Here’s a good reason to use Google Pay: Google can send you a bunch of free money. Many users report that Google accidentally deposited cash into their account, anywhere from $10 to $1,000. Android researcher Mishal Rahman was hit by the bug and shared most of the relevant details on Twitter.

The money came in through Google Pay’s “rewards program”. Just like with a credit card, you occasionally need to get a few bucks back for various promotions, but none of this. Numerous screenshots show users receiving loads of “reward money” for what the post called “dogfooding the Google Pay Remittance experience.” “Dogfooding” is technically speaking for “pre-release software for internal beta testing”, so if a message like this should have gone out at some point, it should only have gone to Google employees and/or some testing partners. Many regular users have received multiple copies of this post with multiple payouts.

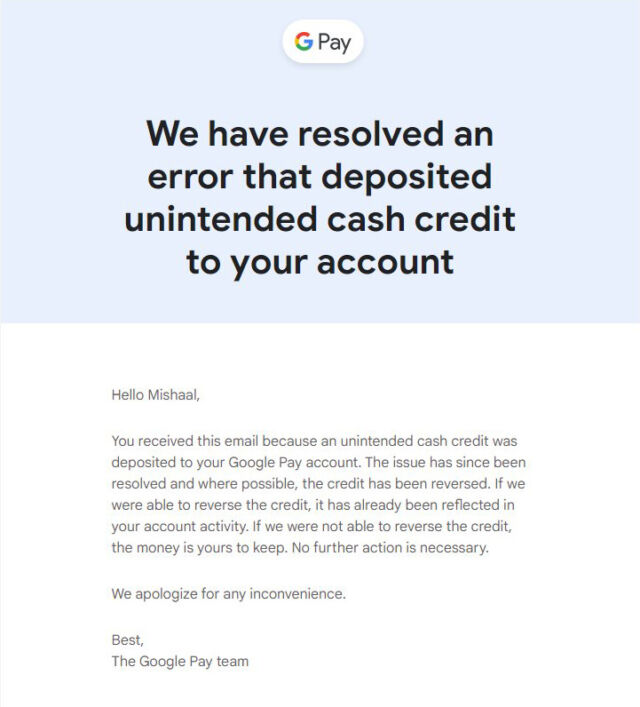

Users who received the unexpected deposits later received an email from the Google Pay team detailing “an error that inadvertently caused cash to be deposited into your account.” The message begins with: “You received this email because an accidental cash credit was applied to your Google Pay account. The issue has since been resolved and credits have been reversed where possible.” We assume that everyone who left the money in their Google Pay account has withdrawn it, but for those who spent or transferred the money, Google adds: “If we couldn’t reverse the credit, it’s keep money from you. No further action is required.”

That’s right: if you spent or transferred the money, you get to keep it! Google doesn’t want to waste its time (or, presumably, its press coverage) chasing down individual users.