When Elon Musk bought $ 44 billion in 2022 X, more than a quarter of them were financed by loans from banks, including Morgan Stanley. Banks normally sell such loans quickly, but in this case they loved that debt because investors were reluctant to bet on the struggling company of the social media company.

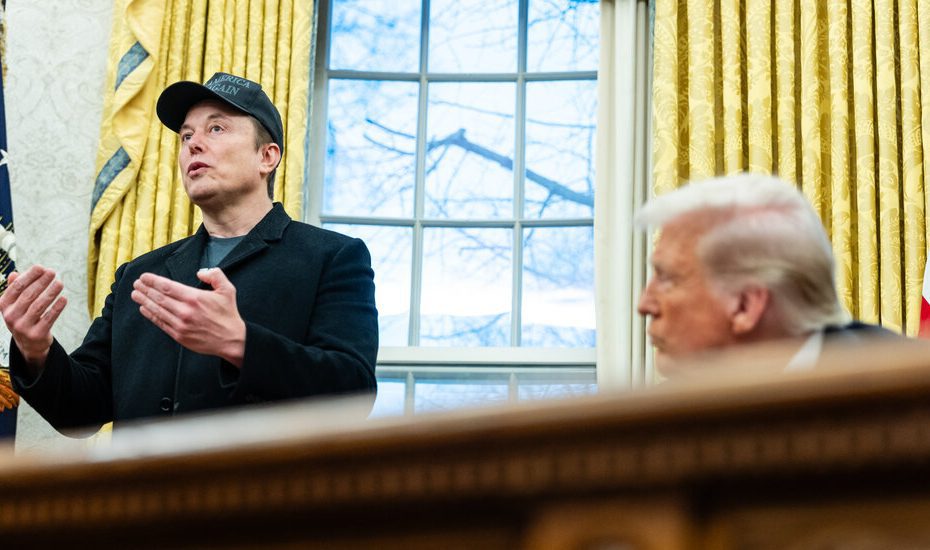

Mr. Musk's new power in the government of President Trump has helped change the thoughts of investors.

On Thursday, the banks sold around $ 4.7 billion in the fault of X, according to two people who are familiar with the transaction, more than the $ 3 billion they originally wanted to sell.

Mr. Musk, who has become a close adviser of the president and runs a government efficiency initiative, has confronted with increasing questions about whether the companies he leads – including the electric car maker Tesla and the Rocket Company SpaceX – benefit from his position as mr.

X has become a go-to-platform for information about the plans of the administration, which Mr. Musk broadcasts to the more than 217 million followers of his account. Advertisers have returned to X in large numbers, said people who are familiar with the deals who feed a boost in income. The company said investors that his income in December rose 21 percent of a month earlier, a person said with knowledge of finances.

An X spokesperson and Morgan Stanley refused to comment. Bloomberg previously reported the jump in the turnover and details of the transaction.

The sale of the debt – which was $ 12.5 billion at the time of the takeover – helps Mr. Musk and the banks, who have been working on it for two years. Only two months ago, investors negotiated to buy that debt with loss of 10 percent to 20 percent for the banks, one person said in the discussions.

But the appetite of investors is drastically shifted. Last week the banks sold $ 5.5 billion of the debt to a small group of investors, said the people who are familiar with the transaction. This month, capital partners with diameter bought $ 1 billion of the debt. The banks have now sold almost all their X debts, leaving around $ 1 billion on their balance sheets.

Investors were motivated to buy X debt because of various factors, including the improvement of the company's income. Advertisers such as Amazon and Apple have returned after they have fled controversial actions by Mr. Musk, according to three people involved in the discussions.

The turnover of X increased by 40 percent last year after a gloomy 2023, said the person who is familiar with the finances of the company. More subscribers pay for the premium service of X, and the artificial intelligence company of Mr. Musk, Xai, X pays X to licensed his data, according to the people who are familiar with X.

“More things seem to come in than in the past two years,” wrote Brett Weitz, X's head of the content of X, in an internal e -mail in January, which was seen by the New York Times.

Last Sunday in the Super Bowl, the company would earn $ 7.9 million in related advertisements, which performed slightly better than the $ 7.2 million of the event in 2024, according to an internal document that was seen by The Times.

The extensive cost -saving measures of the company, including reducing staff by more than 80 percent, have also appealed to investors, said people.

X's Fortuinen – both financially and politics – have improved if Mr. Musk has tailored himself to Mr Trump, according to three people who are familiar with the transaction.

And although the people who are familiar with the deal said that investors had not expected them to borrow Mr. Musk by borrowing money, they saw the future of his companies as clearer now that he was central to the government. They also said that they believed that the new role of Mr. Musk meant that the money would be repaid earlier.

Some advertisers who recently returned to X were concerned about the consequences of interest groups when they supported the company, said that three advertisements -industry leaders who were not authorized to publicly speak of the issue. Others were worried about possible retribution from Mr. Musk if they did not return.

Last year, Mr. Musk sued various major brands and the Global Alliance for Responsible Media, a non -profit coalition of large advertisers led by the world federation of advertisers, claiming that the group had orchestrated a boycott against X. Garm stopped days after the lawsuit was placed, but Mr. Musk has continued to press his case against advertisers. This month his lawyers have added various companies to the case, including LEGO, Nestlé and Shell.

The tires of Mr. Musk with the White House can help other companies. Weeks after Mr Trump was chosen, managers sent a memo to engineers at Palantir and asked that they use grok exclusively, an AI chatbot designed by the Xai of Mr. Musk, two Palantir employees said. It was the first time that the company had asked them to use grok on other chatbots.

A spokeswoman for Palantir refused to comment.

Ryan Mac And Sheera Frenkel contributed reporting.