes in the state root in the chain.

StarkNet was seen at the time as a potential new use of zk rollup technology, leading the team to implement the protocol on the advanced blockchain.

The team chose StarkWare for its technological competitiveness, proven effectiveness and technical developer-centric environment. StarkNet uses STARK validation encryption, which is 10 times faster than SNARK (technology currently used by zkSync).

With validity combinations, transaction costs decrease as the number of transactions in each unique batch grows. This differs from existing L2 scaling systems, where transaction costs typically grow linearly with the total number of transactions, the researchers said.

The real-world performance of StarkEx, a previous dapp-specific scaling engine built by StarkWare, which handled more than $200 billion in transactions in 2021, supported StarkNet’s scaling capability. This figure surpassed $600 billion in May this year.

“We observed a messy and strong developmental community, with individuals coming up with new protocol concepts that didn’t exist at L1.” “We wanted to be at the forefront of innovation,” said Brian Fu, co-founder of zkLend. “And now, in less than six months, we’ve grown from a young community to one that includes games, DeFi and infrastructure technology.”

zkLend tried to future-proof its protocol by building on top of StarkNet. Working on a Layer-3 solution for private zk rollup layers is on StarkNet’s recently revised roadmap, allowing developers to have both public and private L3s on top of the L2, further enhancing the zk rollup solution for privacy.

A dual approach designed to address the challenges of DeFi adoption.

zkLend has made significant efforts to ensure that its protocol has a strong foundation. The team is not ignorant of the issues ahead, the most important of which is the increased competition from established protocols on other networks.

zkLend is positioned as a backbone of the network, providing financial infrastructure to thousands of new customers pouring into the gaming and NFT L2 sectors as part of StarkNet’s current campaign to become the go-to gaming and NFT L2 provider. Even Aave, the largest lending protocol available now, has expressed its intent to join StarkNet.

zkLend plans to leverage everything StarkNet has to offer to become the network’s flagship lending protocol and a private label in DeFi. The network’s low transaction costs will enable it to develop more efficient liquidation models, refocusing attention on the borrower.

The company claims that the protocol’s KYC and whitelisting layer, market pool risk isolation, two-sided collateralisation, loan factor, and a dynamic correlation-linked collateralisation ratio set it apart from others.

While these elements are not groundbreaking, they do provide the ideal setting for what zkLend is all about: Artemis and Apollo.

The protocol’s two ways of dealing with the growing scale of the DeFi market are Artemis and Apollo.

As the team believes the next chapter of DeFi will be institutional, it was critical to develop a protocol that would meet the demands of financial institutions and enterprises looking to enter the market. However, it proved difficult to create a system that met both institutional and retail needs.

Instead, zkLend opted for a split strategy, designing two sister protocols, each targeting a different audience. The protocols are operationally separate, but they are intended to work together in the future to improve capital efficiency.

Artemis is zkLend’s store-centric solution, an open and accessible protocol without permission. The team plans to release an MVP in early July, although Artemis V1 won’t be available until the end of Q3. Flash lending, asset tiering, a better token utility and other protocol interfaces will be included in the final version of the offering.

The second edition of the protocol, which includes adaptive interest rates, long-tailed assets and free swaps, will be ready by the end of the fourth quarter. Aside from these improvements, V2 marks the beginning of Artemis’ DAO transition, which is expected to be completed next year.

Apollo, on the other hand, is specifically designed for institutional clients who join DeFi. Apollo, unlike Artemis, is a permissioned network that provides verified players with custom and visible permissions.

Apollo’s emphasis on compliance makes it a great match for institutions. The product includes a compliance layer, which is uncommon in DeFi, but common in TradFi markets. It includes KYB and KYC checks, as well as strict regulatory compliance.

An MVP for Apollo will be published at the end of the year. In parallel with product development, the team is looking for institutional launch partners and an on-chain KYB supplier.

While the team did not disclose who those partners might be, they did state that other institutions and investors were involved in discussions about how Apollo’s over-collateralized loan products should be structured.

“We’re already seeing an infusion of conventional participants,” Fu added, “but it’s mostly crypto-savvy investment funds and prop trading organizations.” “In addition, they are still testing the waters with a little TVL.” Clearpool, Goldfinch and Maple are examples of success stories in the market. As more of these use cases become public, institutions will feel more comfortable with DeFi and adoption will accelerate.”

(Image credit: zkLend)

When it comes to launch dates, zkLend has a solid plan, but it still relies on StarkNet’s timeline.

“Our public debut is dependent on the launch of the StarkNet public mainnet,” said Jane Ma, co-founder and project lead of zkLend. “By releasing a few additional protocols such as DEXes and DeFi aggregators in addition to releasing, we aim to provide StarkNet users with more use cases and improved composability.”

Therefore, the protocol’s native token, ZEND, has yet to be released. The token was created to support the zkLend protocol, boost activity, reward real network contributors, and give token holders significant governance rights.

The $5 million seed round that zkLend has obtained will be enough to fund the development of the protocol for the time being. The round was led by Delphi Digital and included key cornerstone investments from the likes of StarkWare, Three Arrows Capital and Alameda Research.

The team claimed they have no plans for more fundraising, but they are keeping their options open in case the situation changes.

“Our main focus right now is to bring our MVP product to market by the end of the third quarter of 2022, as well as the full product by the beginning of the fourth quarter of 2022 on the StarkNet mainnet,” said Ma. . “First and foremost, we want to complete our plan and demonstrate the value of our product to existing investors and consumers.”

Gain a competitive advantage in the crypto market

Join Edge to access our very own Discord community, as well as more exclusive material and commentary.

Research in the chain

Pricing Snapshots

more information

Join today for $19 a month. View all benefits.